Friday, March 5, 2010

Fixed Income Weekly

The curve actually sat much flatter before the heavy selling on the long end after this morning’s jobs report, which showed business cut 36,000 payroll positions, better than the 68,000 expected. The labor participation rate ticked up slightly from 64.7% to 64.8% and the unemployment rate held steady at 9.687%. The big story leading up to the release was that severe weather was going to put the hurt on the data. The effect of things like this is impossible to accurately measure, but the market was ready to see a terrible number, and ignore it, but instead we saw a better than expected number, and stocks rallied like a Subaru.

Prepayment speeds are usually a non-event, but Freddie Mac purchased every loan that was at least 120 days delinquent from their mortgage pools in February, so March FHLMC speeds were expected to skyrocket. Freddie MBS underperformed Treasurys in early trading, but buyers stepped in to prove the selloff was a little unjustified considering overall speeds may actually slow down going forward due to the cleanup. Fannie Mae is expected to follow Freddie’s lead in the next few months, but will buy only “a substantial portion” of their 120+ delinquent loans. Fannie Mae is considered to have more problems compared to Freddie, but although Thursday’s release gives some insight into what will come, it by no means answers the market’s questions on what is to come with FNMA.

Have a good weekend.

Cliff J. Reynolds Jr., Investment Analyst

Daily Insight

A better-than-expected increase in retail sales for stores open at least a year (known as chain-store sales) was really the best news yesterday and probably helped to offset the day’s other economic releases, which weren’t exactly helpful. The latest data on pending home sales suggested that the housing-market weakness of the past couple of months will extend into February and March.

The jobless claims data had to be viewed as a net negative – while initial claims fell, they remain at an elevated level and continuing claims are stuck at unprecedented levels. Nonfarm productivity for the most recent quarter posted a very high reading, but only because firms have kept payrolls and hours worked to a minimum. More on all of these releases after the jump.

Energy and health-care shares were a drag on the market. Financials were the best-performing sector as some members of Congress look to dilute the proposed new regulations on the industry and delay its inception.

Click here to read the rest of this entry.

Brent Vondera, Senior Analyst

Thursday, March 4, 2010

Pfizer (PFE) bids for generics business

Oh, Pfizer. You just love acquisitions, don’t you?

Pfizer has reportedly bid $4 billion Euros (or roughly $5.4 billion U.S. dollars) for German generic drugmaker, Ratiopharm. This acquisition would thrust PFE into the big leagues of generic drugs with annual sales of roughly $11 billion compared to the biggest player, Teva Pharmaceuticals (TEVA), which had $13.9 billion in 2009 revenue.

I figured Pfizer would want to focus on integrating the massive Wyeth acquisition, which cost them more than $65 billion, before prowling for additional acquisitions to combat patent losses. The price tag doesn’t really concern me because Pfizer has plenty of cash and investing in a generics business makes some sense. In addition, global scale is critical to generics, so buying the top manufacturer in the EU’s largest market (Germany) is wise.

I suppose my main concern is the vastly different economic of generics compared to the Big Pharma model. Integrating a business with intense cost competition will be more complicated than just writing a big check and eliminating overlapping business costs.

Another concern is that annual generic sales totaled just $83 billion, according to IMS, while PFE alone generates more than $60 billion with much more attractive margins. Significant patent cliffs mean $150 billion in annual sales will go generic by 2014, but growth will then slow substantially.

I guess Pfizer is shrinking it research spending for a reason: they are going to purchase future revenues for the foreseeable future. Ok, so PFE is officially no longer a growth stock. That’s no big deal if they keep paying a fat dividend (current yield of 4.17%) and find ways to grow the dividend at a meaningful rate.

While on the topic of PFE, I should acknowledge that earlier this week an experimental Alzheimer’s treatment, Dimebon, failed to show effectiveness in a large late-stage study. This is one of the drugs I mentioned in this post as a catalyst for 2010 performance. In short, the results were very disappointing to investors.

Daily Insight

Things were going pretty well as somewhat upbeat sentiment in pre-market futures trading flowed into the official session. However, the gains evaporated shortly after lunch, right around the time of President Obama’s press conference urging lawmakers to vote on health-care overhaul (which means they’ll choose reconciliation – so the hurdle is just 51 votes in the Senate) and the Fed released its latest Beige Book – that report expressed concerns over the real estate market and wasn’t particularly cheery on the labor market either.

