By David Ott

When I think of Ken Fisher, I think of junk. Not junk bonds; junk mail.

Fisher is the Chairman of Fisher Investments, a long-time columnist for Forbes Magazine, a best-selling author, and, last but not least, a billionaire. He is also a “proud junker,” and argues that his aggressive direct marketing campaigns merely “cut out the middleman.”

[1]But before Fisher became a marketing juggernaut he wrote 100 Minds That Made the Market, a delightful book with 100 three or four page chapters chronicling the men and women that – for better or for worse – built Wall Street.

In addition to the standard, though necessary, fare like Alexander Hamilton and J.P. Morgan, Fisher includes far lesser known but equally interesting personalities like Thomas Ryan and Floyd Odlum.

If these names don’t ring a bell, you’re not alone. Their lack of name recognition belies their important contributions as Ryan is the creator of the first corporate holding company and Odlum is the original corporate raider (pictured on the phone, poolside).

Clearly, heroes like Hamilton and Morgan deserve their place, but their name and influence is so well known that it is particularly enjoyable learning more about the smaller, yet still important players.

In addition to the famous and the unknown, there are many that fall in between. Famous names that you know today for one reason or another, although you probably don’t know the history.

For example, Charles Dow, (creator of the Dow Jones Index), started the Customer’s Afternoon Letter that ultimately became today’s venerable Wall Street Journal. Charles Merrill, founder of Merrill Lynch, started out as a semi-professional baseball player before famously bringing “Wall Street to Main Street” and started Family Circle magazine on the side.

It’s also easy to see how Main Street developed a healthy skepticism for those on Wall Street. Some of the juiciest stories are of the many criminals that have made their mark on Wall Street and Fisher makes the case that “crooks, scandals and scalawags” offer some virtue as a “sort of perverse” education. Fisher is right, although no one else seems to be getting the message since many of these crimes are still prevalent today despite the mountains of regulation that have been created to prevent history from repeating itself.

Consider Richard Whitney, one of the bluest blue-bloods on Wall Street in the 1920’s, serving top-tier clients like J.P. Morgan. It is said that his personal order to purchase 10,000 shares of U.S. Steele on Black Thursday helped stabilize the market.

His bold action provided him instant notoriety and propelled him to the president of the New York Stock Exchange (NYSE), where he presided until his demise in 1937. It was ultimately revealed that he lost millions of dollars in the Crash, his firm lacked profitability despite its high profile status and he continued to spend lavishly throughout the Depression.

He was able to keep up appearances for years by borrowing $27 million in 111 different loans from his also-prominent brother, acquaintances who knew him by reputation, and from creditors from some of his business dealings.

When all of his borrowing sources dried up, he turned to crime by taking stealing from his clients and the NYSE. He was sentenced to five to ten years in Sing Sing and was banned from the securities industry for life – not to mention suffering the media frenzy covering his fall from grace.

For every devious character, though, there is an inspiring story as well. Amadeo Giannini, for example, was a banker in San Francisco during the 1906 earthquake. The earthquake caused major fires throughout the city and as they encroached on his bank, he loaded the cash, securities and gold onto vegetable wagons and bravely walked the bank’s assets out of the city.

When the city was safe and the funds could be secured, he was the first banker to begin lending in an effort to rebuild the city. By 1929, he had 400 branch locations and over $1 billion in capital. His bank today is Bank of America.

Fisher makes a point of only including those who have passed away. He writes in the forward that his was partly due to his reluctance to write about his father, the famous practitioner who also wrote the classic book, Common Stocks and Uncommon Profits.

This viewpoint also ensures that only the truly great make the list avoids those who may just be a flash in the pan. Only after the final chapter is written can history appropriately be judged. In due time, there will be many more pioneers to write about, like the legendary international investor Sir John Templeton who passed away this month.

As Fisher brings the dead to life with interesting stories and antidotes, he is also tells an even more remarkable story: the creation of the most powerful and far-reaching capital markets system in the history of mankind. Wall Street is the nexus of global capital and each of the innovators outlined has a unique story of contribution worthy of telling.

In some ways, their stories also tell a broader story about America. Although Fisher doesn’t dwell on factors like heritage or religion, these he does describe how these were definitely challenging factors for many of the greats who were of Italian decent or Jewish faith.

