Friday, November 6, 2009

Afternoon Review

Today’s labor report showed that payrolls fell by 190,000 in October versus an expected loss of 175,000. The bigger headline in the media, though, was the unemployment rate hitting 10.2%, the highest level since 1983.

General Electric (GE) led industrials after two separate analysts raised their ratings and share-price estimates. Also contributing to gains were transportation stocks, especially the railroads, which are still rising after Warren Buffett’s lofty valuation of Burlington Northern Santa Fe. (More on this topic can be found here.)

Despite all of press industrials received, the materials sector was the best weekly performer, finishing with a 5% gain. Gold stocks led in the sector, advancing nearly 13% this week. Although the Materials sector was strong this week, the CRB Commodity Index recorded a 1.8% loss on the week. This may not surprise you if you read the September 17 post comparing commodity exposure strategies.

--

Peter J. Lazaroff, Investment Analyst

Fixed Income Weekly

This week’s decision by the Federal Open Market Committee (the committee that determines the Fed’s monetary policy) did some decent market moving this week despite only being one of many baby steps to come.

So what changed from last release? Not much. The committee sees household spending expanding, compared to only stabilizing in September. The previously scheduled $200 billion in agency debt purchases will now be reduced to “about $175 billion”, due mostly to the lack of paper available. Other than that, it was a carbon copy of the statement from the September 23 release. A Barron’s article from a couple weeks ago speculated that some Fed officials were considering removing all or part of the “exceptionally low levels of the federal funds rate for an extended period” phrase from the comments. We didn’t get that much of a switch from last meeting but we are definitely a little closer now.

Fannie Mae – The Landlord

Announced yesterday, Fannie Mae will begin renting homes back to troubled homeowners who prove they cannot afford to pay their mortgage. The new “Deed for Lease” program will offer an alternative to eviction to homeowners who have their mortgage either owned or guaranteed by Fannie Mae. In order to qualify homeowners must be between 1 and 11 months late on their mortgage and cannot qualify for a loan modification. Yes. There are homeowners who are more than 11 months late on their mortgage but still living in their home. Could that be masking some problems from the housing data the market has been juiced about lately? Just a thought…

The leases will be for 12 months, after which they will try to sell the home at a higher price than they could right now. Fannie claims that it is unlikely that homeowners will be able to buy their home back after the lease expires, sighting that the home will only be offered to qualified homebuyers. In reality, the term “qualified” has held several different meanings within the credit universe during the last few years, so who’s to say that someone with a major blemish on their credit history in the last year and no down payment won’t again be considered qualified. It’s a loose term at best. My expectation is for this program to crash and burn just like the mortgage modification program.

Cliff J. Reynolds Jr., Investment Analyst

Daily Insight

Stocks rallied hard as a number of better-than-expected results removed the wait-and-see attitude that has been the trend the day before a monthly employment report. The market sure seems willing to erase the losses recorded over the previous couple of weeks, undoubtedly helped by the Fed’s latest signal that the Bernanke bullet train will remain a blur – after Wed’s very soft FOMC statement it’s obvious ZIRP is with us for quite a while still as they kept the “exceptionally” low level of rates for “an extended period” wording in place.

Futures started things off higher after much better-than-expected profit and revenue results from Cisco Systems Wednesday night. Then, yesterday morning’s larger-than-expected decline in initial jobless claims and a chain-store sales report that easily surpassed expectations boosted investor sentiment into the official trading session.

Consumer discretionary, financials and industrials (the same groups that led the market lower on Wednesday) led the broad market’s advance.

Trading in the U.S. dollar was very volatile yesterday, but it did manage to gain some ground. ECB and Bank of England presidents Trichet and King signaled they will begin to remove their emergency level of monetary easing. This will not make the dollar’s road any easier to travel as our Fed keeps policy floored. As (if they actually end up doing so) the European central banks begin to gently raise rates and reduce their government bond purchases it should strengthen their currencies relative to the greenback and further boost interest-rate differentials in their favor.

The Fed isn’t even mildly changing course for some time…unless forced to by a catastrophic dollar rout – that seems to be the only thing that could get their attention and end the ZIRP.

Market Activity for November 5, 2009

Productivity

Productivity

The Labor Department reported that productivity (output per hour worked) surged 9.5% at an annual rate in the third quarter. To offer some perspective, anything over 3.0% at an annual rate is powerful. It means that firms are able to absorb higher costs and that means they do not have to pass those costs, in full, onto the consumer via prices. But we need to explain a distinction between good productivity, which is longer-lasting, and productivity that is, well, less good as it comes solely from the slashing of payrolls.

The good productivity occurs when firms have the incentive to produce and innovate. This results as investors, the providers of seed money, take calculated risk and finance future innovations – generally driven by higher after-tax return expectations. When this innovation comes to market in the form of equipment enhancements, it means higher living standards -- jobs and real wages are driven higher. This type of productivity was in play over the past quarter century as tax rates on capital and income were reduced from the harmful levels of 70% on income (at the top rate) and 40% on the capital gains tax. Productivity continued to expand through the 1980s, 1990s and 2000s even as 48 million jobs were created in the U.S. over this stretch.

Conversely, the less than good sort of productivity is no friend of those looking for work right now because it arrives only when firms slash payrolls (specifically hours worked). And this is what we’re seeing in these latest productivity readings. (This is along the lines of what we’ve discussed for some time now. Firms will very likely squeeze evermore work out of existing employees, for an extended period, before adding to payrolls – this means a lack of final demand and economic weakness; it’s kind of tough for consumers to boost spending when the jobless rate remains at such heights. It becomes even more difficult when consumers are already burdened by historically high debt levels.

The policy direction of massive deficit spending, and the higher tax rates that follow, will only increase the chances that firms remain cautious and this has additional implications for the labor market. Higher tax rates, and while they are not here yet those paying attention understand much higher tax rates via various forms are a very real threat, will make it difficult for the new innovations needed to keep good productivity rolling without high levels of unemployment.

What drove this latest productivity reading was a 4% annualized increase in output, while hours worked slid 5.0% at an annual rate. On output, this gain was the first after falling for four-straight quarters (two of which saw output decline at record postwar levels). The other part of the equation, the tumble in hours worked marked the eighth-straight quarter of decline.

So these very heightened levels of productivity will prove helpful in the short term (particularly with regard to profits), but the benefit is likely to be fleeting if the correct economic policies are not advanced. The good type of productivity (via capital equipment enhancements, which is dependent upon lower tax rates on both capital and incomes), the type with a longer staying power, may have a rough time getting going in the new policy world it appears we find ourselves. It’s important to make these distinctions.