Basic material shares were the best-performing sector for a third-straight session. Health-care was the laggard, leading the three of the 10 major sectors that fell on the session.

Click here to read the rest of this entry.

Brent Vondera, Senior Analyst

Wednesday, March 3, 2010

Daily Insight

Companies are sitting on record levels of cash, roughly $1.18 trillion for S&P 500 members, and early signs suggest they’ll deploy that cash in a manner that boosts returns for shareholders via buybacks and dividend hikes. (S&P 500 members’ cash levels jumped $518 billion over the past year after slashing capital spending by 43%. Excluding financials, corporate cash stands at $820 billion, up 27% over the past year.)

Firms see the environment as challenging and are not confident profits alone are going to drive share prices higher. Certainly, dividend payouts will need to increase as the coming tax-rate hikes on dividend income will erode after-tax returns. The two plans being pushed: hike the dividend-income tax rate from the current 15% to 22.9% (20% + 2.9% Medicare tax) or drive the rate to the investor’s marginal tax rate – the former having the most support.

Of course, if profit growth does not become durable then this strategy becomes a negative for job growth. Firms will not spend cash on both areas unless the revenue and income is there to support it. They’ll continue to seek profit-enhancing productivity gains via reduced payrolls.

The Dow average was held back by the index’s tech names -- IBM, Microsoft and Hewlett-Packard.

Along with information technology, telecom and consumer discretionary shares were the three of the major 10 sectors to lose ground on the session. Basic material, energy and utility shares handily out-performed the market.

Click here to read the rest of this entry.

Brent Vondera, Senior Analyst

Tuesday, March 2, 2010

Daily Insight

Most overseas bourses performed well the night before, which also offered a boost to the U.S. market, on the weekend’s news that the EU is readying a Greek bailout. Finance ministers will continue to state that they’ll hold Greece’s feet to the fire with regard to austere budget constraints, but as the Greek government get closer to the necessary bond sales needed to roll maturing debt the EU will remove this rhetoric even if the German populace is steadfastly against a bailout – Germany being the EU’s stalwart and major force in the bailout.

Consumer discretionary shares led the broad market higher after the latest personal spending data came in a touch better-than-expected. Utilities, which have had an especially hard time since the end of 2009, was the second-best performing S&P 500 sector. Information technology and basic material shares rounded out the best performing groups.

Financials were the day’s relative loser after HSBC, Britain’s largest bank, reported setting aside higher provisions to guard against a rising non-performing loan count.

Click here to read the rest of this entry.

Brent Vondera, Senior Analyst

Monday, March 1, 2010

February 2010 Recap

January retail sales data showed that U.S. consumers are starting to pull more of their weight, but a surprising increase in initial jobless claims and disappointing durable goods report near the end of the month kept investors expectations for the economy tempered. Housing data didn’t help either, with sales of previously owned U.S. homes falling 7.2% in January to a seven month low.

More important to the markets was the Federal Reserve raising the interest rate it charges banks for emergency loans and reaffirming that broad tightening of credit was not imminent. In addition, core consumer prices fell for the first time since 1982, leaving room for the Fed to keep rates relatively low if necessary.

The MSCI EAFE index posted a small loss of 0.65% on weaker-than-expected European Union GDP data and concerns surrounding Greece’s debt problem. The MSCI Emerging Markets Index squeaked out a 0.34% gain in the face of China removing economic stimulus. The bright spot among international areas was the MSCI Pacific Ex-Japan Index, which posted a 3.12% gain on strength in Australia.

Domestic REITs outperformed all other asset classes amid merger and acquisition activity. Multiple bids were made public for General Growth Properties, which filed for the biggest real-estate bankruptcy in U.S. history after amassing $27 billion in debt during an acquisition spree. Simon Property Group offered $10 billion and Brookfield Asset Management, which owns roughly $1 billion in General Growth debt, offered $2.63 billion for a 30% stake. General Growth is holding out for a higher bid, which led REITs to advance further.

Rates were barely lower for the month, falling just a few basis points across the curve, while news in bond land was dominated by sovereign credit issues overseas. Corporate spreads domestically were tighter by a few beeps compared to the end of January, despite widening out mid-month to levels not seen since November.