Without a doubt that the next 100 minds will include a far more diverse group who will have overcome many of the same obstacles that unfortunately still persist in similar forms today.

Despite the obstacles, however, many of the next 100 will have worked their way to the top through the right combination with drive, determination and, most importantly, transformative ideas.

Based on this excellent book, I wish Fisher would spend less time on “Eight Investing Mistakes” or “Ten Predictions for 2009” and make the jump from junk to investment grade writing about America’s great financial history.

July 21, 2008

_________________________________________________________________

Recommendation: Market Perform

100 Minds that Made the Market

By: Ken Fisher

John & Wiley & Sons, Inc., Hoboken, New Jersey 2007

First Published: 1993

ISBN: 978-0-470-13951-6

As reported in yesterday’s Insights, the Gross Domestic Product (GDP) figures did not meet expectations for the second quarter and were reduced in the fourth quarter from expansion to contraction. The main contributors were personal consumption (added 1.08 percent), exports (added a huge 2.42 percent) and government consumption (added 0.67 percent). Housing continued to weigh on GDP with residential fixed investment subtracting 0.67 percent, but the big factor was the large subtraction from inventories that dragged down GDP by 1.92 percent.

As reported in yesterday’s Insights, the Gross Domestic Product (GDP) figures did not meet expectations for the second quarter and were reduced in the fourth quarter from expansion to contraction. The main contributors were personal consumption (added 1.08 percent), exports (added a huge 2.42 percent) and government consumption (added 0.67 percent). Housing continued to weigh on GDP with residential fixed investment subtracting 0.67 percent, but the big factor was the large subtraction from inventories that dragged down GDP by 1.92 percent.

To no surprise, financials and consumer discretionary shares led the market lower – these are the pressure points on days of weakness as concerns over housing, tax rates, price stability and the job market effect these sectors more than any other.

To no surprise, financials and consumer discretionary shares led the market lower – these are the pressure points on days of weakness as concerns over housing, tax rates, price stability and the job market effect these sectors more than any other.

Financials led the market lower, as the S&P 500 index that tracks these shares plunged 6.75% -- the group had caught fire over the previous six trading sessions, jumping off a 10-year low, up 30%. Consumer discretionary, the other catalyst behind the market’s recent multi-day rally, lost 2.81%; industrials also took it on the chin, losing 2.51%.

Financials led the market lower, as the S&P 500 index that tracks these shares plunged 6.75% -- the group had caught fire over the previous six trading sessions, jumping off a 10-year low, up 30%. Consumer discretionary, the other catalyst behind the market’s recent multi-day rally, lost 2.81%; industrials also took it on the chin, losing 2.51%. Certainly not helping sales is a wider-than-normal 30-year fixed mortgage spread. As the chart below illustrates – depicted by the yellow line – even though the 10-year Treasury sits at the very low level of 3.99%, the 30-year mortgage rate is higher than it otherwise would be due to increased risks. The current spread has widened to 260 basis points, from its normal range of 150-180 basis points. (We’re referring to the spread between the 30-year mortgage and the 10-year Treasury it runs off of.)

Certainly not helping sales is a wider-than-normal 30-year fixed mortgage spread. As the chart below illustrates – depicted by the yellow line – even though the 10-year Treasury sits at the very low level of 3.99%, the 30-year mortgage rate is higher than it otherwise would be due to increased risks. The current spread has widened to 260 basis points, from its normal range of 150-180 basis points. (We’re referring to the spread between the 30-year mortgage and the 10-year Treasury it runs off of.)  On supply, the number of existing homes on the market rose 0.2% in June, resulting in the months’ worth of supply figure increasing to 11.1 – likely double where we need to be. Exacerbating this situation is rising foreclosures, which have doubled over the past year. As of the latest data, foreclosures have risen to 2.5% of the total mortgage market. Roughly 11% of sub-prime loans have entered the foreclosure process and 1.25% of prime loans are in foreclosure.

On supply, the number of existing homes on the market rose 0.2% in June, resulting in the months’ worth of supply figure increasing to 11.1 – likely double where we need to be. Exacerbating this situation is rising foreclosures, which have doubled over the past year. As of the latest data, foreclosures have risen to 2.5% of the total mortgage market. Roughly 11% of sub-prime loans have entered the foreclosure process and 1.25% of prime loans are in foreclosure. The median home price dropped 6.1% last month compared to June 2007 – although that figure is up 10% since hitting a multi-year low in February. As of June, the median price of an existing home came in at $215,000.