Jobless Claims

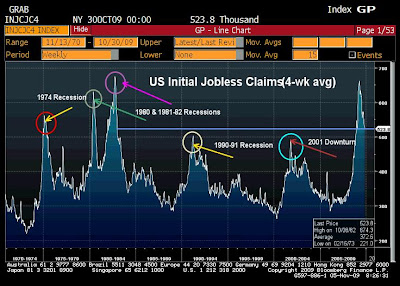

The Labor Department reported that initial jobless claims fell 20,000 to 512,000 in the week ended October 31. This beat the expectation by 10,000 as economists has expected claims to fall to 522K. This is the best move to the 500K level since they fell from 554k in late December to 488K in the first week of January. We have yet to get below what I’m calling the critical 500K level again (a point that is just above the 1991 recession and 2001 downturn peaks), but things appear to be on the right track.

The four-week average of claims fell 3,000 to 523,750 – the lowest level since January before they skyrocketed to 658K. No one expects that to occur again as we’ve gotten past the worst of the payroll declines.

Continuing claims fell for a seventh-straight week, down 68,000 to 5.749 million. As we’ve touched on for weeks now, this reading is being distorted by the exhaustion of benefits, which as of the latest payroll data continues to climb to record levels – as of September the exhaustion rate of the unemployed who had been collecting jobless benefits rose to 52.4%. Tomorrow’s data will shed new light on this reading.

Continuing claims fell for a seventh-straight week, down 68,000 to 5.749 million. As we’ve touched on for weeks now, this reading is being distorted by the exhaustion of benefits, which as of the latest payroll data continues to climb to record levels – as of September the exhaustion rate of the unemployed who had been collecting jobless benefits rose to 52.4%. Tomorrow’s data will shed new light on this reading.

Further, the 68,000 decline in traditional claims was more than offset by the 114,800 increase in emergency and extended jobless benefits.

By the way, Congress, or is it Parliament, has passed another 20-week extension to jobless benefits. I believe this brings the total to 79 weeks for those that are eligible. The extension provides another 14 weeks of benefits in all states, plus another six weeks for those in states with jobless rates over 8.5%. There are 26 states that meet that threshold.

(Also part of that bill is an extension of the homebuyers’ tax credit of $8,000 to April 30. Buyers who have owned their residence for at least five years would qualify to receive a $6,500 credit if they buy another – they would not have to sell the current home but the new one would have to qualify as their primary residence. Singles making up to $125,000 and couples making up to $225,000 would qualify. The market distorting games continue.)

(Also part of that bill is an extension of the homebuyers’ tax credit of $8,000 to April 30. Buyers who have owned their residence for at least five years would qualify to receive a $6,500 credit if they buy another – they would not have to sell the current home but the new one would have to qualify as their primary residence. Singles making up to $125,000 and couples making up to $225,000 would qualify. The market distorting games continue.)

Chain Store Sales

Chain-store retail sales (which is just year-over-year results for stores open at least one year) rose 2.1% in October, which blew by the expectation for a rise of just 0.1%. This move marks the second month of increase, same-store sales rose 0.1% in September, after 10-straight months of decline. All segments of the data have posted at least 14 months of declines with the exception being discount and drug chains. Thus, the year-ago comparisons have become very easy. Recall that these past two months of increase are compared to the beginning of economic hell when the consumer went into hiding in late September-October of 2008.

Apparel chains saw y/o/y sales rise 1.0%, after a 0.7% increase in September. Luxury chains posted a 1.8% increase in sales, the first in 16 months and those declines were huge averaging -13% y/o/y during this stretch. Discounters posted a 2.5% y/o/y sales jump in October. Drug chains saw sales boosted by 3.4%.

The only segment that continued to post declines was department stores, which extends the y/o/y declines to 16 months.

Overall, this is a good report, but it is off of easy comps and considering the fragility of the labor market results will likely be choppy over the next several months.

Employment Report

All eyes will be on the October jobs report this morning, which is expected to show 175,000 in payroll losses. This will mark the 22nd straight month of payroll declines and the losses have been massive – 7.2 million jobs have been erased over this stretch. We are going to see these declines move to statistically insignificant levels of < 100K per month in short order and one should expect to see mild job increases (yes, increases) by early 2010.

However, it will very likely take at least four quarters of above average (avg. being 3.4%) real GDP readings in order to bring the unemployment rate below 9.5%. (First, the jobless rate must move well above 10% as it always continues to rise even when job creation begins.) I am extremely skeptical above trend GDP results will occur for four quarter in this environment and give zero credence to forecasts that this expansion even comes close to those we’ve seen over the past 25 years.

The Fed is at zero, which means when the tightening campaign begins, it will not look like the normal ¼ point increases. The tightening will be aggressive, and when it occurs at the same time that tax rates are moving higher, the challenge to the economy will be enormous. It will take quick and substantial changes to the policy direction in order to expect otherwise, and even if that occurs, we still have to deal with the reversal of monetary policy.

Have a great weekend!

Brent Vondera, Senior Analyst

Thursday, November 5, 2009

Performance 1-Year After Presidential Election

I was only planning on using the S&P 500 since it is a broader gauge of market performance, but then realized that data from 1900-1925 (which was unavailable for the necessary 12-month periods) would yield significantly different average returns. As a result, I included the less broad market measure the Dow Jones Industrial Average.

No real or meaningful conclusions can be drawn from this data – obviously there are many factors that contributed to the market’s movements in these 12-month periods.

--

Peter J. Lazaroff, Investment Analyst

Daily Insight

U.S. stocks sold off in the final hour of trading after spending the entire session higher by about 1.5%. By the time the bell rang the Dow closed up just 0.30% and the broad S&P 500 just 0.10%. I guess it was the old story “buy on the rumor sell on the news” as Fed policy makers kept their aggressive easing campaign in place.

Financial, industrial and energy were the worst performing groups on the session. The fact that energy was down seemed a bit strange on a day in which the price of crude rose back above $80. But think about it. The Fed keeps the pedal to the metal, that doesn’t exactly give the impression that the economy is at all able to stand on its own – as a result, these sectors will lead to the downside. The credit-card regulations coming out of Washington certainly also put pressure on the financials.

The dollar got Bernanke’d, giving up the little progress it had made over the previous six sessions.

Market Activity for November 4, 2009 Mortgage Applications

Mortgage Applications

The Mortgage Bankers Association reported that applications rose 8.2% in the week ended October 30, the first increase in four weeks. Purchases continued to fall though as the homebuyers’ tax credit has effectively expired and potential buyers were uncertain as to the extension.