Daily Insight

A strong regional manufacturing report offered the greatest boost to the market. a revised GDP reading that came in a bit higher than previously estimated may have helped a little too but the increase was mainly due to a downward revision on the inflation gauge tied to the report – nominal GDP was unchanged from the initial estimate, more on that below the jump.

The January existing home sales report kept the day’s gains to a minimum as sales posted the second-largest monthly decline on record; the largest decline occurred in the previous month.

Financial and industrial shares led the broad market higher. Bank stocks helped propel the financials after Barclays recommended buying shares of JP Morgan. I don’t know, JP Morgan is one of the best-run banks out there but the fourth-quarter FDIC report on the industry didn’t paint a pretty picture for the industry. The coverage ratio among insured banks slipped again last quarter to a level that is less than half where it was a few years ago when loan quality was strong – trouble lurks if loan quality fails to improve markedly, and quick.

Utility and consumer staples were the losers on the session, being the only two of the top 10 sectors to close lower on the session.

Click here to read the rest of this entry.

Brent Vondera, Senior Analyst

Friday, February 26, 2010

Fixed Income Weekly

Treasuries have been fighting two separate battles. One is Fed policy. The short end has been bouncing around within a tight .7%-1.1% range for 6 months now. The hike in the discount rate last week brought about a kneejerk move higher in short-term yields, but after much nay saying by policy makers they have settled down to just about where they were before the Fed made the change. The Fed remains very unconcerned with current levels of inflation, Q4 PCE was 1.6% annualized versus 1.4% in Q3, but longer term effects of current policy have the market demanding much higher yields on the long-end, which explains the record high spread between 2s and 10s of 291 basis points on Monday.

Secondly, the budget/credit/currency issues in Europe are pushing money into dollars, and in turn Treasurys. It’s the typical safety trade really. It sure helped with the $126 billion the Treasury had to sell this week, which all traded through the “when issued” yield, a sign of better than expected demand.

Next week is full of more Fed speak, which should get the market jumpstarted after closing on a very quiet note (relatively) this week.

Have a good weekend.

Cliff J. Reynolds Jr., Investment Analyst

Weekly Roundup: ESRX, MON, RIG

Express Scripts (ESRX) +5.89%

Investors bid up ESRX shares following 2010 guidance that suggested the integration of WellPoint’s NextRx unit is ahead of schedule.

The acquisition of NextRx gave ESRX the scale to compete with its biggest competitors in the pharmacy benefit manager (PBM) industry. PBMs negotiate drug prices with manufacturers and retailers on behalf of clients.

ESRX’s proven track record of successfully integrating acquisitions and the firm’s outlook that suggesting synergies associated with the transaction are likely to come earlier have lifted investor confidence in the firm’s ability to achieve above normal earnings growth over the next few years.

ESRX and other PBMs are positioned to benefit from positive trends such as the aging population, healthcare cost containment efforts, and increasing customer acceptance of mail-order pharmacies. More important, though, is the looming patent cliff in 2011 and 2012 since ESRX earns profit margins when customers use generics over brand-name pharmaceuticals.

ESRX’s fourth quarter income rose 8%, including one-time charges from the NextRx acquisition, helped by an increase in the use of generic drugs to 69.1% from 67.3% helped push margins higher.

Monsanto (MON) -7.10%

MON lowered its second quarter profit outlook as the late 2009 harvest is shifting purchases to the second half of the year.

MON also said the two new products they are counting on to drive earnings this decade may be planted on 20% fewer acres in 2010 than previously forecast. Farmers are trying the new products in the numbers expected, but on fewer acres. MON said the shortfall may reduce earnings by less than 5 cents a share.

The two products of topic are Roundup Ready Yield soybeans, which increase yields 7% to 11% from the original product introduced in 1996, and SmartStax corn seed, which has eight genetic changes (traits) that resist bugs and tolerate herbicides.

MON shares have been crushed this year, but I think sell-off is not justified. The SmartStax corn seed is a true game-changer that can drive margins as well as market share gains for the firm’s corn business in coming years. As for the soybean product, China recently gave import approval to Roundup Ready 2 Yield soybeans, which paves the way for large-scale commercial introduction of the product.

Longer-term, MON’s success comes down to its powerful research and development efforts – the firm plows 10% of sales into R&D – and their elite production and distribution capabilities.

