Dow 10,000! Again.

Stocks rallied hard as a number of better-than-expected results removed the wait-and-see attitude that has been the trend the day before a monthly employment report. The market sure seems willing to erase the losses recorded over the previous couple of weeks, undoubtedly helped by the Fed’s latest signal that the Bernanke bullet train will remain a blur – after Wed’s very soft FOMC statement it’s obvious ZIRP is with us for quite a while still as they kept the “exceptionally” low level of rates for “an extended period” wording in place.

Futures started things off higher after much better-than-expected profit and revenue results from Cisco Systems Wednesday night. Then, yesterday morning’s larger-than-expected decline in initial jobless claims and a chain-store sales report that easily surpassed expectations boosted investor sentiment into the official trading session.

Consumer discretionary, financials and industrials (the same groups that led the market lower on Wednesday) led the broad market’s advance.

Trading in the U.S. dollar was very volatile yesterday, but it did manage to gain some ground. ECB and Bank of England presidents Trichet and King signaled they will begin to remove their emergency level of monetary easing. This will not make the dollar’s road any easier to travel as our Fed keeps policy floored. As (if they actually end up doing so) the European central banks begin to gently raise rates and reduce their government bond purchases it should strengthen their currencies relative to the greenback and further boost interest-rate differentials in their favor.

The Fed isn’t even mildly changing course for some time…unless forced to by a catastrophic dollar rout – that seems to be the only thing that could get their attention and end the ZIRP.

Market Activity for November 5, 2009

Productivity

Productivity

The Labor Department reported that productivity (output per hour worked) surged 9.5% at an annual rate in the third quarter. To offer some perspective, anything over 3.0% at an annual rate is powerful. It means that firms are able to absorb higher costs and that means they do not have to pass those costs, in full, onto the consumer via prices. But we need to explain a distinction between good productivity, which is longer-lasting, and productivity that is, well, less good as it comes solely from the slashing of payrolls.

The good productivity occurs when firms have the incentive to produce and innovate. This results as investors, the providers of seed money, take calculated risk and finance future innovations – generally driven by higher after-tax return expectations. When this innovation comes to market in the form of equipment enhancements, it means higher living standards -- jobs and real wages are driven higher. This type of productivity was in play over the past quarter century as tax rates on capital and income were reduced from the harmful levels of 70% on income (at the top rate) and 40% on the capital gains tax. Productivity continued to expand through the 1980s, 1990s and 2000s even as 48 million jobs were created in the U.S. over this stretch.

Conversely, the less than good sort of productivity is no friend of those looking for work right now because it arrives only when firms slash payrolls (specifically hours worked). And this is what we’re seeing in these latest productivity readings. (This is along the lines of what we’ve discussed for some time now. Firms will very likely squeeze evermore work out of existing employees, for an extended period, before adding to payrolls – this means a lack of final demand and economic weakness; it’s kind of tough for consumers to boost spending when the jobless rate remains at such heights. It becomes even more difficult when consumers are already burdened by historically high debt levels.

The policy direction of massive deficit spending, and the higher tax rates that follow, will only increase the chances that firms remain cautious and this has additional implications for the labor market. Higher tax rates, and while they are not here yet those paying attention understand much higher tax rates via various forms are a very real threat, will make it difficult for the new innovations needed to keep good productivity rolling without high levels of unemployment.

What drove this latest productivity reading was a 4% annualized increase in output, while hours worked slid 5.0% at an annual rate. On output, this gain was the first after falling for four-straight quarters (two of which saw output decline at record postwar levels). The other part of the equation, the tumble in hours worked marked the eighth-straight quarter of decline.

So these very heightened levels of productivity will prove helpful in the short term (particularly with regard to profits), but the benefit is likely to be fleeting if the correct economic policies are not advanced. The good type of productivity (via capital equipment enhancements, which is dependent upon lower tax rates on both capital and incomes), the type with a longer staying power, may have a rough time getting going in the new policy world it appears we find ourselves. It’s important to make these distinctions.