The median home price dropped 6.1% last month compared to June 2007 – although that figure is up 10% since hitting a multi-year low in February. As of June, the median price of an existing home came in at $215,000. In a separate report, the Labor Department reported initial jobless claims jumped to 406,000 in the week ended July 19 from a revised 372,000 the previous week.

In a separate report, the Labor Department reported initial jobless claims jumped to 406,000 in the week ended July 19 from a revised 372,000 the previous week. This morning crude-oil prices are extending upon yesterday’s gain. Oil hit the $124 handle on Wednesday, but has moved up a bit to $126.33 as I type.

This morning crude-oil prices are extending upon yesterday’s gain. Oil hit the $124 handle on Wednesday, but has moved up a bit to $126.33 as I type. The laggards were energy, basic materials and utility shares. The CRB Index, which measures a basket of commodity prices has dropped 12.5% over the past eight trading sessions and oil alone has fallen $20 from the all-time high of $145.29. The S&P 500 Energy index has plunged nearly 17% from its high hit in mid-May and 15% this month. The group has likely been oversold as they’ll continue to make great money at these levels and continue to boost dividend payouts.

The laggards were energy, basic materials and utility shares. The CRB Index, which measures a basket of commodity prices has dropped 12.5% over the past eight trading sessions and oil alone has fallen $20 from the all-time high of $145.29. The S&P 500 Energy index has plunged nearly 17% from its high hit in mid-May and 15% this month. The group has likely been oversold as they’ll continue to make great money at these levels and continue to boost dividend payouts.

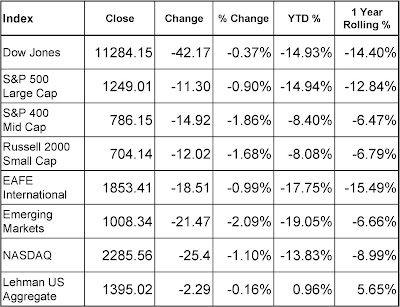

Oil and the dollar trade are based on a variety of factors, but a major variable is the Fed’s direction. The sways in the table above helps to explain the ups and downs in the dollar and oil prices off late. As the market increases its expectation the Fed will hike, oil will continue to move in the right direction – of course hurricane activity and geopolitical events will have their own effect on price. If they send market expectations on another wild goose chase by becoming more dovish on the inflation front again, oil and the dollar may just return to an undesirable direction.

Oil and the dollar trade are based on a variety of factors, but a major variable is the Fed’s direction. The sways in the table above helps to explain the ups and downs in the dollar and oil prices off late. As the market increases its expectation the Fed will hike, oil will continue to move in the right direction – of course hurricane activity and geopolitical events will have their own effect on price. If they send market expectations on another wild goose chase by becoming more dovish on the inflation front again, oil and the dollar may just return to an undesirable direction. Of course, the very welcome decline in oil prices has also helped the market over the past five sessions – actually four of the past five sessions as we were fractionally lower on Monday. Yesterday oil prices closed in on the $125 per barrel handle, pushing stocks higher in the afternoon session.

Of course, the very welcome decline in oil prices has also helped the market over the past five sessions – actually four of the past five sessions as we were fractionally lower on Monday. Yesterday oil prices closed in on the $125 per barrel handle, pushing stocks higher in the afternoon session. Oil prices have plunged $20 over the last seven sessions as we have hit the $125 handle this morning – falling another 1.59% to $125.92. We began to come off the all-time high closing price of $145.18 hit last Tuesday and estimations, and now the reality, that Hurricane Dolly will remain West of the major energy infrastructure in the Gulf has certainly helped things. Program trading has likely kicked into gear due to the degree of the decline, pushing the price of oil even lower.

Oil prices have plunged $20 over the last seven sessions as we have hit the $125 handle this morning – falling another 1.59% to $125.92. We began to come off the all-time high closing price of $145.18 hit last Tuesday and estimations, and now the reality, that Hurricane Dolly will remain West of the major energy infrastructure in the Gulf has certainly helped things. Program trading has likely kicked into gear due to the degree of the decline, pushing the price of oil even lower. And speaking of inflation, it’s been interesting to watch bond yields remain so low. Yes, yield have risen of late but we sit at 4.15% on the 10-year Treasury as we speak, which is still one of the lowest levels of the past 40 years.

