The broad market began the session higher as investors liked the fact that weekly jobless claims dropped a bit and remained nicely below the 400,000 level, but quickly lost ground as the latest regional manufacturing survey showed continued weakness. Stocks then reversed course as oil prices moved lower, fueled by technology, transportation and consumer discretionary names.

Energy stocks were the worst-performing group yesterday as crude price closed lower by 3.36%.

Oil prices slipped $4.59 per barrel yesterday, to close at $132.09, as the Chinese government announced it will curtail fuel subsidies and price caps. By rolling back these command-and-control policies one can expect demand to respond.

In addition, the crude market will hopefully come under pressure over the next month as China reduces production activity in an attempt to clear the air of substantial smog problems ahead of the Olympic games.

I still think the crude trade – in the very short-term – is more a function of Fed policy and the dollar than anything else, but these developments should have us come off the highs. We shall see.

Onto the market in general, the WSJ is calling the stock market a pinball, bouncing between technical levels. We’ve talked about this for some time, being stuck in a range as uncertainties keep the S&P 500 (SPX) between 1275 and 1430. Currently, we’re at the mid-point of this range – 1342 on SPX.

It will likely take some time to break out of this range – I’m talking about upside break-out. In the short term, once the Fed gets it right and the market’s current concerns over the Presidential election are allayed (Intrade – pay to play betting – has the relative free-market candidate down by 30 points) we’ll gain some strength. After that it will depend on longer-term policies.

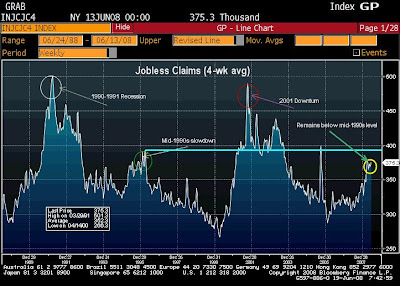

The graph below is an update to the one posted last week.

In the meantime, it will prove beneficial to stick to the allocation that best meets your risk tolerance and goals. One never knows when the rally – a sustained rally -- will come, but it generally arrives when least expected. Again, pro-growth polices are key, and I believe this is the road the U.S. will choose, outside of our typical swerves off of the prosperity-producing path on occasion. We have not swerved just yet, but the uncertainty of such action is one concern that has investors a bit wary.

In the meantime, it will prove beneficial to stick to the allocation that best meets your risk tolerance and goals. One never knows when the rally – a sustained rally -- will come, but it generally arrives when least expected. Again, pro-growth polices are key, and I believe this is the road the U.S. will choose, outside of our typical swerves off of the prosperity-producing path on occasion. We have not swerved just yet, but the uncertainty of such action is one concern that has investors a bit wary.On the economic front, jobless claims for the week ended June 14 declined 5,000 to 381,000. As touched on yesterday, I was looking for this figure to come back to the 375,000, but a decline is good and continuing claims fell to the lowest level in six weeks.

We remain meaningfully below the 400,000 level – hitting 400k would indicate statistically significant monthly job losses – and well below levels of the typical recession/downturn. Notice, as most readers are aware, that we have yet to even hit the mid-1990s slowdown level, which was a period of extremely transitory slowing that saw economic growth bounce back with much force.

Finally, the Philly Fed index – a gauge of factory activity compiled by the Philadelphia Federal Reserve Bank – showed that manufacturing activity continues to weaken. Most regions in fact have shown weaker factory activity over the past few months, but the Philadelphia region has been particularly hard hit as it is more dependent on the housing sector than any other.

Finally, the Philly Fed index – a gauge of factory activity compiled by the Philadelphia Federal Reserve Bank – showed that manufacturing activity continues to weaken. Most regions in fact have shown weaker factory activity over the past few months, but the Philadelphia region has been particularly hard hit as it is more dependent on the housing sector than any other.

Most of the sub-indices were ugly as well, with new orders and shipments moving lower. Unfilled orders and delivery times were also negative, but improved from the May readings.

Importantly, the largest manufacturing region, the Chicago-area – is holding up pretty well as it hovers around the break-even point that divides expansion from contraction. The nation-wide survey looks pretty much the same, as we’ve depicted with graphs over the past few months.

I do believe the sector as a whole will improve and move back to expansion mode sometime in the next couple of months, as business spending and the production necessary to rebuild inventories take hold. That said the regional surveys will likely remain shaky until housing finally bottoms.