Jobless Claims

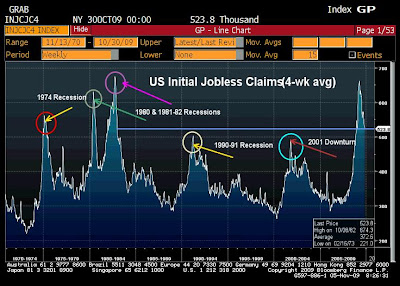

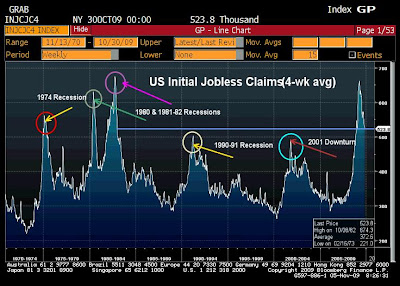

The Labor Department reported that initial jobless claims fell 20,000 to 512,000 in the week ended October 31. This beat the expectation by 10,000 as economists has expected claims to fall to 522K. This is the best move to the 500K level since they fell from 554k in late December to 488K in the first week of January. We have yet to get below what I’m calling the critical 500K level again (a point that is just above the 1991 recession and 2001 downturn peaks), but things appear to be on the right track.

The four-week average of claims fell 3,000 to 523,750 – the lowest level since January before they skyrocketed to 658K. No one expects that to occur again as we’ve gotten past the worst of the payroll declines.

Continuing claims fell for a seventh-straight week, down 68,000 to 5.749 million. As we’ve touched on for weeks now, this reading is being distorted by the exhaustion of benefits, which as of the latest payroll data continues to climb to record levels – as of September the exhaustion rate of the unemployed who had been collecting jobless benefits rose to 52.4%. Tomorrow’s data will shed new light on this reading.

Continuing claims fell for a seventh-straight week, down 68,000 to 5.749 million. As we’ve touched on for weeks now, this reading is being distorted by the exhaustion of benefits, which as of the latest payroll data continues to climb to record levels – as of September the exhaustion rate of the unemployed who had been collecting jobless benefits rose to 52.4%. Tomorrow’s data will shed new light on this reading.

Further, the 68,000 decline in traditional claims was more than offset by the 114,800 increase in emergency and extended jobless benefits.

By the way, Congress, or is it Parliament, has passed another 20-week extension to jobless benefits. I believe this brings the total to 79 weeks for those that are eligible. The extension provides another 14 weeks of benefits in all states, plus another six weeks for those in states with jobless rates over 8.5%. There are 26 states that meet that threshold.

(Also part of that bill is an extension of the homebuyers’ tax credit of $8,000 to April 30. Buyers who have owned their residence for at least five years would qualify to receive a $6,500 credit if they buy another – they would not have to sell the current home but the new one would have to qualify as their primary residence. Singles making up to $125,000 and couples making up to $225,000 would qualify. The market distorting games continue.)

(Also part of that bill is an extension of the homebuyers’ tax credit of $8,000 to April 30. Buyers who have owned their residence for at least five years would qualify to receive a $6,500 credit if they buy another – they would not have to sell the current home but the new one would have to qualify as their primary residence. Singles making up to $125,000 and couples making up to $225,000 would qualify. The market distorting games continue.)

Chain Store Sales

Chain-store retail sales (which is just year-over-year results for stores open at least one year) rose 2.1% in October, which blew by the expectation for a rise of just 0.1%. This move marks the second month of increase, same-store sales rose 0.1% in September, after 10-straight months of decline. All segments of the data have posted at least 14 months of declines with the exception being discount and drug chains. Thus, the year-ago comparisons have become very easy. Recall that these past two months of increase are compared to the beginning of economic hell when the consumer went into hiding in late September-October of 2008.

Apparel chains saw y/o/y sales rise 1.0%, after a 0.7% increase in September. Luxury chains posted a 1.8% increase in sales, the first in 16 months and those declines were huge averaging -13% y/o/y during this stretch. Discounters posted a 2.5% y/o/y sales jump in October. Drug chains saw sales boosted by 3.4%.

The only segment that continued to post declines was department stores, which extends the y/o/y declines to 16 months.

Overall, this is a good report, but it is off of easy comps and considering the fragility of the labor market results will likely be choppy over the next several months.

Employment Report

All eyes will be on the October jobs report this morning, which is expected to show 175,000 in payroll losses. This will mark the 22nd straight month of payroll declines and the losses have been massive – 7.2 million jobs have been erased over this stretch. We are going to see these declines move to statistically insignificant levels of < 100K per month in short order and one should expect to see mild job increases (yes, increases) by early 2010.

However, it will very likely take at least four quarters of above average (avg. being 3.4%) real GDP readings in order to bring the unemployment rate below 9.5%. (First, the jobless rate must move well above 10% as it always continues to rise even when job creation begins.) I am extremely skeptical above trend GDP results will occur for four quarter in this environment and give zero credence to forecasts that this expansion even comes close to those we’ve seen over the past 25 years.