Transocean (RIG) -5.30%

RIG’s earnings trailed consensus amid decreasing demand for rigs. Only 69% of RIG’s fleet was working during the fourth quarter, down from 90% a year earlier.

Utilization declined in six of seven rig categories, more than offsetting the 18% increase in the fleet’s average daily lease rate. Idling rigs, even for a few days, directly hits the bottom line since the day rates (or rental rates) are so substantial.

The market is down on RIG shares after this report, but the company’s superior free-cash-flow generation and above average earnings visibility versus its peers should not be ignored. RIG management has made it clear they plan to return significant cash to shareholders through dividends and buybacks over the next two to three years.

Last week, RIG announced a $3.2 billion share-buyback program as well as the issuance of a $1 billion special dividend. Instituting a buyback program rather than paying out a larger dividend at this juncture gives the company financial flexibility for opportunistic acquisitions.

The potential for a jackup spin-off could also help support shares in the near-term.

Peter J. Lazaroff, Investment Analyst

Daily Insight

Things got started on a bad note as futures were pointing lower due to concerns over growth prospects in Europe and the likelihood that sovereign debt woes would spread throughout the zone. Also putting the hurt on morning trading was the latest report on jobless claims, which showed the uptrend has extended to seven weeks now. Initial claims have just about returned to the 500K mark – peak levels of the last two economic contractions.

But around 1:00CST stocks staged a comeback, which was also right around the time Bloomberg News reported that the Obama Administration may ban all foreclosures until they have been screened and rejected by the government’s Home Affordability Mortgage Program, or HAMP. We discussed this proposal to halt foreclosures in Wednesday’s letter, so I won’t get into it again here.

Telecommunication and financial shares led the decline. Consumer-related and health-care shares were the relative winners, but still down for the session.

Click here to read the rest of this entry.

Brent Vondera, Senior Analyst

Thursday, February 25, 2010

Daily Insight

Bernanke was on Capitol Hill yesterday providing his semi-annual testimony on the economy and monetary policy, an event officially termed Humphrey-Hawkins testimony although few still call it that these days, and that’s when he reiterated the economy still needs a record-low level of fed funds. That comment reversed a market retreat that had followed the release of new homes sales for January, which we’ll get to below.

Nine of the 10 major industry groups gained ground on the session, led by financial, consumer discretionary and technology shares -- the sole loser on the session being basic material shares.

Basic materials have been down for three sessions now, and the fact that they lost ground again on Wednesday when the overall market was up shows that the mid-session rebound in stocks was all due to the easy-monetary policy trade rather than upbeat sentiment on the potential for economic growth.

Normally, when the Fed reiterates they’ll keep rates at record lows for an extended period commodity-related material stocks are among the leading performers. But people are losing faith in a durable expansion (whether we’re talking global or domestic) and that’s invoking some profit taking within this sector, which has pretty much been in play since mid-January.

I’m not even sure traders want to be buying stocks at this level, but they feel this is the only place to deploy money because of the Fed-induced puny yields within the low-risk sphere – which is precisely a major part of the Fed’s agenda.

Click here to read the rest of this entry.

Brent Vondera, Senior Analyst

Wednesday, February 24, 2010

Daily Insight

Market sentiment appears to be increasingly mercurial. We have these weeks in which the market believes the recovery is going to be normal, both in terms of degree and duration, followed by stints of concern.

The former mentality, in my view, is one that’s distorted by ultra-easy monetary policy and unprecedented levels of global government stimuli. A recent viewing of the 1980s classic (ok, maybe not a classic) “Back to School” reminded me of a Dylan Thomas poem, and indeed the equity market doesn’t want to go gently into that good night, but rages against the dying of the light...I paraphrase. Yet we must acknowledge that debt-driven recessions don’t simply fizzle out as the aftermath drags on – its takes time for the de-leveraging process to play out.

Further, the severity of these types of contractions occurs so quickly that the government response is over-bearing and carries with it additional problems, particularly by delaying the inevitable and the misallocation of resources that result – adverse implications follow and they show up in a lack of business confidence and employment.

These are the realities with which the market is currently entangled, mistakenly euphoric by the distortive actions of government only to be occasional reminded by realities on the ground. We need end consumer demand to take over from the inventory cycle and government stimulus, yet this confidence reading was a stark reminder that we’re really nowhere near this scenario.