Refinancing activity rose 14.5% after three weeks of decline (outsized declines over the previous two weeks) as the 30-year fixed mortgage rate moved below 5.00% again.

Challenger Layoffs Announcements

The job-cuts survey from executive outplacement firm Challenger, Gray & Christmas estimated that layoff announcements declined 50.7% to 112,884 last month from October 2008. On a month-over-month basis, layoffs fell 10,725, or 16%, to 55,679.

The October reading is the lowest level of monthly announced layoffs in 17 months, so things are moving in the right direction. This is a vital first step. The next step is obviously payroll additions but firms are very likely to squeeze more work out of existing employees before adding jobs. There is a lot of slack out there. Just as we talked about yesterday by way of the factory orders reports, unfilled orders continued to decline and that means the existing workforce is having no problem keeping up with orders. Until existing workers become quite stretched, firms are not going to rush to hire more workers in this environment.

Additionally, small and medium-sized businesses will lead job creation, as is always the case. But these firms are having trouble getting financing as the banking industry remains saddled with poor credit quality and loan defaults. Thus they are preserving their capital positions and holding back from providing the financing to small business. There is nothing terribly unusual about this in general, it is the reality when loan delinquencies rise. But the current environment has seen an abnormally high level of delinquency rates, and that means financing is that much harder to come by for the smalls and mediums.

ADP Employment

U.S. companies eliminated 203,000 in October, according to business outsourcing solutions firm ADP, down from the 227,000 estimated by the firm during September (the official government jobs report showed a loss of 263,000 jobs for that month – we get the official October reading tomorrow). This marks the 21st straight month of job losses.

Small and medium firms led the job cuts last month, again not official but according to this survey, as both reduced payrolls by 75,000 a piece. Small firms are defined as those with less than 50 employees and medium firms as those with between 50-499 employees. Large firms shed 53,000 positions.

ISM Non-manufacturing

The Institute for Supply Management reported that the service sector expanded for a second-straight month in October. Although, the pace of expansion eased a bit as ISM non-manufacturing slipped to 50.6 from 50.9 in September. A reading above 50 marks expansion, so you can see service-sector growth is pretty tenuous.

Most of the sub-indices moved in the right direction. Overall business activity picked up to 55.2 from 55.1; new orders rose more than one point to 55.6 from 54.2; backlog of orders rose to 53.5 from 51.5.

However, the measures that are most in sight right now slipped. The inventory measure fell 4.5 points to 43.0 (been in contraction mode for 14 months). The inventory sentiment figure rose to 63.5 from 62.0 (a reading over 50 on this one means that firms view stockpiles are still too high). And the employment gauge fell to 41.1 from 44.3 on September.

Nine of the 18 industries tracked reported expansion, and that is up from five in September.

What respondents were saying:

“Cost-cutting efforts continue.” (Transportation & Warehousing)

“Overall business activity increasing – forecast even better market conditions in the coming months.” (Construction)

“Business climate remains encouraging, but recovery will remain slow in rebounding.” (Professional, Scientific & Technical Services)

“The weakening U.S. dollar contributing to upward pressure on commodity prices.” (Wholesale Trade)

FOMC – ZIRP Lives

The FOMC (rate-setting and policy decision-making committee of the Federal Reserve) kept their statement essentially unchanged from that of the September meeting as the “exceptionally” low level of fed funds for an “extended period” phrases remained. As touched on yesterday, this is a clear signal to all that the banking system remains in a tough spot – credit quality is deteriorating and lending continues to contract. Therefore, the Fed feels the need to continue recapitalizing the banks, the main goal of the zero interest-rate policy (ZIRP), and whatever it can do to juice the housing market.

In terms of these key comments the statement was a carbon copy of the previous meeting’s wording. But there were some changes in other regards:

- The Fed will purchase just $175 billion of agency debt now, versus the $200 billion in the previous plan. (For clarity, they will complete their $1.25 trillion of agency mortgage-backed securities by the end of the first quarter 2010. They’ve completed the $300 billion purchase of Treasury securities.)

- Household spending appears to be expanding. The previous statement said that household spending seems to be stabilizing.

- The Fed stated three conditions that will determine how long they keep policy accommodative: elevated resource slack (a high unemployment rate), subdued inflation trends and stable inflation expectations.

Mainstream economists, in their reaction to the FOMC statement, sang in unison about the Fed’s three stated criteria. As if from a choir, they acted as if this is some new revelation. It is not. Anyone who has paid attention and studied the Fed’s mindset for decades now knows that the unemployment in particular is what the Fed focuses on. Long-time readers know that this has been my main critique of the Fed for several years now. It’s nothing more than the same old Phillips Curve nonsense that has gotten the Fed, and the rest of us, in trouble so many times -- and none greater than their previous policy mistakes (2002-2005 when they kept real rates negative) that led to the housing bubble and the over-leveraged nature of households and institutions.

Many may have suspected it, these latest statements remove any doubt. Bernanke is not going to remove the spike punchbowl for some time. The unemployment rate is a lagging indicator, and so are the traditional measures of inflation. Therefore, they will extend the aggressive accommodation for much longer than is warranted – nothing new there. This means the unwinding of this policy, the tightening, is likely to be severe and harsh. Better to mildly remove the emergency level of fed funds, bringing it 0.75%-1.00%, than to keep things floored like this. If the economy cannot deal with a 1.00% FF, then stocks have gotten ahead of the economic state of things by a larger degree than I have thought.

What Bernanke & Co. needs to focus on is credit expansion. When this begins to kick up, that’s when the money-pumping agenda explodes into inflation. Instead, they just cannot bring themselves to shed the flawed Keynesian models that cause them to make harmful mistakes. This latest FOMC statement does nothing to increase my level of confidence in this Fed.

Have a great day!

Brent Vondera, Senior Analyst

Wednesday, November 4, 2009

P/B ratio

In honor of Warren Buffett’s latest acquisition, I wanted to explain one of his favorite valuation methods: evaluating a company’s price-to-book (P/B) ratio. Broadly speaking, the P/B ratio compares a stock’s market value to its book value to determine whether or not the company is undervalued.

Book value is a company’s assets (cash, inventory, equipment, real estate, etc) minus intangible assets (copyrights, logos, etc) and liabilities (debt, unearned revenue, etc.).

Consider a simple example in which a company has $100 million in assets on the balance sheet and $75 million in liabilities. If there are 10 million shares outstanding, each share would represent $2.50 of book value. If each share sells on the market at $5, then P/B ratio would be 2.

