I wasn’t in on Friday so I don’t know what drove the market throughout the session. What did occur is the broad market closed the session lower, but just mildly as the S&P 500 recouped nearly all of its early-session losses. The NASDAQ Composite along with mid and small cap indices closed higher.

The day’s economic releases probably has a net positive effect on investors after the early losses, the session’s low point was put in just an hour into trading. Things began to improve by late-morning and more or less held that mid-day momentum.

Information technology was the only sector of the 10 majors to close higher on the day. Industrials and utility shares led the market lower as they were the worst performing sectors.

The un-SummitI think the market was expecting the typical conclusion following the EU’s summit – discussions on how to provide aid to Greek’s budget problems. But that’s not what they got as the Euro-zone’s finance ministers stated there wouldn’t be an announcement of a detailed bailout. The market could begin to question the EU commitment over the next couple of weeks.

We’ll watch as this plays out. Frankly I like that the EU is holding Greece accountable for its reckless budget decisions – they have to do the heavy lifting here. But the Greeks, specifically the public unions, are not going to take this lying down, they’ve become too accustomed to government largess, handouts and public-sector wage growth that is likely significantly disconnected from market realities.

I really hope the EU isn’t attempting to play a game of chicken with the markets, thinking that just because they are talking about the subject public sector funding problems won’t arise; they’ll end up losing if they do. And this is about much more than just Greece as the political response to the very tough 2008-09 recession has heavily strained budgets for most Western countries. This is a bailout crazed environment, traders want to see anything that extends the rally in the short term; if they don’t get it, things may get ugly.

However, if they are serious about playing hard ball with Greece, the EU finance ministers that is, things may still get sketchy in the short term, but at least it should set up for government budget improvements that make a heck of a lot more sense for long-term economic growth potential. One thing that is for sure is the issue isn’t going away.

Retail Sales

On Friday, the Commerce Department reported that retail sales rose 0.5% (+0.3% was expected) in January. Ex-gasoline was up the same and core sales (ex gas, autos and building materials) came in at a hot 0.8% - this even as building materials got hammered, down 1.2% for the month; the figure is off by 9.9% over the past 12 months.

The furniture and aforementioned building materials segments were the only components of the report to post declines in January. Food & beverage was up 0.8%; gasoline stations up 0.4% (probably all price driven though); sporting goods sales advanced 1.0%; general merchandise was up 1.5% (after getting hit by 1.1% in December due to weather); non-store retailing jumped 1.6% after high-powered advances in December and November of 2.2% an 2.5%, respectively.

The non-store retailing results do make it difficult for one to argue that the December decline in overall retail sales was due to winter weather. The strong results show that online purchases picked up a lot of the slack. BTW, I forgot to mention above that the December decline was upwardly revised to show sales slipped 0.1%, not the 0.3% initially estimated. Notwithstanding that upward revision for December, the December-January combination is still weak from the perspective of the past several years.

This is a good report considering income growth has been flat-to-weak as the jobless rate sits at 9.8%. I do caution though that pretty decent spending over the past several months, really going back to May with a couple of weak numbers thrown in, has gotten ahead of household cashflows. The growth in government transfer payments, still hovering at the record percentage of total personal income, cannot continue. These payments are helping to drive consumer spending, but also driving deeper federal budget deficits.

We’ll see the savings rate dip in January from December’s 4.8% as result of this retail spending. Since this figure has to get to the long-term average of roughly 6.5% (this is a reality due to high joblessness and the evaporation of $12 trillion from household net worth) we’ll see weak personal consumption trends over the next year at least – but not without a big quarter here and there, remember those homebuyers tax credits will be going out over the next few months.

Consumer ConfidenceThe latest confidence reading came from the University of Michigan’s poll on the subject. The headline reading dipped to 73.7 from 74.4 in January – the long-term average is 88.0.

Consumers’ view of the current economic situation improved to 84.1 from 81.1, this is the highest reading since March 2008. However, the expectations reading (consumers’ take on things over the next six months) got crushed, falling to 66.9 from 70.1 – a reading of 66.9 is about the average of the past two recessions. (I’m talking about 1982 and 1991, the 2001 downturn was just that, it was not a technical recession in my view.)

The improvement in the current situation figure is probably due to the decline in the jobless rate last month. Consumers see this and believe the jobless rate will continue to decline, but it doesn’t exactly work this way, as we’ll see in the coming months.

Business InventoriesThe Commerce Department reported that business stockpiles fell in December after the first back-to-back gains since July-August 2008. In fact, those increases in the previous two reporting months were the first positive readings at all since August 2008.

Business inventories fell 0.2% in December, but it did result from higher sales as they advanced a very nice 0.9%. One would like to see a little more confidence among business managers (but who can blame them) but this is better than inventories falling even as sales collapse, which is what occurred in the 10 months that ran November 2008-August 2009.

The inventories-to-sales ratio has nearly returned to the all-time low of 1.24 touched in January 2006, coming in at 1.26 months’ worth in December.