Troubles in Europe isn’t helping matters as those economies appear to be losing steam. The German economy unexpectedly stalled in the previous quarter and that is weighing on the entire euro-zone, not to mention their sovereign debt issues.

All 10 major industry groups declined on the session, led by financials (yesterday’s best performer), basic material and energy shares.

Click here to read more.

Brent Vondera, Senior Analyst

Tuesday, February 23, 2010

Currency Swaps

Currency swaps have been getting some attention recently in relation to Greece entering such agreements to conceal the extent of its budget deficit.

In its simplest form, a currency swap is an over-the-counter derivative in which two parties agree to exchange streams of interest payments in different currencies. A country or corporation typically enters into a currency swap when they borrow money in foreign currency and are concerned about foreign exchange fluctuations.

For example, if a country like Greece borrows dollars in the U.S., then they have to repay that debt in dollars. If the dollar strengthens against the euro, then Greece’s debt burden would increase. As a result, Greece might prefer to repay the debt in Euros, and currency swaps are an easy way to do that.

In a plain vanilla swap, two parties exchange principal amounts at the beginning of the swap – the principal amounts are set so as to be approximately equal to one another given the exchange rate at the time the swap is initiated. Then, at intervals specified in the swap agreement, the parties will exchange interest payments on their respective principal amounts. At the end of the swap agreement, the parties re-exchange the original principal amounts – the principal payments are unaffected by exchange rates.

Greece’s swaps were not the plain vanilla kind that are designed to help manage debt, but instead were customized swaps designed to generate cash. In this instance, one party agrees to exchange money up front in return for higher payouts in the future. This sounds an awful lot like a loan, right? Yet these currency swaps are not accounted for as loans on the books of the national government.

It’s pretty easy to understand investors’ fears considering Greece has been hiding huge long-term liabilities from creditors. It’s even scarier to think about all the other countries that may have potentially entered into similar contracts.

Peter J. Lazaroff, Investment Analyst

Daily Insight

Dovish comments from the ultimate monetary dove Janet Yellen – President of the San Francisco Fed Bank – helped bank stocks as she stated the Fed will need to keep rates very low as the economy will operate below potential for the next two years. Yellen is not a current member of the rate-setting FOMC.

Financial and industrial shares were the only gainers among the 10 major sectors. As mentioned above, energy and basic material shares led the decline, along with utilities.

Oil prices advanced past the $80/barrel handle again, just two weeks back it looked as though crude was going below $70. The index that tracks energy stocks didn’t follow this move in crude though as shares of Schlumberger (which makes up roughly 6% of the index) weighed on the measure. The oil-services giant announced it would purchase Smith International in an all stock deal. Schlumberger shareholders didn’t like the premium the company decided to pay for Smith, so sent the stock lower as a result.

Volume was lackluster yet again as just 905 million shares traded on the NYSE Composite. That’s 21% below even the weak average volume of the past six months and 35% below what was considered the norm a couple of years back.

Click here to read more.

Brent Vondera, Senior Analyst

Monday, February 22, 2010

Daily Insight

The headline delinquency figures for the fourth quarter looked good, in a relative sense. The report showed mortgages that are at least 30 days late improved on a quarter-over-quarter basis, although mortgages that are 90-days late deteriorated, more on that below.

The CPI data helped to ease concerns that the Fed will earnestly begin the Great Unwind sooner than was previously expected. Pre-market trading showed a significant degree of unease following the Fed’s surprise discount rate hike after the bell on Thursday (at least in terms of timing, Bernanke has telegraphed this was coming). The tamer-than-expected CPI print, namely the negative reading on core CPI (a worthless indicator right now in my view but the Fed continues to give core inflation readings -- which exclude food and energy prices -- the most merit), offered support the fed funds rate won’t be hiked anytime too soon.

It was a good week for stocks. The market was open just four days due to Presidents Day and the broad market was up in all four, ending the week higher by 3.13% and erased most of the late-January/early-February losses. As we open this morning, the S&P 500 is just 3.56% below the 15-month high hit on January 19.

Click here to read the rest of this post.