The Fed is at zero, which means when the tightening campaign begins, it will not look like the normal ¼ point increases. The tightening will be aggressive, and when it occurs at the same time that tax rates are moving higher, the challenge to the economy will be enormous. It will take quick and substantial changes to the policy direction in order to expect otherwise, and even if that occurs, we still have to deal with the reversal of monetary policy.

Have a great weekend!

Brent Vondera, Senior Analyst

Stocks rallied hard as a number of better-than-expected results removed the wait-and-see attitude that has been the trend the day before a monthly employment report. The market sure seems willing to erase the losses recorded over the previous couple of weeks, undoubtedly helped by the Fed’s latest signal that the Bernanke bullet train will remain a blur – after Wed’s very soft FOMC statement it’s obvious ZIRP is with us for quite a while still as they kept the “exceptionally” low level of rates for “an extended period” wording in place.

Futures started things off higher after much better-than-expected profit and revenue results from Cisco Systems Wednesday night. Then, yesterday morning’s larger-than-expected decline in initial jobless claims and a chain-store sales report that easily surpassed expectations boosted investor sentiment into the official trading session.

Consumer discretionary, financials and industrials (the same groups that led the market lower on Wednesday) led the broad market’s advance.

Trading in the U.S. dollar was very volatile yesterday, but it did manage to gain some ground. ECB and Bank of England presidents Trichet and King signaled they will begin to remove their emergency level of monetary easing. This will not make the dollar’s road any easier to travel as our Fed keeps policy floored. As (if they actually end up doing so) the European central banks begin to gently raise rates and reduce their government bond purchases it should strengthen their currencies relative to the greenback and further boost interest-rate differentials in their favor.

The Fed isn’t even mildly changing course for some time…unless forced to by a catastrophic dollar rout – that seems to be the only thing that could get their attention and end the ZIRP.

Market Activity for November 5, 2009

Productivity

Productivity

The Labor Department reported that productivity (output per hour worked) surged 9.5% at an annual rate in the third quarter. To offer some perspective, anything over 3.0% at an annual rate is powerful. It means that firms are able to absorb higher costs and that means they do not have to pass those costs, in full, onto the consumer via prices. But we need to explain a distinction between good productivity, which is longer-lasting, and productivity that is, well, less good as it comes solely from the slashing of payrolls.

The good productivity occurs when firms have the incentive to produce and innovate. This results as investors, the providers of seed money, take calculated risk and finance future innovations – generally driven by higher after-tax return expectations. When this innovation comes to market in the form of equipment enhancements, it means higher living standards -- jobs and real wages are driven higher. This type of productivity was in play over the past quarter century as tax rates on capital and income were reduced from the harmful levels of 70% on income (at the top rate) and 40% on the capital gains tax. Productivity continued to expand through the 1980s, 1990s and 2000s even as 48 million jobs were created in the U.S. over this stretch.

Conversely, the less than good sort of productivity is no friend of those looking for work right now because it arrives only when firms slash payrolls (specifically hours worked). And this is what we’re seeing in these latest productivity readings. (This is along the lines of what we’ve discussed for some time now. Firms will very likely squeeze evermore work out of existing employees, for an extended period, before adding to payrolls – this means a lack of final demand and economic weakness; it’s kind of tough for consumers to boost spending when the jobless rate remains at such heights. It becomes even more difficult when consumers are already burdened by historically high debt levels.

The policy direction of massive deficit spending, and the higher tax rates that follow, will only increase the chances that firms remain cautious and this has additional implications for the labor market. Higher tax rates, and while they are not here yet those paying attention understand much higher tax rates via various forms are a very real threat, will make it difficult for the new innovations needed to keep good productivity rolling without high levels of unemployment.

What drove this latest productivity reading was a 4% annualized increase in output, while hours worked slid 5.0% at an annual rate. On output, this gain was the first after falling for four-straight quarters (two of which saw output decline at record postwar levels). The other part of the equation, the tumble in hours worked marked the eighth-straight quarter of decline.

So these very heightened levels of productivity will prove helpful in the short term (particularly with regard to profits), but the benefit is likely to be fleeting if the correct economic policies are not advanced. The good type of productivity (via capital equipment enhancements, which is dependent upon lower tax rates on both capital and incomes), the type with a longer staying power, may have a rough time getting going in the new policy world it appears we find ourselves. It’s important to make these distinctions.

