U.S. stocks broke a four-day losing streak, getting a lift from the prior night’s rally in Chinese stocks (as that government tempered concern they would attempt to curb equity and property speculation). A measure of retail sales showed August declines were less-than-expected, which also may have helped the equity markets.

Financials, after leading the indices lower for two days, were the best performing group. Basic material shares recorded another good session as metals prices gained again, led by gold and silver. Silver raged ahead, up 5.17% to $16.15 per oz. Gold came within $2 of $1,000 before pulling back to $993, up 1.64% on the session.

Advancers turned the table yesterday, beating decliners by a five-to-one margin. Volume was typical of this summer’s activity, 1.1 billion shares traded on the NYSE Composite, in line with the three-month average

Market Activity for September 3, 2009 Initial Jobless Claims

Initial Jobless ClaimsThe Labor Department reported that initial jobless claims fell 4,000 to 570,000 in the week ended August 29 from an upwardly revised 574,000 (was initially reported as 570,000) in the week prior. The estimate was for a decline to 564K from the initial estimate of 570,000 in the prior week. So, the expectation was close to right on the change (down 4K vs. an expected 6K decline), but missed by a wider margin on the level due to the revision higher from the prior week.

The four-week average, which smoothes out weekly volatility to a degree, rose 4,000 to 571,250. With this being the final week of the month (claims for the week ended Aug. 28) this is the average for all of August, up from the July average of 557K.

Continuing claims rose 92,000 to 6.234 million for the week ended August 22 (there’s a one week lag between continuing and initial claims for those wondering about the different dates). The level is hovering right at the four-week average of 6.216 million.

Emergency unemployment compensation jumped 85,500. This involves the extension of benefits an additional 33 weeks. So, normal benefits period is 26 weeks, plus this emergency extension…some may call this welfare.

This data won’t have a bearing on the first look at the August jobs report, as that will be released tomorrow. However, if claims fail to come lower from this level that is high in the 500K handle it does suggest that the September jobs data will not show much improvement in monthly job losses. Ultimately, we’ll have to wait a couple of weeks to have more confidence in this take, but I bring it up because some (including myself) have believed jobs losses would ease to something closer to 200K by the September jobs release – this level of claims appears to say that monthly losses will remain closer to 300K.

To put this into perspective, while the rate of employment decline has improved big time from the outsized losses of 500K-600K just four months back, 250K-300K in payroll losses is commensurate with the worst levels we seen during the typical recession. If jobless claims fail to ease back closer to 500K (the average over the past two months is 565K) in quick order, we’ll need to delay the expectation that job losses will fall to levels that are below a historically high elevation.

ISM Non-Manufacturing

The ISM non-manufacturing reading continued to improve in August, rising to 48.4 from 46.4 in July, illustrating that business conditions within the service sector declined at a slower rate than in the previous month. This was a bit above expectations for a 48.0 print. The dividing line between expansion and contraction is 50. (Recall, the ISM manufacturing reading earlier in the week surpassed the 50 mark. The fact that this service sector reading failed to do so is an additional confirmation that the rise in factory activity was largely due to what will be a short-term bounce in auto production via the clunker-cash scheme)

The business activity sub-index rose above 50 for the first time since the economy fell apart in September.

Seven of the 18 industries reported expansion, 10 reported contraction and one stated activity was unchanged from July. For perspective, the July data had six industries report expansion, eight reported activity contracted and four said activity was unchanged. On a net basis this indicates deterioration to me, but because there was one more industry reporting growth, it was enough to push the business activity index higher.

The employment index rose two points to 43.5, nice to see improvement but it remains well in contraction mode.

The inventory change index fell four points to 43.0. This is not a good sign. The market is expecting a rebuilding in inventories to help current-quarter GDP. (We will get some help from inventories, specifically due to vehicle assemblies, but it may not be as helpful as many had hoped. Respondents stated that they are “driving managers to reduce and maintain [inventories]at lower level.” I think they meant to say and/or, but that was the quote.

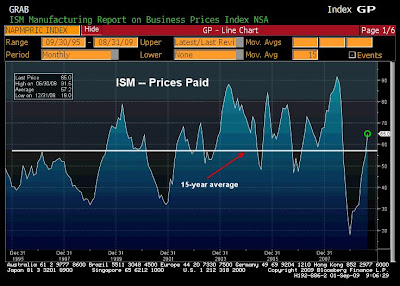

The prices paid sub-index soared 21.8 to 63.1 in August, indicating a substantial jump in prices paid from July. This is a record rise in prices paid, although I need to make note that this data only goes back to 1997. In August, 23% of respondents stated higher prices vs. 13% in July; 71% reported no change vs. 59% in July; and 6% reported lower prices vs. 28% in July. That’s a big shift in one month’s time. Sounds like a slack problem.