Brent Vondera, Senior Analyst

Friday, February 19, 2010

Weekly Roundup: LLL, WLP, CERN, WMT, WAG

L-3 Communications Holdings Inc. (LLL) +3.33%

LLL agreed to buy Insight Technology Inc. to add night-vision goggles and thermal-imaging systems to its already diverse defense portfolio. The acquisition will be completed in the second quarter and will immediately add to operating results. Insight, which also makes laser aiming devices and laser rangefinders, is expected to have about $290 million in sales in 2010.

Just last week, LLL’s CEO Michael Strianese said the company had “plenty of dry powder” for acquisitions with about $1 billion in cash as well as access to credit. The purchase will be an all cash transaction, but the terms are yet to be disclosed.

LLL has a strong history of acquiring cutting-edge technology and his built a stable position in the defense industry thanks to its diversified product portfolio – LLL has about 2,000 contracts with no single contract accounting for more than 3% of total revenue.

The Pentagon’s budget is slated to increase by 3.4%, not including money for the wars in Iraq and Afghanistan. In particular, the Pentagon’s procurement budget is set for a 7.6% increase with command, control, and communications systems expected to see a boost. This will directly benefit firms like LLL and Harris Corporation (HRS).

WellPoint Inc. (WLP) -0.86%

WLP shares fell this week amid the company’s Congressional testimony over proposed premium increases in California. WLP said in a statement the pervious earnings forecast for 2010 is now subject to the “ability to secure and maintain sufficient premium rates.”

The health insurer has postponed premium increases of as much as 39% for two months so that California’s insurance commissioner could review the plan after it was heavily criticized by state officials and the Obama administration.

The recession and difficult labor market is leading younger, healthier individuals to forgo insurance, skewing the mix of policy holders toward the elderly. This dynamic and rising medical costs are the basis for WLP’s premium increases. Insurers were banking on federal legislation to help contain rising healthcare costs, but there is little choice but to raise rates since the healthcare bill has stalled.

Cerner (CERN) +3.00%

After a rough start to 2010, CERN has rebounded a bit in the past few weeks. Some of the bounce may be attributable to investors taking positions after the sell-off in January – the stock fell 8.22% for the month. CERN also reported earnings late last week that should a strong rebound in systems sales during the fourth quarter, which suggest the healthcare IT environment is improving.

Also lifting sentiment was various analyst upgrades for both CERN and fellow healthcare IT firm Quality Systems Inc. (QSII).

Additional content from this week:- Wal-Mart Stores (WMT) hurt by deflation and lower traffic

- Walgreen Co. (WAG) buys New York drugstore chain

--

Peter J. Lazaroff, Investment Analyst

Fixed Income Weekly

The short end sold off hard immediately after the release, gaining about 10 basis points in yield in the few hours following the announcement, but eased off the lows a bit in Friday’s trading. I don’t think that this move was meaningless, but it’s pretty close. The jump in rates was from the low end of the .8% to 1.1% range on the 2-year that we’ve been in for a while, and should expect to be in for at least the first half of 2010. As far as this move telegraphing an adjustment to the fed-funds rate goes, we still haven’t seen anything substantial from the Fed. Sure, Thomas Hoenig became the first dissenting vote last meeting when he urged to committee to remove the “extended period” language from the statement, but Thursday’s test will be followed by many more before a real move is made.

Have a good weekend.

Cliff J. Reynolds Jr., Investment Analyst

Daily Insight

A strong earnings report from Hewlett-Packard also helped to boost the market. The largest personal computer maker beat profit and sales estimates during the fourth quarter – although operating earnings (which removes one-time items that either boost or depress profits) did miss estimates by 4.4%; this is the number we watch. Total sales rose 8% thanks to a 41% jump in sales to the BRICs (Brazil, Russia, India and China) – undoubtedly fueled by China and their massive stimulus program.

Hewlett enjoyed increased market share, holiday spending and business outlays as firms had unspent equipment budgets at the end of 2009. This is something we talked about last week, I think it was; firms were unwilling to spend during most of 2009 and as November and December arrived they uses those funds to replace aging equipment. We’ll need to see a comparable follow through in the first quarter to confirm that something exciting is occurring on the business spending front.

Earnings results from Wal-Mart that missed its projection partially offset the good report from Hewlett. Wal-Mart reported that sales for stores open at least a year fell 1.6% in the three months ended January 31. CEO Mike Duke warned that sales will be “more challenging” in the current quarter and. Some people saw the WMT news as a sign consumers are trading up to a higher price point. I’m not sure about that one with 9.8% unemployment and 17% under-employment, but we’ll see.