Jobless Claims

The Labor Department reported that initial jobless claims fell 20,000 to 512,000 in the week ended October 31. This beat the expectation by 10,000 as economists has expected claims to fall to 522K. This is the best move to the 500K level since they fell from 554k in late December to 488K in the first week of January. We have yet to get below what I’m calling the critical 500K level again (a point that is just above the 1991 recession and 2001 downturn peaks), but things appear to be on the right track.

The four-week average of claims fell 3,000 to 523,750 – the lowest level since January before they skyrocketed to 658K. No one expects that to occur again as we’ve gotten past the worst of the payroll declines.

Continuing claims fell for a seventh-straight week, down 68,000 to 5.749 million. As we’ve touched on for weeks now, this reading is being distorted by the exhaustion of benefits, which as of the latest payroll data continues to climb to record levels – as of September the exhaustion rate of the unemployed who had been collecting jobless benefits rose to 52.4%. Tomorrow’s data will shed new light on this reading.

Continuing claims fell for a seventh-straight week, down 68,000 to 5.749 million. As we’ve touched on for weeks now, this reading is being distorted by the exhaustion of benefits, which as of the latest payroll data continues to climb to record levels – as of September the exhaustion rate of the unemployed who had been collecting jobless benefits rose to 52.4%. Tomorrow’s data will shed new light on this reading.

Further, the 68,000 decline in traditional claims was more than offset by the 114,800 increase in emergency and extended jobless benefits.

By the way, Congress, or is it Parliament, has passed another 20-week extension to jobless benefits. I believe this brings the total to 79 weeks for those that are eligible. The extension provides another 14 weeks of benefits in all states, plus another six weeks for those in states with jobless rates over 8.5%. There are 26 states that meet that threshold.

(Also part of that bill is an extension of the homebuyers’ tax credit of $8,000 to April 30. Buyers who have owned their residence for at least five years would qualify to receive a $6,500 credit if they buy another – they would not have to sell the current home but the new one would have to qualify as their primary residence. Singles making up to $125,000 and couples making up to $225,000 would qualify. The market distorting games continue.)

(Also part of that bill is an extension of the homebuyers’ tax credit of $8,000 to April 30. Buyers who have owned their residence for at least five years would qualify to receive a $6,500 credit if they buy another – they would not have to sell the current home but the new one would have to qualify as their primary residence. Singles making up to $125,000 and couples making up to $225,000 would qualify. The market distorting games continue.)

Chain Store Sales

Chain-store retail sales (which is just year-over-year results for stores open at least one year) rose 2.1% in October, which blew by the expectation for a rise of just 0.1%. This move marks the second month of increase, same-store sales rose 0.1% in September, after 10-straight months of decline. All segments of the data have posted at least 14 months of declines with the exception being discount and drug chains. Thus, the year-ago comparisons have become very easy. Recall that these past two months of increase are compared to the beginning of economic hell when the consumer went into hiding in late September-October of 2008.

Apparel chains saw y/o/y sales rise 1.0%, after a 0.7% increase in September. Luxury chains posted a 1.8% increase in sales, the first in 16 months and those declines were huge averaging -13% y/o/y during this stretch. Discounters posted a 2.5% y/o/y sales jump in October. Drug chains saw sales boosted by 3.4%.

The only segment that continued to post declines was department stores, which extends the y/o/y declines to 16 months.

Overall, this is a good report, but it is off of easy comps and considering the fragility of the labor market results will likely be choppy over the next several months.

Employment Report

All eyes will be on the October jobs report this morning, which is expected to show 175,000 in payroll losses. This will mark the 22nd straight month of payroll declines and the losses have been massive – 7.2 million jobs have been erased over this stretch. We are going to see these declines move to statistically insignificant levels of < 100K per month in short order and one should expect to see mild job increases (yes, increases) by early 2010.

However, it will very likely take at least four quarters of above average (avg. being 3.4%) real GDP readings in order to bring the unemployment rate below 9.5%. (First, the jobless rate must move well above 10% as it always continues to rise even when job creation begins.) I am extremely skeptical above trend GDP results will occur for four quarter in this environment and give zero credence to forecasts that this expansion even comes close to those we’ve seen over the past 25 years.

The Fed is at zero, which means when the tightening campaign begins, it will not look like the normal ¼ point increases. The tightening will be aggressive, and when it occurs at the same time that tax rates are moving higher, the challenge to the economy will be enormous. It will take quick and substantial changes to the policy direction in order to expect otherwise, and even if that occurs, we still have to deal with the reversal of monetary policy.

Have a great weekend!

Brent Vondera, Senior Analyst

No comments:

Post a Comment