Have a great weekend!

Brent Vondera, Senior Analyst

Inventories are simply too elevated and until we get the sales figures to kick up, we’re not going to see the inventory-to-sales figure come much lower. As the graph below depicts, new home inventory stands at 10.6 months’ worth of supply. We need this number to come down to 6 months’ worth before housing begins to add to growth once again. My feel is that housing will flatten out by the second quarter of 2009 and will add slightly to growth by the end of 2009.

Inventories are simply too elevated and until we get the sales figures to kick up, we’re not going to see the inventory-to-sales figure come much lower. As the graph below depicts, new home inventory stands at 10.6 months’ worth of supply. We need this number to come down to 6 months’ worth before housing begins to add to growth once again. My feel is that housing will flatten out by the second quarter of 2009 and will add slightly to growth by the end of 2009. In a separate report, Commerce also stated industrial production declined for a second-straight month, falling 0.2% in May. The April decline was 0.7% and the trend is not good. It’s important that we see some rebound for June because we do not want one of these sub-zero gaps to occur – illustrated by the chart --, that would spell trouble.

In a separate report, Commerce also stated industrial production declined for a second-straight month, falling 0.2% in May. The April decline was 0.7% and the trend is not good. It’s important that we see some rebound for June because we do not want one of these sub-zero gaps to occur – illustrated by the chart --, that would spell trouble. Lastly, the Labor Department showed that producer prices jumped 1.4% in May and 7.2% from the year-ago period. This was mostly driven by higher energy prices as the ex-energy reading rose by a much lighter 0.4% in May and is up little more than half as much in terms of the overall reading from the year-ago period.

Lastly, the Labor Department showed that producer prices jumped 1.4% in May and 7.2% from the year-ago period. This was mostly driven by higher energy prices as the ex-energy reading rose by a much lighter 0.4% in May and is up little more than half as much in terms of the overall reading from the year-ago period. Of the 10 major S&P 500 industry groups, financials were the best-performing area, adding 1.05%. Energy and information technology shares also gained some ground, while consumer staple and health-care shares led the laggards lower. By the close, six of the 10 ended in the red.

Of the 10 major S&P 500 industry groups, financials were the best-performing area, adding 1.05%. Energy and information technology shares also gained some ground, while consumer staple and health-care shares led the laggards lower. By the close, six of the 10 ended in the red. I think the view regarding some tightening will increase again this morning after the producer price index for May is releases at 7:30CDT. This number is trending 6-7% year-over-year and unless it returns to the 4-5% range, the Fed will feel pressure to do something – at least I hope they will for the dollar’s sake and the price of oil.

I think the view regarding some tightening will increase again this morning after the producer price index for May is releases at 7:30CDT. This number is trending 6-7% year-over-year and unless it returns to the 4-5% range, the Fed will feel pressure to do something – at least I hope they will for the dollar’s sake and the price of oil. This weekend we also saw that Saudi Arabia has chosen to boost production by 550,000 barrels per day beginning next month. This will bring their daily production to roughly 10 million barrels. It appears that Bush trip a couple of weeks back actually was effective – it was reported at the time that he went hat-in-hand to the Saudi’s and came back with nothing. I don’t think it is a coincidence that they are suddenly announcing a boost to production as the President likely reminded the Saudi Family it is the U.S. that stands between them and an Iranian regime that would love to invade as Mideast hegemony is their primary goal.

This weekend we also saw that Saudi Arabia has chosen to boost production by 550,000 barrels per day beginning next month. This will bring their daily production to roughly 10 million barrels. It appears that Bush trip a couple of weeks back actually was effective – it was reported at the time that he went hat-in-hand to the Saudi’s and came back with nothing. I don’t think it is a coincidence that they are suddenly announcing a boost to production as the President likely reminded the Saudi Family it is the U.S. that stands between them and an Iranian regime that would love to invade as Mideast hegemony is their primary goal. As the whole point of this morning’s commentary suggests, higher energy prices were the driver of the CPI report. The energy component jumped 4.4% in May as gas and electricity was up 2.3% and gasoline up 5.7%.

As the whole point of this morning’s commentary suggests, higher energy prices were the driver of the CPI report. The energy component jumped 4.4% in May as gas and electricity was up 2.3% and gasoline up 5.7%.