Basic material shares led the broad market higher, followed by industrials. Nine of the 10 major industry groups closed higher, telecoms being the only loser.

Market Activity for February 18, 2010

Greenback

GreenbackThe U.S. dollar rallied on concerns out of the EU (those sovereign debt issues) and the continued flee from the euro. The situation remains such that the dollar only catches a bid on bad news and investors are certainly fleeing the EU currency, which has gotten smacked by 10% since December. But later in the session the greenback gave up those gains as the euro caught a bit of a bid – speculation that the Swiss engaged in some currency intervention, selling their franc to halt its gains and this meant buying some euros.

While the dollar erased early-session gains it remained above the 80 handle on the Dollar Index (DXY). If it holds here it will help to contain the inflation readings over the subsequent months, particularly with regard to import price inflation that has become a bit frothy of late. After the bell the dollar rallied hard on news the Fed raised the discounts rate, more on this below.

This dollar boost also has ramifications for multi-nationals. Global growth is still not strong enough to boost multi-national company sales without help from a lower currency value – a lower dollar value makes our goods cheaper to overseas buyers. (I am in no way advocating that policy makers move to put pressure on the dollar, they’ve done enough harm to the greenback with an insane level of government spending and the Fed’s ZIRP. You can’t create a prosperous environment by kicking your currency into the dirt, even if it does help in the short term.)

If the U.S. dollar continues to rally on euro woes, and the current belief that Fed tightening is on the way, then this is going to do some damage to profit expectations a couple of quarters out.

Well, so much for that decline in claims last week. The Labor Department reported that initial jobless claims rose 31,000 to 473,000 in the week ended February 13 after falling 41,000 to 442,000 in the previous week. Economists had expected claims to fall to 438K.

So you look at the past two weeks and initial claims are down 10,000 but the level remains well above 450K. The previous week’s decline brought excitement that initial claims would crash below the 400K level but that seems a bit premature now. (The 400K level is important because it always signals at least mild monthly job growth.)

The four-week average on initial claims fell 1,500 to 467,500.

Overall continuing claims resumed their move higher too. Standard claims, those that last the traditional 26 weeks, came in unchanged from the week prior.

Overall continuing claims resumed their move higher too. Standard claims, those that last the traditional 26 weeks, came in unchanged from the week prior. However, Emergency Unemployment Compensation (EUC) rose 274,000. Over the past six weeks EUC claims have jumped 707,000.

However, Emergency Unemployment Compensation (EUC) rose 274,000. Over the past six weeks EUC claims have jumped 707,000.  Neither the initial nor the continuing claims data suggest the labor market in improving to a point in which we’ll see job growth, much less statistically significant job growth. I’ve been expecting to see mild job growth beginning in February or March (meaning monthly growth of at least 50K). These numbers aren’t offering much confidence in this call.

Neither the initial nor the continuing claims data suggest the labor market in improving to a point in which we’ll see job growth, much less statistically significant job growth. I’ve been expecting to see mild job growth beginning in February or March (meaning monthly growth of at least 50K). These numbers aren’t offering much confidence in this call.We need job growth to keep things going, to get final consumer demand trending higher. Without it, the inventory-led GDP boost we’ve seen is going to fizzle out in short order.

Producer prices rose 1.4% in January according to the Labor Department, which outpaced the 1.0% rise that was expected. The increase was mostly due to the fuel components as the ex-energy reading rose just 0.3%. But energy sort of matters as it makes up between 8-12% of disposable income for most households. It’s ridiculous for the Fed to use an inflation gauge that excludes food and energy as their desired tool for tracking price activity.

The overall energy component rose 5.1% for the month, boosted by an 11.5% jump in gasoline. Overall consumer goods rose 1.8% in January and are up 18.4% at an annual rate over the past three months. Gasoline and residential electricity are two components within the consumer goods segment.

Over the past 12 months the PPI is up 4.6%, quite a turnaround just three months removed from an 11-month streak of PPI decline.

