U.S. stocks sold off on Tuesday, extending the losing streak to three sessions as it appears the trend we touched on in yesterday’s letter has shifted. Not only does the famous second-derivative trade appear exhausted, but the broad market fell 2.2% on a day in which the manufacturing index posted its first move into expansion territory in 19 months.

One can never make too much out of two or three days of trading, and we should keep that in mind, but the correction that seemed quite overdue after a tremendous run from the depths of the March 9 low may be upon us.

I see there are money managers out this morning stating stocks can’t fall more than 5-10% simply because ISM has moved to expansion mode. One should remind them of the 2002 market. ISM spent eight-straight months above 50 during 2002, yet coming off of a quick 22% rally the S&P 500 went into a 31% freefall at exactly the same time ISM was hitting expansion mode. How quickly memories are erased.

Also weighing on stocks yesterday was speculation across bond desks that a major bank would fail on Friday. Even if this is baseless, the talk of such an event will certainly bring back the vaunted run for safety back to the Treasury market. The 10-year finished 3.37% -- here we go again?

All 10 major sectors declined on the session, led by a 5.26% slide in financial shares. Utility shares were the best performing group on a relative basis, down just 0.72%.

All 10 major sectors declined on the session, led by a 5.26% slide in financial shares. Utility shares were the best performing group on a relative basis, down just 0.72%.

Volume blew by the three-month average. Roughly 1.6 billion shares traded on the NYSE Composite, 33% more than the average for this summer. Sixteen stocks fell for every one that rose on the Big Board.

Market Activity for September 1, 2009

ISM Manufacturing (August)

ISM Manufacturing (August)

The Institute for Supply Management’s manufacturing gauge for August jumped to 52.9 (a reading above 50 marks expansion) from 48.9 in July. This marks the first time the nationwide factory index has moved to expansion in 19 months (January 2008). (Yesterday, in getting everyone ready for this reading, I stated the last time it hit expansion territory was September 2008, sorry about that error I was thinking about the Chicago manufacturing reading).

Eleven of the 18 manufacturing industries reported growth last month, that’s up from seven in July.

New orders jumped 9.6 points to 64.9 – a reading that is well-above the 30-year average of 53.8. This sub index was the main driver for the overall ISM number.

New orders jumped 9.6 points to 64.9 – a reading that is well-above the 30-year average of 53.8. This sub index was the main driver for the overall ISM number.

The employment index ticked up slightly but remains in contractions mode. I noticed a comment from PIMCO’s Tony Crescenzi yesterday, in which he pointed to the jump in supplier deliveries (another sub-index of ISM) to 57.1 from 52.0 in July – this component of ISM works in the opposite direction, a reading above 50 means slower delivery times.

The employment index ticked up slightly but remains in contractions mode. I noticed a comment from PIMCO’s Tony Crescenzi yesterday, in which he pointed to the jump in supplier deliveries (another sub-index of ISM) to 57.1 from 52.0 in July – this component of ISM works in the opposite direction, a reading above 50 means slower delivery times.

Crescenzi states that this may mean manufacturing job growth is on the horizon. That would be nice. No doubt the jump in orders has caused some potential bottleneck issues. One can see this in the new order less inventories figure, which jumped to the highest reading since June 1975. But manufacturers understand that the jump in orders is largely driven by the auto sector, and to a lesser extent apparel as the fall line ups roll out. Neither of these factors spells sustained orders growth though, and thus factories are more likely to boost hours worked for current workers than to add to payrolls at this time.

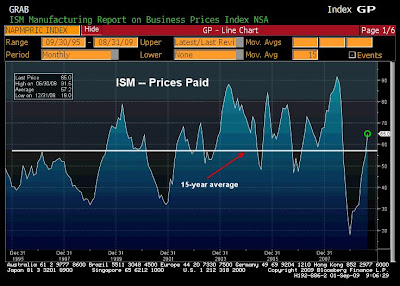

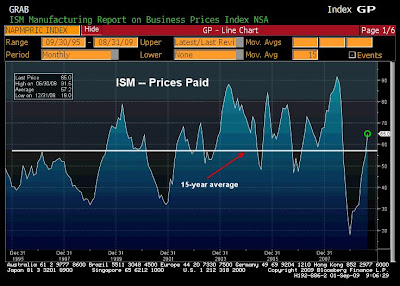

The prices paid index surged. Early inflation signal? We shall see.