A company may be trading at less than its book value (or have a P/B ratio of 1) for two very different reasons. One reason could be that the market believes the asset value is overvalued or that there is something fundamentally wrong with the company. If this is true, then investors should stay away since a downward correction of that asset value by the market would result in negative returns.

The other possibility is that the company is earning a dismal (maybe even negative) return on its assets. In this case, changes in management or business conditions may prompt a turnaround in prospects and provide strong positive returns. If this turnaround never materializes, then the company could at least be broken up for its asset value and, in turn, provide shareholders with a profit.

Although the P/B ratio is traditionally used by value investors, it’s also useful for investors seeking growth at a reasonable price. Growth companies tend to have higher P/B ratios, which is fine as long as the company has a high return on equity (ROE). Large discrepancies between P/B and ROE should raise a red flag.

So how does Buffett’s recent acquisition of Burlington Northern Santa Fe (BNI) railroad look?

The purchase price of $100 a share gives BNI a P/B of 2.80 and a P/E of 20 times future earnings – not exactly what most would consider a “value.” What this means is that Buffett believes the company’s growth prospects are very attractive once the economy recovers.

Railroads do, in fact, have good operating leverage to an economic recovery since more than half of operating expenses are fixed – increases in rail volume would significantly enhance profit margins. Buffett also has a history of seeking companies with strong competitive advantages such as barriers to entry. The established network of nearly impossible to replace assets provides railroads with staggering barriers to entry.

Acropolis, too, has been buyers of railroads since March; however, we favor Norfolk Southern (NSC) due to its cheaper valuation, impressive profitability, diverse customer base, and commitment to returning value to shareholders. And since we are talking P/B ratios, NSC’s is only 1.82 compared to BNI’s 2.70.

The P/B ratio shouldn’t be the sole reason for making an investment decision. Like all valuation methods, it varies across industries and can be distorted by a company’s accounting methods in their financial statements. Still, the P/B ratio is a nice starting point for finding undervalued companies.

--

Peter J. Lazaroff, Investment Analyst

Daily Insight

Industrial shares led the broad market’s advance, propelled by the two deals. The basic material (certainly helped by a big time rally in the price of gold) and energy sectors were close behind. The losers on the session were health-care, utilities, tech, telecoms and consumer staples – all closed lower on the session.

Berkshire’s all-out purchase of railroad giant Burlington Northern is clearly a bet (since Buffett is an economic advisor to the Obama Administration it was probably much safer than a “bet”) on increased infrastructure spending and future taxes on carbon emissions that make truckers less competitive relative to the rails.

Advancers whipped decliners by a two-to-one margin even though the overall market didn’t really have much juice to it. The advancers surely didn’t advance by much, with the exception of the transports on the Burlington deal. The Dow Jones Transportation Average massively outperformed the market (up 5.28% on the trannies vs. the 0.24% pick up for the broad index).

Market Activity for November 3, 2009

Gold

GoldThe front-month gold contract rose to a record, spiking $31 to $1085.80 (still well below the 1980 inflation-adjusted price of roughly $2350/oz.) as India’s central bank went on a little buying spree – they purchased 200 tons, or $6.7 billion worth, of gold from the IMF.

Bianco Research

Bianco ResearchIs this a move to diversify away from currencies (namely the U.S. dollar) as the world loses confidence in governments’ ability to stabilize currency values? It seems that way. The purchase boosted India’s gold holdings by 55%. Hey big Ben, it’s kind of difficult to ignore this transaction!

Earnings Season

We haven’t heard a lot about earnings season after the first couple of weeks of results. It’s interesting how the press makes such a big deal in the early stages of the season when just a few companies have reported, and attention tapers off when it really counts -- and it counts now as 80% of S&P 500 members have released results.

Analysts and financial commentators had talked much of the fact that 82% of S&P 500 members have beat expectations, but those were pretty low-ball estimates – firms have low-balled estimates for several years now, but the percentage of positive surprises shows they were really marking things low this go around; the long-term average of S&P 500 members that beat expectations is 59%.

Profit results overall though are quietly eroding, quietly because no one seems to be talking about it. A couple of weeks into the season results were down roughly 8% from the year-ago period. Last week when we touched on profit results, S&P 500 earnings were down 15%. Currently, with most firms now having reported, overall profits are down 22.3% (down 26.6% ex-financials). That’s not much better than the previous quarter’s results in which overall profits fell 28.9% and ex-financial was down 27.9%. And the current results are being compared against easier year-ago period comps than the comparisons for the previous quarter.

FOMC

We’ve got a lot of important data/announcements for the remainder of this week. We have the preliminary jobs reports via the Challenger Layoffs and ADP Employment surveys as we wait for the official October jobs results on Friday. We also have same-store retail sales results for October coming on Thursday. But we also have the latest FOMC (Fed’s rate-setting and monetary policy committee) two-day meeting and the comments that follow the meetings end, which occurs this afternoon.

So we turn to the Fed and the market awaits the comments. It is clear that one expects they’ll increase the benchmark fed funds rate. So, the market will be intensely focused to the wording and clues as to when Bernanke & Co. will shift from their ZIRP “for an extended period” to simply a policy that is just accommodative. That is, shifting from the current emergency level of fed funds to something closer to 1%-2% over the next several months to a year. It’s easy to forget, I guess, as the Fed has kept the pedal to the metal, but 1%-2% FF is still amazing accommodative.

This ZIRP policy that has been in place for almost a full year now, and will have extended beyond a year by the time it is removed, is arguably justified based on the troubled state of the economy but it is also destructive as well. The Fed needs to be very careful not to extend this for too long – besides we need to know if the economy can stand without it. If it can’t manage to grow at 1%-2% FF, then the market has some valuation adjustments to get on with – for sure, the distorting effects of the Fed’s policy needs to end for it will only cause a more severe blowback the longer they wait.

For instance, the ZIRP has devolved the U.S. dollar into a carry trade currency – traders borrow at the exceptionally low U.S. interest rates and invest in higher return vehicles; the occurrence of this is obvious as virtually all asset classes (and even those that are not official asset classes) are moving in the same direction. Stocks, bonds, gold, oil, industrial metals, they are all moving in tandem – a very unusual occurrence. When the Fed does turn course and eventually moves to increase rates (and removes the carry trade) the mad dash for the riskier-asset exit door will ensue and that more than likely means a simultaneous decline among many different asset classes. The longer the Fed waits, the more damaging this run for cover will be on asset prices.

The Fed has backed itself into a corner, and it began with their mistakes all the way back in the 2002-2005 period, which was a primary cause of this entire mess. The longer they remain in the corner, the more head shots the economy will take when they step out. As a result, the Fed meetings, and comments that follow, will become intensely important events.