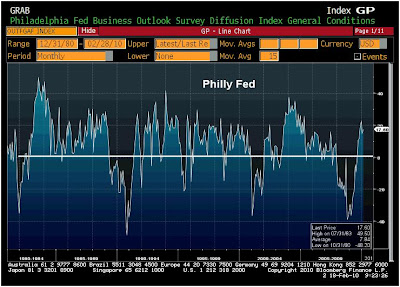

Philly Fed

Philly FedThe Philadelphia Federal Reserve Bank’s gauge of factory activity within their district rose to 17.6 in February (in line with expectations) from January’s 15.2. This follows a good headline figure from the Empire index (New York-area manufacturing) so the month is off to a good start. Like Empire though, some of the sub-indices suggest factories aren’t going to be quick to hire workers.

The new orders index jumped to 22.7 from 3.2 in January – this is the highest reading since April 2006. Inventories rose to 3.2 from -1.6 -- a similar level of improvement showed up in Empire. The employment data was mixed as the number of employees gauge rose to 7.4 from 6.1, yet the average workweek index fell to 1.6 from 4.2 – that divergence doesn’t make sense and one questions which reading is providing the right picture.

Among the components we’re watching most closely for clues of future hiring, the readings weren’t quite as good. The unfilled orders index fell big time, dropping to -7.5 from 3.6; the delivery times index declined to -2.1 from 6.6. We need these reading to trend in positive territory for several months as it would show that factories are having difficulty keeping up with orders. So long as they are not, which is what negative readings suggest, manufacturing employment is unlikely to move higher.

Maybe the big new orders reading will provide the work needed to stretch current workers and send the unfilled orders and delivery times gauges higher over the next couple of months. Households are saddled with high debt levels and those liabilities have to be paid down to some extent before this economy can return to normal – to state the obvious, that takes employment growth.

For now manufacturing activity is looking good, a rebound that began 5-6 months back, as inventories had been slashed at record levels and firms are rebuilding those stockpiles a bit.

Fed Timing Surprises the Market

The Fed chose to raise the discount rate by 25 basis points to 0.75% last night after the market closed. (This is the rate banks are charged to borrow directly from the Fed.) They also returned the term of these loans to overnight from 28 days. This move gets the discount rate closer to its normal 100 basis point spread over fed funds

This move by Bernanke is not a surprise as there has been talk of such action for a couple of months and they laid this out in their minute release on Wednesday. The timing is a bit interesting though. This change is intended to encourage financial institutions to rely more on money markets rather than the central bank for short-term liquidity needs.

It will be interesting to watch how the market perceives this move, possibly expecting the total exit strategy to occur sooner than formerly expected. This is a test by the Fed, testing to see how the market reacts; I still think they’ll be slow to move with regard to actual tightening – raising the fed funds rate. Former Fed Governor Laurence Meyer is predicting fed funds won’t rise for the first time until mid-2011.

For past issues of Daily Insights and other daily publications please visit: www.acrinv.com/blog

Have a great weekend!

Brent Vondera, Senior Analyst

Thursday, February 18, 2010

Wal-Mart Stores (WMT) hurt by deflation and lower traffic

The impact of deflation on operations is becoming increasingly obvious for a company that has traditionally been a back-door dollar play – WMT buys goods from foreign countries where the dollar is strong and sells them in the U.S. The company spent a good part of last year downplaying the impact of deflation in food and in other areas such as consumer electronics, but deflation cannot be ignored. Still, WMT has not publicly addressed with how it is dealing with this issue.

A decrease in traffic during the quarter was also responsible for disappointing results. I can’t help but assume some of the traffic decline is due to consumers trading. WMT’s low price advantage has been crucial in attracting recession-stricken consumers, but increasing signs of stabilization threaten to reverse this trend. Comparing WMT’s results to those from high-end grocer Whole Foods (WFMI) earlier this week makes the trade-up case even more compelling. WFMI raised its full-year forecast amid more store traffic and increased number of items per sales ticket.

Consumer sentiment won’t be going gangbusters until the unemployment rate moves significantly lower, but still investors should be less focused on WMT’s low-cost position and pay more attention to the company’s international sales.

Much of the company’s future leans on their international success. International operations have grown to roughly $100 billion in annual sales from nothing 20 years ago, but much of that growth came from directly acquisitions. And while international sales are growing faster than those in the U.S., profitability is lower – international operating margins are 5% and 7% in the U.S. An even bigger concern is that WMT has not been able to show the economies of scale or explicit synergies that were always the rationale for such expansion.

--

Peter J. Lazaroff, Investment Analyst