On inflation, I’ve expressed the concern before about the slack in the economy.

First, it’s rather hilarious for me to bring up the term “slack” because it is a total Keynesian take on things. To explain, it goes like this: if the economy has a lot of slack (that is, the job market has shed millions of jobs, and plant capacity sits at a low level (and currently capacity utilization is just off of the all-time lows) then inflation cannot possibly become a problem, according to the Keynesian economist. They believe this because if there is a lot of slack, say in the job market (ie. the unemployment rate is high and firms don’t have to pay up for quality workers) then wages are not rising substantially and thus firms do not have to pass these costs along to consumers.

But that’s their little world. In reality, inflation is more a function of too much money chasing too few goods than it is a function of a tight labor market. As a result, while most economists do not seem to fear harmful levels of inflation to be a possibility in the foreseeable future, I tend to think otherwise.

The massive cuts in employment and idle plant resources can cause prices to rage once even a mild increase in demand presents itself. The productive capacity will not be their right away to meet this demand (even if it is fleeting) and thus prices may jump. I don’t believe troublesome levels of inflation are right upon us, but this unprecedented jump in ISM prices paid may be an early indication of what is possible over the next 12-18 months.

Certainly, the deflation argument seems quite removed from reality – in fact, it will take another financial-sector crisis (banks continuing to sit on massive amounts of cash instead of lending it out) to make deflation a reality.

Chain Store Sales

Well, despite the state sales-tax holidays implemented for the back-to-school (B2S) shopping season, same-store sales (stores open at least a year) fell 2.0% in August, as reported by the International Council of Shopping Centers.

While this is an improvement from the roughly 5% average year-over-year decline of the previous three months, its marks the worst B2S season in a long time. I don’t think anyone should rule out that clunker-cash, at least to some extent, also dragged sales lower – effectively cannibalizing sales from other retail sources. For instance, if the clunker-cash was too enticing to pass up, the consumer is writing a check to the DMV to cover sales tax.

Apparel and department store sales took another beating, down 4.3% and 7.3%, respectively (although the rate of decline eased from the July readings). Luxury store sales continue in the tank, off 12.3% -- the average of the previous two months, but improvement (if you can call it that) from super deep declines of 20% during the spring months. Even discount chains were down 1%.

Year-ago comparables will get increasingly easier once we get into October, but there is little doubt consumer activity will remain depressed for a prolonged period – bouts of rebound, but nothing sustained.

Have a great weekend!

Brent Vondera, Senior Analyst

Initial Jobless Claims

Initial Jobless Claims Continuing claims rose 92,000 to 6.234 million for the week ended August 22 (there’s a one week lag between continuing and initial claims for those wondering about the different dates). The level is hovering right at the four-week average of 6.216 million.

Continuing claims rose 92,000 to 6.234 million for the week ended August 22 (there’s a one week lag between continuing and initial claims for those wondering about the different dates). The level is hovering right at the four-week average of 6.216 million. Emergency unemployment compensation jumped 85,500. This involves the extension of benefits an additional 33 weeks. So, normal benefits period is 26 weeks, plus this emergency extension…some may call this welfare.

Emergency unemployment compensation jumped 85,500. This involves the extension of benefits an additional 33 weeks. So, normal benefits period is 26 weeks, plus this emergency extension…some may call this welfare. The business activity sub-index rose above 50 for the first time since the economy fell apart in September.

The business activity sub-index rose above 50 for the first time since the economy fell apart in September. On inflation, I’ve expressed the concern before about the slack in the economy.

On inflation, I’ve expressed the concern before about the slack in the economy.

Mortgage Applications

Mortgage Applications Preliminary Employment Reports

Preliminary Employment Reports ADP estimates that the service-providing sector cut 146,000 positions and goods-producing positions to be down by 152,000. These are higher numbers than the improvement we saw in July’s official data. Service industries cut just 128K vs. the 200K+ avg. for the previous three months and goods-producing industries cut just 119K in July, up from the 190K avg. during the previous three months. By way of the ISM and regional factory gauges, many are expecting goods producing to continue to improve. As a result, if this ADP figure is accurate it could be a blow to the market when the official report is released tomorrow.

ADP estimates that the service-providing sector cut 146,000 positions and goods-producing positions to be down by 152,000. These are higher numbers than the improvement we saw in July’s official data. Service industries cut just 128K vs. the 200K+ avg. for the previous three months and goods-producing industries cut just 119K in July, up from the 190K avg. during the previous three months. By way of the ISM and regional factory gauges, many are expecting goods producing to continue to improve. As a result, if this ADP figure is accurate it could be a blow to the market when the official report is released tomorrow.