I’ll tell you this, the Fed is keeping a close eye on the banking industry now and may see the challenges to the financial system as still so great that they feel compelled to keep ZIRP in place. If the members of the FOMC cannot decide to even mildly remove some of this aggressive accommodation, then that should be a crystal clear signal to all that they see loan portfolios are continuing to erode at an alarming rate. What else would justify this emergency level of rates and the consequences that follow?

Factory Orders

The Commerce Department reported that factory orders rose a healthy 0.9% in September, slightly more than expected, after a 0.8% decline in August. Bookings for durable goods orders (which currently make up half of factory orders) jumped 1.4% after a 2.7% decline in August. Machinery orders fueled the gain in durables as mining, construction and power transmission companies ordered new equipment. Bookings for non-durable goods (such as food, petroleum, clothing, paper products, etc.) rose 0.5% in September. Food, petro and paints and coating (autos) led non-durable shipments higher. Beverage & tobacco, apparel and paper products dragged on non-durables.

The proxy for business-equipment spending rose 1.8%, after a 1.0% decline in August; the figure has been absolutely crushed over the past year, down 16% -- although an improvement from the year-over-year 21% decline as of August.

Unfilled orders fell for a 12th straight month (longest stretch of decline since records began in 1992), down 0.3% in September, which shows factories (even with much lower payroll levels) are having no problem meeting orders.

Inventories fell for a 13th straight month, down 1.0% for the month. The inventory-to-shipments ratio fell for a fourth straight month to 1.36 (from 1.38) but remains well-above the record low of 1.13 hit in December 2005.

The gain in factory orders marks the fifth increase in six months. From here we will see if it is sustainable, it will all depend on the timeline with which final demand arrives. If it is lacking, due to a persistently high jobless rate, we won’t get that full-blown inventory dynamic we’ve been waiting for and that will show up in the production numbers.

The gain in factory orders marks the fifth increase in six months. From here we will see if it is sustainable, it will all depend on the timeline with which final demand arrives. If it is lacking, due to a persistently high jobless rate, we won’t get that full-blown inventory dynamic we’ve been waiting for and that will show up in the production numbers.October Auto Sales

Late in the day yesterday we got the October auto sales figures, which bounced a bit from September’s very weak 9.20 million units. Vehicle sales rose to 10.45 million at an seasonally-adjusted annual rate (SAAR).

Have a great day!

Brent Vondera, Senior Analyst

Tuesday, November 3, 2009

Afternoon Review: Buffett, Transports, Semiconductors

Markets swung between gains and losses before ending higher. Helping push stocks higher was the fact that the dollar pared early gains. The dollar’s losses also resulted in crude oil bumping up to just under the $80 level.

Traders’ may be hesitating to push stocks into positive territory as they await several economic releases later in the week including the monetary policy announcement from the Fed tomorrow, and the labor report on Friday – both items could potentially give investors a better view of the pace of ht economic recovery.

Berkshire Hathaway’s acquisition of Burlington Northern Santa Fe was the top story of the day, pushing railroad companies and other transportation stocks higher. Berkshire’s Chairman and CEO Warren Buffett paid a 30% premium for the railroad.

Believers in the Dow Theory may make a bullish argument following today’s upward action in the Dow Jones Transportation Index. The Dow Theory says that transportation companies move what industrials are making and, thus, serve as a good leading indicator. Others, however, argue that semiconductors are better indicators of future market direction.

Within the technology universe, economically sensitive semiconductors tend to lead the pack. Just as some technicians watch the Dow Jones Transportation Index for indications of future market movements, others refer to the Philadelphia Semiconductor Index (SOX). The SOX has slipped this week on unfavorable research notes from Morgan Stanley and Goldman Sachs, both of which citing higher expectations following strong third-quarter earnings and, thus, greater downside risk.

--

Peter J. Lazaroff, Investment Analyst

Daily Insight

The sell-off, which completely erased a 1.5% rally from the get go, seemed to follow a statement from the associate director of the Fed’s bank supervision division that banking system conditions remain “far from robust” and examiners have noticed “sharp deterioration” in loan portfolios. He explicitly stated problems the Fed is seeing in commercial real estate loans but also seemed to show concern regarding corporate loan portfolios as well. We’ll touch on some statements on bank regulation and commercial real estate below.

In the end consumer staples, basic material, and industrial shares led the gains. Utilities and telecoms were the losers as the only two of the 10 major industry groups that failed to end on the plus side. Financials were whipsawed, down as much as 4.2% from their day’s peak but ended up closing just 1.6% below the session’s apex – the group closed the session higher by roughly 0.8%.

In the end consumer staples, basic material, and industrial shares led the gains. Utilities and telecoms were the losers as the only two of the 10 major industry groups that failed to end on the plus side. Financials were whipsawed, down as much as 4.2% from their day’s peak but ended up closing just 1.6% below the session’s apex – the group closed the session higher by roughly 0.8%.Ten stocks rose for very seven that declined on the NYSE. Some 1.5 billion shares traded on the NYSE Composite, 16% higher than the six-month average.

Market Activity for November 2, 2009

Banking Industry Issues – and That Means Economic Issues

Banking Industry Issues – and That Means Economic IssuesThe WSJ reported on Saturday that regulators have issued guidelines that allow banks to term commercial real estate loans as “performing” even when the underlying property values have fallen below the loan amount. This is not a reversal of existing rules, but does provide more clarity as banks struggle to deal with the erosion in commercial RE assets.

This increased clarity is not that all that much different from the change to mark-to-market (specifically FASB 157) accounting that offered greater lucidity (at the time with regard to troubled residential loans) and stopped the regulation from artificially destroying capital positions within the banking system. If banks are going to hold assets (a loan) to maturity, so long as the interest and principal payments are current, why write them down to distressed prices and destroy capital? It would only cause additional economic harm – and indeed it did.

But also recall, before that I was conspicuously in favor of the original TARP. That program would have used an RTC-style structure to remove bad assets from banks’ books and placed them in an account that the government would run -- hold assets for 5-10 years, however long it takes, until the RE market normalizes and sell them off. Regulators can provide increased levels of clarity, and that is helpful, but it doesn’t change the fact that banks still carry a lot of troubled loans on their books.

This was Bill Seidman’s Resolution Trust Corp. back in the very early 1990s that proved so successful, it made a profit for the government, and that is the point – doing what history has shown to work. Unfortunately, TARP was changed to this idiot idea of injecting government money into the banking system – we expressed a steadfast objection to this move back in the winter of 2008. It was changed because the original TARP plan was seen as too plodding, but it may very well have been up and running by now – if so, we may just be on the road to a somewhat more normal environment.