And speaking of inflation, it’s been interesting to watch bond yields remain so low. Yes, yield have risen of late but we sit at 4.15% on the 10-year Treasury as we speak, which is still one of the lowest levels of the past 40 years. Maybe inflation will come crashing lower and this spread, which is probably the most accurate high-frequency market indicator we have, is gauging things correctly. Of course, some of the low-interest rate environment is due to risk concerns, thus investors have fled to the Treasury market for safety – so there’s a possibility this market has not fully accounted for future inflation expectations. We shall see, but I would expect yields to rise some from here.

Maybe inflation will come crashing lower and this spread, which is probably the most accurate high-frequency market indicator we have, is gauging things correctly. Of course, some of the low-interest rate environment is due to risk concerns, thus investors have fled to the Treasury market for safety – so there’s a possibility this market has not fully accounted for future inflation expectations. We shall see, but I would expect yields to rise some from here. All and all, the losses among the benchmark indices were mild. Mid and small cap stocks posted nice gains.

All and all, the losses among the benchmark indices were mild. Mid and small cap stocks posted nice gains. We received some earnings disappointments after the bell last night, the largest being poor results from American Express as credit-card defaults rose to 5.3% from 2.9% a year earlier. This is the big one that is sending stock-index futures lower this morning. We’ve had a number of financial names post better-than-expected results, but all it takes is one bad one in this environment and the bears got it in AMEX’s results.

We received some earnings disappointments after the bell last night, the largest being poor results from American Express as credit-card defaults rose to 5.3% from 2.9% a year earlier. This is the big one that is sending stock-index futures lower this morning. We’ve had a number of financial names post better-than-expected results, but all it takes is one bad one in this environment and the bears got it in AMEX’s results.  My chief concern regarding real income growth is this escalation in commodity prices, namely the energy area. Congress and the White House must follow through on last week’s very good comments on drilling with action. Too, the Fed must focus more on price stability. If crude prices do not stabilize this economy will be in trouble as income growth will not be able to keep up and business profit margins will be squeezed further. There are some things that are out of our control in this regard, but within those areas that we do control this must be dealt with now.

My chief concern regarding real income growth is this escalation in commodity prices, namely the energy area. Congress and the White House must follow through on last week’s very good comments on drilling with action. Too, the Fed must focus more on price stability. If crude prices do not stabilize this economy will be in trouble as income growth will not be able to keep up and business profit margins will be squeezed further. There are some things that are out of our control in this regard, but within those areas that we do control this must be dealt with now. We have to get several uncertainties out of the way still, inflation concerns are now another issue equity investors must deal with, making the task of assigning the correct market multiple very difficult, so one should be prepared for stocks to continue within this trading range. But we’ll eventually break out to the upside. Several positives that no one seems to be talking about is the awesomely streamlined nature of most industries – it is absolutely amazing how many sectors continue to record decent-to-healthy profit growth even as most input costs have risen in such a quick fashion.

We have to get several uncertainties out of the way still, inflation concerns are now another issue equity investors must deal with, making the task of assigning the correct market multiple very difficult, so one should be prepared for stocks to continue within this trading range. But we’ll eventually break out to the upside. Several positives that no one seems to be talking about is the awesomely streamlined nature of most industries – it is absolutely amazing how many sectors continue to record decent-to-healthy profit growth even as most input costs have risen in such a quick fashion. The spread between the 10-year Treasury and the 30-year mortgage rate remains much higher than normal, as you can see – currently running at 210 basis points, the normal range is 150-175. The Fed can keep rates very low – thus keeping the 10-year probably lower than it otherwise would be – but the market is saying, I don’t think so; we’re not originating mortgages at normal spreads due to increased risks.

The spread between the 10-year Treasury and the 30-year mortgage rate remains much higher than normal, as you can see – currently running at 210 basis points, the normal range is 150-175. The Fed can keep rates very low – thus keeping the 10-year probably lower than it otherwise would be – but the market is saying, I don’t think so; we’re not originating mortgages at normal spreads due to increased risks.