All 10 major sectors declined on the session, led by a 5.26% slide in financial shares. Utility shares were the best performing group on a relative basis, down just 0.72%.

All 10 major sectors declined on the session, led by a 5.26% slide in financial shares. Utility shares were the best performing group on a relative basis, down just 0.72%. ISM Manufacturing (August)

ISM Manufacturing (August) New orders jumped 9.6 points to 64.9 – a reading that is well-above the 30-year average of 53.8. This sub index was the main driver for the overall ISM number.

New orders jumped 9.6 points to 64.9 – a reading that is well-above the 30-year average of 53.8. This sub index was the main driver for the overall ISM number. The employment index ticked up slightly but remains in contractions mode. I noticed a comment from PIMCO’s Tony Crescenzi yesterday, in which he pointed to the jump in supplier deliveries (another sub-index of ISM) to 57.1 from 52.0 in July – this component of ISM works in the opposite direction, a reading above 50 means slower delivery times.

The employment index ticked up slightly but remains in contractions mode. I noticed a comment from PIMCO’s Tony Crescenzi yesterday, in which he pointed to the jump in supplier deliveries (another sub-index of ISM) to 57.1 from 52.0 in July – this component of ISM works in the opposite direction, a reading above 50 means slower delivery times. Some of this rebound in ISM manufacturing is due to the inventory dynamic. As we’ve talked about for a few months now, the very low state of inventories will encourage firms to boost production in order to rebuild those stockpiles.

Some of this rebound in ISM manufacturing is due to the inventory dynamic. As we’ve talked about for a few months now, the very low state of inventories will encourage firms to boost production in order to rebuild those stockpiles.

Chicago PMI

Chicago PMI The reading beat the expectation of a move to 48.0 and I certainly thought it would be another month before we got back to 50, which we stated after the latest factory reading out of Philadelphia on August 20. One would have thought this move to spark a rally in stock prices, but the market actually traded lower on the news before regaining some of those losses later in the session.

The reading beat the expectation of a move to 48.0 and I certainly thought it would be another month before we got back to 50, which we stated after the latest factory reading out of Philadelphia on August 20. One would have thought this move to spark a rally in stock prices, but the market actually traded lower on the news before regaining some of those losses later in the session. The employment index remains in deep contraction, hitting 38.7, but has improved significantly from the cycle low of 25.0 in May. (And on employment, we get the August payroll data on Friday. While the weekly jobless claims data suggest monthly job losses will be worse than what we saw in July, the firming in the auto sector should keep factory employment losses milder than was the case just two months back – this sector showed the rate of decline in jobs losses slowed meaningfully during July and that should continue in August.)

The employment index remains in deep contraction, hitting 38.7, but has improved significantly from the cycle low of 25.0 in May. (And on employment, we get the August payroll data on Friday. While the weekly jobless claims data suggest monthly job losses will be worse than what we saw in July, the firming in the auto sector should keep factory employment losses milder than was the case just two months back – this sector showed the rate of decline in jobs losses slowed meaningfully during July and that should continue in August.) The Commercial Hurt

The Commercial Hurt

Personal Income and Spending

Personal Income and Spending While the headline figure didn’t show it, the internals of the income data were a vast improvement from what we’ve seen over the past several months. Compensation and wages & salaries (two of the three largest components of the data, personal income from assets being the third) both rose 0.1% in July; this follows eight month of decline. So, even though the 0.1% increase is paltry and won’t do much to help elevate consumption, it’s something. These key components have gotten shellacked over the past 12 months, down 4.2% and 5.1%, respectively.

While the headline figure didn’t show it, the internals of the income data were a vast improvement from what we’ve seen over the past several months. Compensation and wages & salaries (two of the three largest components of the data, personal income from assets being the third) both rose 0.1% in July; this follows eight month of decline. So, even though the 0.1% increase is paltry and won’t do much to help elevate consumption, it’s something. These key components have gotten shellacked over the past 12 months, down 4.2% and 5.1%, respectively. This is what I mean by borrowing from the future. The CARS program is just delaying what needs to occur, a cash savings rate that needs to settle in at roughly 8% in order to get consumers feeling right again – based on current realities within the home, stock and labor markets.

This is what I mean by borrowing from the future. The CARS program is just delaying what needs to occur, a cash savings rate that needs to settle in at roughly 8% in order to get consumers feeling right again – based on current realities within the home, stock and labor markets.