The overall reality though is that commercial RE defaults are a ticking bomb for a large portion of the banking system that the market seems to be ignoring – a lot of risks have been ignored of late but this is what an easy-money/ZIRP does, it distorts markets. The larger issue now is that without an RTC-style program banks will be saddled with bad assets for some time to come and that means little to no credit expansion. In the world of intense government intervention we currently find ourselves, an RTC-style solution would have been much less damaging than many of the things we have tried (and continue to try).

We are in a nasty situation here and the investor needs to come to grips with the reality on the ground, you just can’t casually move out along the risk curve as if this were a normal business-cycle expansion, or a typical political environment.

ISM Manufacturing

The Institute for Supply Management’s manufacturing index rose to 55.7 in October (highest since April 2006), up nicely from 52.6 printed in September – the reading blew by the expectation of 53.0.

This move in ISM marks the third month of expansion and the October reading is fairly robust (for this environment); it mirrors the 55 print out of China the night before.

This move in ISM marks the third month of expansion and the October reading is fairly robust (for this environment); it mirrors the 55 print out of China the night before.Most of the sub-indices looked good as new orders, backlog of orders, supplier deliveries and export orders remained in expansion mode. However, all of these but export orders showed a slower pace of expansion relative to the September readings.

The best news of the report was the rise in the employment figure – up to 53.1 from 46.2, the first month of expansion since July 2008 (probably some callbacks thanks to increased auto assemblies). This area was a big concern on Friday when the Chicago manufacturing’s employment figure remained pretty deep in contraction territory. Eight of the 18 industries tracked by ISM reported employment growth, up from three in September.

The best news of the report was the rise in the employment figure – up to 53.1 from 46.2, the first month of expansion since July 2008 (probably some callbacks thanks to increased auto assemblies). This area was a big concern on Friday when the Chicago manufacturing’s employment figure remained pretty deep in contraction territory. Eight of the 18 industries tracked by ISM reported employment growth, up from three in September. The inventory figures have been another area of concern as the data has yet to show an actual rebuilding of stockpiles is taking place. ISM’s inventory figure bounced in October, but it does remain in contraction mode, up to 46.9 from 42.5 – the trend is really nice though. The customer inventories reading (what respondents to the ISM survey think of their customers’ inventories levels) fell 0.5 to 38.5. This means they think their customers’ stockpile levels are too low, so after seven months now of this reading being below 50 maybe this is a sign some inventory rebuilding may ensue over the next couple of months. Conversely, it also shows that businesses have little confidence regarding future sales.

The inventory figures have been another area of concern as the data has yet to show an actual rebuilding of stockpiles is taking place. ISM’s inventory figure bounced in October, but it does remain in contraction mode, up to 46.9 from 42.5 – the trend is really nice though. The customer inventories reading (what respondents to the ISM survey think of their customers’ inventories levels) fell 0.5 to 38.5. This means they think their customers’ stockpile levels are too low, so after seven months now of this reading being below 50 maybe this is a sign some inventory rebuilding may ensue over the next couple of months. Conversely, it also shows that businesses have little confidence regarding future sales. Overall, it was a good report and certainly the best we’ve seen (from an all-around perspective) since the summer of 2007. Thirteen of the 18 industries tracked reported growth, unchanged from September.

Overall, it was a good report and certainly the best we’ve seen (from an all-around perspective) since the summer of 2007. Thirteen of the 18 industries tracked reported growth, unchanged from September.Pending Home Sales

The National Association of Realtors reported that September pending home sales jumped 6.1% from the previous month – the reading was expected to come in unchanged. This large increase in contract signings was undoubtedly due to the rush to get in before the first-time homebuyers’ tax credit expires (have to close before November 30, and it’s taking 6-8 weeks to close). The October data will likely mark an end to this strong six-month run that was driven by a powerful trifecta – the tax credit, the home buying season and Fed-induced rock bottom interest rates. Of course, September home buyers didn’t know the credit was going to be extended, which is highly likely now.

In terms of region, the West led the way as pending home sales jumped 10.2% -- a sign foreclosure-driven price declines also fueled the September increase. The Midwest posted the second-best increase, up 8.1%, with the South printing a 4.9% rise. Contract signings fell 2.0% in the Northeast.

In terms of the tax credit’s extension, the number we keep hearing is April 30 (or contract closed 60 days after that date). At some point though the credits must come to an end and that is when we’ll learn the true status of the housing market. As mentioned above, this is just another government scheme that distorts the true market fundamentals.

Construction Spending

Construction spending rose 0.8% in September, fueled by a 3.9% jump in residential construction. I can see this becoming quite the problem when home sales wane as the supply figure will jump again.

The commercial side declined for a fifth-straight month, down 13.7% at an annual rate over the past three months. The public side has helped to offset the plunge in private-sector commercial construction (private sector down 26.8% annualized over the past three months and getting worse, public sector commercial construction up 5.3% on the same basis).

Futures

Stock-index futures are down big this morning as the safety trade makes a bit of a comeback. However, pre-market trading has pared some of those losses on news that Berkshire Hathaway, the investment vehicle for Warren Buffett, will purchase the 77% of Burlington Northern (railroad) that is doesn’t already own in a cash and stock deal. The deal is $100/share, or a 30% premium to yesterday’s closing price.

Have a great day!

Brent Vondera, Senior Analyst

Monday, November 2, 2009

October 2009 Recap

The S&P 500 snapped its streak of seven consecutive monthly gains as investors grappled with the sustainability of the global economic recovery. The higher-than-expected report on third quarter GDP confirmed that the economy is recovering as did the Index of Leading Economic Indicators, which beat estimates by rising 1% in September and marking the sixth straight month of gains.

Too, earnings season helped confirm the recovery is taking hold. Management commentary has been cautiously optimistic, with many companies suggesting the worst is behind us, but warning the recovery remains bumpy. The reaction to positive earnings has been more muted than in the previous quarter since revenue results failed to impress. Investors had been looking for revenue growth, rather than cost-cutting, to boost profits.

Investor enthusiasm surrounding an improvement in the economy had pushed stocks to 2009 highs early in the month, but all that evaporated as the month came to a close. On cue, the VIX Index, also known as the market’s “fear gauge,” jumped to its highest level in nearly four months, moving above 30 near the month’s end. In addition to the sustainability of the economic recovery, investor concerns include the removal of massive fiscal and monetary stimulus, the weak U.S. consumer, the actual and proposed government spending, and the weak U.S. dollar.