One can take both good and bad messages from this report.

The good is that the inventory-to-sales ratio is rock bottom. Firms have slashed stockpiles like never before, at least in the postwar era, and sales have begun to bounce. We’ll watch to see if this sales trend has the juice to keep going, but the combination of super-low stockpiles and increasing sales suggests the next two GDP quarters will be good, catalyzed by the inventory dynamic we been talking about for a long time now. (First-quarter GDP is shaping up to post another reading in the 5% handle.)

The bad is that even though inventories are near record lows it has not yet compelled firms to aggressively rebuild stockpiles; this is a result of high levels of uncertainty – doubts that consumer spending will continue to trend higher and worries of higher tax rates and an increased regulatory environment. If sales keep improving, then firms will be forced to rebuild inventories – that means more production. But if they don’t, then the catalyst the rebuilding process offers to economic growth will not fully take hold.

Have a great day!

Brent Vondera, Senior Analyst

Greenback

Greenback Overall continuing claims resumed their move higher too. Standard claims, those that last the traditional 26 weeks, came in unchanged from the week prior.

Overall continuing claims resumed their move higher too. Standard claims, those that last the traditional 26 weeks, came in unchanged from the week prior. However, Emergency Unemployment Compensation (EUC) rose 274,000. Over the past six weeks EUC claims have jumped 707,000.

However, Emergency Unemployment Compensation (EUC) rose 274,000. Over the past six weeks EUC claims have jumped 707,000.

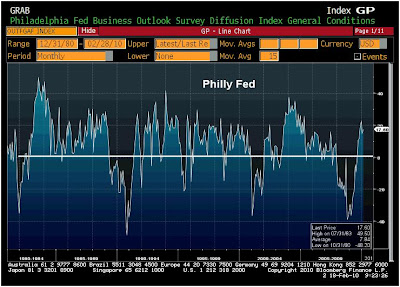

Philly Fed

Philly Fed

Mortgage Applications

Mortgage Applications

Recall the foreclosure figures we touched on again yesterday – 300K foreclosure filings a month, 2.8 million in 2009, another 3 million in 2010, a current distressed loan balance of $450 billion. We’re talking about three years before this inventory (both actual and shadow) clears, according to S&P. So any home building only extends the time to which the housing market can normalize.

Recall the foreclosure figures we touched on again yesterday – 300K foreclosure filings a month, 2.8 million in 2009, another 3 million in 2010, a current distressed loan balance of $450 billion. We’re talking about three years before this inventory (both actual and shadow) clears, according to S&P. So any home building only extends the time to which the housing market can normalize.

Empire Manufacturing

Empire Manufacturing The average workweek also posted a nice gain, accelerating to 8.33 from 5.33 in January. Again, this is good news. While it will take larger average workweek readings to get job growth going, the trajectory is helpful. The number of employees rose to 5.56 from 4.00, so a little help there.

The average workweek also posted a nice gain, accelerating to 8.33 from 5.33 in January. Again, this is good news. While it will take larger average workweek readings to get job growth going, the trajectory is helpful. The number of employees rose to 5.56 from 4.00, so a little help there. Rising foreclosures are adding to inventory and are do so in an aggressive manner at some point in the not-too-distant future. The government is offering lenders cash incentives to modify loans, but this is only delaying the inevitable – as we’ve talked about for several months now – as a very high percentage of those modified mortgages are back in default 2-3 months later, as you can see via the “recidivism” chart below. (S&P calls modified loans “cured” loans)

Rising foreclosures are adding to inventory and are do so in an aggressive manner at some point in the not-too-distant future. The government is offering lenders cash incentives to modify loans, but this is only delaying the inevitable – as we’ve talked about for several months now – as a very high percentage of those modified mortgages are back in default 2-3 months later, as you can see via the “recidivism” chart below. (S&P calls modified loans “cured” loans) A record 3 million homes will be repossessed this year, according to RealtyTrac, up from 2.82 million in 2009 . Foreclosure filings rose 15% in January and have exceeded 300,000 per month for 11-straight months.

A record 3 million homes will be repossessed this year, according to RealtyTrac, up from 2.82 million in 2009 . Foreclosure filings rose 15% in January and have exceeded 300,000 per month for 11-straight months. The NAHB’s gauge of prospective buyers held at a reading of 12 last month. Continued low interest rates, meaningfully lower home prices, and the home buyers’ tax credit are not enough to get things moving for the market. It will ultimately take significant job growth to propel the housing market into a durable rebound, and even then it will still have to contend with coming supply from all of these foreclosures.

The NAHB’s gauge of prospective buyers held at a reading of 12 last month. Continued low interest rates, meaningfully lower home prices, and the home buyers’ tax credit are not enough to get things moving for the market. It will ultimately take significant job growth to propel the housing market into a durable rebound, and even then it will still have to contend with coming supply from all of these foreclosures.