The relationship between the dollar and stocks was incredibly tight throughout the month, with days of dollar strength causing stocks to fall and vice versa. Other asset classes such as gold and energy prices were also closely correlated with the dollar.

The riskiest investments were the month’s worst performers, a reversal from the last seven months. Smaller capitalization stocks trailed their larger counterparts, while Financials and Materials sectors were the worst performing sectors in the S&P 500.

Energy was the top performing sector, with a weaker U.S. dollar pushing up prices of fuels such as oil, natural gas, and coal. The only other sector to finish in the black was Consumer Staples, which benefited from cheap valuations relative to the rest of the market as well as its defensive nature.

--

Peter J. Lazaroff, Investment Analyst

Daily Insight

Of course, we’ll just have to wait and see if this is simply a correction phase after the significant rally from the March depths or something more serious. There is little doubt the economic picture remains quite troubling, especially with regard to the banking industry’s woes and the ramifications this has on economic growth over the next 12-18 months.

The sectors that have led this rally got smoked on Friday as financials lost 4.75%, basic materials slid 3.82% and energy fell 3.49%.

We’ve seen a lot of people talk about the reflation trade, commodity and energy stocks, but these groups are likely to pull back meaningfully before rising again. These areas were places investors should have been looking to get into back in March, but not after their huge run from those late-winter lows. This is one reason I’ve ripped on the bandwagon tendencies of Wall Street. There’s been a lot of “strong buy” recommendations on the commodity stocks lately, a dangerous thought for those looking to make a quick buck – basic materials soared 80% from their lows before this latest reversal.

The broad market ended the month down 1.98%, the first monthly decline in eight months. However, on a 12-month rolling return basis, the S&P 500 marked its first positive return in 22 months.

Market Activity for October 30, 2009

Personal Income and Spending

Personal Income and SpendingThe Commerce Department reported that personal income was flat in September, as another strong month for rental income and an outsized rise (from historical average not in terms of this new larger government world we now live in) in government transfer payments offset declines in the most important segments – compensation and wage & salary.

In terms of those segments, compensation fell 0.1% in September (down 4.3% y/o/y); wage & salary fell 0.2% (down 5.2% y/o/y); proprietor’s income rose 0.1% (down 6.3% y/o/y); rental income rose 1.9% (up a large 24.2% y/o/y); interest income down 0.6% (down 8.3% y/o/y ); dividend income down 1.3% (smashed by 25.4% y/o/y); and transfer payments – out of your pocket and into others’ – rose 0.8% (up 13.5% y/o/y).

So, we continue to see incomes in general continue to erode, without the $17.3 billion in transfer payments personal income would have been down about 0.2% last month. But this is no surprise as the very weak labor market means that the two most important segments of this data (compensation and wage/salary) are going down. So not to totally disrespect the retired, of course interest income is an important number also, you can thank the Fed’s ZIRP for much of this erosion.

On the spending side, consumption fell 0.5% in September after the “cash for clunkers” (CFC) and back-to-school/sales tax holiday induced jump of 1.3% in August.

Spending on durables got clocked, down 7% last month after CFC boosted the figure by 6.1% in August. Funny though, the decline in September completely erases the August gain and puts the durable spending figure below that seen in July. So as we’ve been talking about the clunker cash scheme was completely a one-and-done event.

Spending on non-durables was solid though, up 0.7% in September after the BTS/sales tax holiday induced 2.2% jump in August.

The saving rate increased to 3.3% from 2.8% in August. I love this one. Policy makers are doing everything they can to make sure this figure doesn’t rise above 4% as they keep coming up with schemes to keep people spending. The cash savings rate moved to 4.0% early in the year and hit 5.9% in May before the government came up with the clunker cash program that pushed it back down.

But all we’re doing is delaying what needs to occur. Households need to boost cash savings as stock and home prices have been pounded (stocks down 30% from the peak and homes down 25%). The cash savings rate needs to go to 6%-8% and stick there before consumer spending can trend higher in a sustained manner.

But all we’re doing is delaying what needs to occur. Households need to boost cash savings as stock and home prices have been pounded (stocks down 30% from the peak and homes down 25%). The cash savings rate needs to go to 6%-8% and stick there before consumer spending can trend higher in a sustained manner.Via Thursday’s GDP report we see consumer spending rose to a post-WWII high of 71% of GDP. This figure needs to, and will, move back to the historic average of 65% of GDP, particularly due to high unemployment. When the bill for this spending comes due (higher tax rates) and the Fed must eventually unwind its unprecedented monetary easing experiment (higher interest rates) consumer spending will move back down to that historic average and the hit to economic growth will be felt as a result. I do not enjoy effusing this negative tone, but it is the reality of things; wishful thinking has no place in the world in which we currently live.

Chicago PMI

The Chicago Purchasing Managers Index printed a blowout number (for this environment) with several of the sub-indices up big; however, the employment figure declined ans remains in deep contraction mode. Maybe this is why stocks sold off even as the headline figure was strong.

The reading for the most important regional factory survey came in at 54.2 for October (highest since September 2008 – significant date, credit meltdown began) , which easily beat the forecast of 49. The September reading was 46.1.

The new orders index jumped to 61.4 from 46.3; order backlog rose to 41.9 from 36.7; delivery times 50.7 from 49.3; inventories remain in the dirt, falling another seven points to 32.2. Nevertheless, if October’s strength in new orders continues it will signal a good pace of inventory rebuilding will ensue. But it will take a solid new orders trend.

The new orders index jumped to 61.4 from 46.3; order backlog rose to 41.9 from 36.7; delivery times 50.7 from 49.3; inventories remain in the dirt, falling another seven points to 32.2. Nevertheless, if October’s strength in new orders continues it will signal a good pace of inventory rebuilding will ensue. But it will take a solid new orders trend. The number of employees figure dipped to remain at low level of 38.3. Unfortunately, Chicago PMI does not offer an average workweek (hours worked per week) reading. This is a key number to watch for the factory sector in general as firms will squeeze every bit they can out of the existing workforce before adding to payrolls.

The number of employees figure dipped to remain at low level of 38.3. Unfortunately, Chicago PMI does not offer an average workweek (hours worked per week) reading. This is a key number to watch for the factory sector in general as firms will squeeze every bit they can out of the existing workforce before adding to payrolls. The market will be intensely focused on the employment figure in today’s ISM reading (nationwide manufacturing survey) as economists attempt to gauge the October jobs report for signs at to whether the pace of job losses trend lower or remain at past recessionary levels.

The market will be intensely focused on the employment figure in today’s ISM reading (nationwide manufacturing survey) as economists attempt to gauge the October jobs report for signs at to whether the pace of job losses trend lower or remain at past recessionary levels.Futures

U.S. stock-index futures are higher this morning on strong, and trending higher, PMI (Purchasing Managers Index) out of China. China’s huge and infrastructure-focused stimulus is boosting manufacturing activity in the country. Their $586 billion stimulus amounts to 18% of GDP. For an equivalent here in the U.S. we’d have to triple our $787 billion fiscal stimulus.

The Chinese government has also directed banks to lend. Credit expansion has doubled in the past six months and this is also boosting activity. But can it last? The global economic environment does not seem to be self-supporting. Even China’s Commerce Minister warned that the global economy may “plunge” if nations withdraw support measures.

And speaking of support, Ford’s earnings results are just out and the automaker posted its first profit in North America since the first quarter of 2005. A lot of this was due to cost cutting, but clunker cash was another factor. Thanks Uncle Sugar!

Have a great day!

Brent Vondera, Senior Analyst

About Us

To learn more visit: http://www.acrinv.com/

Acropolis Retirement Plan Solutions provides deep knowledge and expertise to meet your unique needs. Our mission is to unite with plan sponsors and empower every participant to realize their retirement savings goals.

To learn more visit: http://www.acrinv-rps.com/

Use Terms

Disclosures

Articles

- Acropolis in the News (11)

- Bonds (179)

- Book Reviews (9)

- Daily Insights (462)

- Investing (17)

- Market Minute (1)

- Participant Insights (4)

- Portfolio Insights (7)

- Stocks (289)

Blog Archive

-

►

2011

(1)

- ► 02/06 - 02/13 (1)

-

►

2010

(132)

- ► 06/27 - 07/04 (3)

- ► 06/06 - 06/13 (2)

- ► 05/23 - 05/30 (4)

- ► 05/16 - 05/23 (4)

- ► 05/09 - 05/16 (5)

- ► 05/02 - 05/09 (5)

- ► 04/25 - 05/02 (5)

- ► 04/18 - 04/25 (6)

- ► 04/11 - 04/18 (4)

- ► 04/04 - 04/11 (4)

- ► 03/28 - 04/04 (6)

- ► 03/21 - 03/28 (6)

- ► 03/14 - 03/21 (7)

- ► 03/07 - 03/14 (7)

- ► 02/28 - 03/07 (8)

- ► 02/21 - 02/28 (8)

- ► 02/14 - 02/21 (8)

- ► 02/07 - 02/14 (6)

- ► 01/31 - 02/07 (7)

- ► 01/24 - 01/31 (8)

- ► 01/17 - 01/24 (7)

- ► 01/10 - 01/17 (4)

- ► 01/03 - 01/10 (8)

-

▼

2009

(634)

- ► 12/27 - 01/03 (6)

- ► 12/20 - 12/27 (2)

- ► 12/13 - 12/20 (3)

- ► 12/06 - 12/13 (9)

- ► 11/29 - 12/06 (5)

- ► 11/22 - 11/29 (5)

- ► 11/15 - 11/22 (7)

- ► 11/08 - 11/15 (6)

- ▼ 11/01 - 11/08 (11)

- ► 10/25 - 11/01 (12)

- ► 10/18 - 10/25 (10)

- ► 10/11 - 10/18 (12)

- ► 10/04 - 10/11 (7)

- ► 09/27 - 10/04 (8)

- ► 09/20 - 09/27 (10)

- ► 09/13 - 09/20 (14)

- ► 09/06 - 09/13 (12)

- ► 08/30 - 09/06 (14)

- ► 08/23 - 08/30 (13)

- ► 08/16 - 08/23 (16)

- ► 08/09 - 08/16 (15)

- ► 08/02 - 08/09 (16)

- ► 07/26 - 08/02 (19)

- ► 07/19 - 07/26 (32)

- ► 07/12 - 07/19 (21)

- ► 07/05 - 07/12 (14)

- ► 06/28 - 07/05 (16)

- ► 06/21 - 06/28 (16)

- ► 06/14 - 06/21 (17)

- ► 06/07 - 06/14 (15)

- ► 05/31 - 06/07 (10)

- ► 05/24 - 05/31 (6)

- ► 05/17 - 05/24 (4)

- ► 05/10 - 05/17 (15)

- ► 05/03 - 05/10 (16)

- ► 04/26 - 05/03 (15)

- ► 04/19 - 04/26 (16)

- ► 04/12 - 04/19 (16)

- ► 04/05 - 04/12 (14)

- ► 03/29 - 04/05 (15)

- ► 03/22 - 03/29 (17)

- ► 03/15 - 03/22 (12)

- ► 03/08 - 03/15 (12)

- ► 03/01 - 03/08 (14)

- ► 02/22 - 03/01 (11)

- ► 02/15 - 02/22 (11)

- ► 02/08 - 02/15 (8)

- ► 02/01 - 02/08 (12)

- ► 01/25 - 02/01 (12)

- ► 01/18 - 01/25 (11)

- ► 01/11 - 01/18 (12)

- ► 01/04 - 01/11 (12)

-

►

2008

(230)

- ► 12/28 - 01/04 (10)

- ► 12/21 - 12/28 (8)

- ► 12/14 - 12/21 (12)

- ► 12/07 - 12/14 (12)

- ► 11/30 - 12/07 (10)

- ► 11/23 - 11/30 (9)

- ► 11/16 - 11/23 (11)

- ► 11/09 - 11/16 (8)

- ► 11/02 - 11/09 (10)

- ► 10/26 - 11/02 (10)

- ► 10/19 - 10/26 (12)

- ► 10/12 - 10/19 (10)

- ► 10/05 - 10/12 (5)

- ► 09/28 - 10/05 (5)

- ► 09/21 - 09/28 (4)

- ► 09/14 - 09/21 (6)

- ► 09/07 - 09/14 (5)

- ► 08/31 - 09/07 (4)

- ► 08/24 - 08/31 (5)

- ► 08/17 - 08/24 (6)

- ► 08/10 - 08/17 (5)

- ► 08/03 - 08/10 (8)

- ► 07/27 - 08/03 (5)

- ► 07/20 - 07/27 (6)

- ► 07/13 - 07/20 (7)

- ► 07/06 - 07/13 (6)

- ► 06/29 - 07/06 (6)

- ► 06/22 - 06/29 (8)

- ► 06/15 - 06/22 (5)

- ► 06/08 - 06/15 (11)

- ► 06/01 - 06/08 (1)