Some of this rebound in ISM manufacturing is due to the inventory dynamic. As we’ve talked about for a few months now, the very low state of inventories will encourage firms to boost production in order to rebuild those stockpiles.

Some of this rebound in ISM manufacturing is due to the inventory dynamic. As we’ve talked about for a few months now, the very low state of inventories will encourage firms to boost production in order to rebuild those stockpiles.

But the surge in the new orders index does not jibe with aggregate demand, which has yet to rebound. What is occurring is more than just the inventory dynamic, a function of all business cycle upswings. The boost in vehicle orders is the primary contributor. One can see this by way of the “what respondents are saying” section of the ISM report. The transportation and fabricated metals sectors were clearly the most upbeat, other industries stating activity is on the rise struck a rather cautious tone. Comments from the fabricated metals industry even explicitly stated that manufacturing has increased “thanks to cash for clunkers.”

I noticed an often-quoted economist state, “that the pieces are falling in place for a recovery to take hold.” I wouldn’t get too carried away here. This move in ISM is very welcome, but clunker-cash is over. I wonder if car dealers appreciate people calling this clunker-cash. Since most are still waiting for their government payments, maybe we should call it clunker IOUs.

Prior to this government subsidization, car sales had been in the tank for nine-straight months. This was due to the reverse wealth effect, very weak job market and tighter credit conditions. What occurs once the auto makers have replenished stockpiles? One would think dealer inventories will swell again. Does anyone really believe that car sales will follow a path that is unlike what had occurred before cash for cars?

Unfortunately, instead of a prolonged expansion in factory orders that generally lasts several years in the typical economic recovery, my view is that this one will last only a few months.

In the short-term though, GDP for the current quarter will mark the end of the four-quarter contraction. The latest two readings on ISM average 50.9. I’m guessing economists are upping their third-quarter GDP estimates as we speak.

Construction Spending (July)

Construction spending fell 0.2% in July, following a 0.1% increase for June. The index is down 10.5% year-over-year.

The residential side of things was robust in July as private-sector home construction jumped 2.3% and public-sector outlays for housing rocketed up 3.6% -- that is a huge one month move. (This is a great start to the quarter and suggests housing will lift Q3 GDP, marking the first positive impact from this component in 13 quarters. Again, those GDP estimates are on the rise)

The increase on the residential side, however, was not enough to offset the private sector weakness in commercial construction spending, which was down 1.2% -- down 8.3% y-o-y and lower by 15.8% past three months on an annualized basis.

Looking out over the next several months, private sector commercial construction will remain in the tank, I’m not sure what will happen on the residential side, but it would be a surprise to see a complete recovery in this segment as the inventory/sales ratio for new homes, while much lower, remains elevated. The public sector will take over though and boost this overall reading as the bulk of the government’s stimulus spending has yet to roll out.

Pending Home Sales (July)

Pending home sales continue to roll, up 3.2% for July – the sixth month of increase. Contract signings were fueled by a 12.1% jump in the West (where California’s state tax credit on new home purchases combines with the federal government credit and foreclosure-related price declines) and a 3.1% increase in the South. Pending home sales fell 3.0% in the Northeast and 2.0% in the Midwest.

This data suggests we’ll see another nice month for existing and new home sales when the July data is released. We’re heading for that tax credit expiration, have to close by November 1; we’ll see what happens to sales after that – unless it is extended, which some have speculated.

Another Big Find

BP has reported a giant discovery at the Tiber Prospect in the Gulf of Mexico that may hold more than 3 billion barrels of oil. The well is located about 250 miles southeast of Houston. Between this and the huge find off of the coast of Brazil not that long ago, the “peak oil” crowd is really taking some blows.

More of this to come, technological improvements will lead to additional finds. Despite what many would like everyone to believe, we are not even close to running out of oil; we should be more focused our own preservation.

Have a great day!

Brent Vondera, Senior Analyst

One can never make too much out of two or three days of trading, and we should keep that in mind, but the correction that seemed quite overdue after a tremendous run from the depths of the March 9 low may be upon us.

I see there are money managers out this morning stating stocks can’t fall more than 5-10% simply because ISM has moved to expansion mode. One should remind them of the 2002 market. ISM spent eight-straight months above 50 during 2002, yet coming off of a quick 22% rally the S&P 500 went into a 31% freefall at exactly the same time ISM was hitting expansion mode. How quickly memories are erased.

Also weighing on stocks yesterday was speculation across bond desks that a major bank would fail on Friday. Even if this is baseless, the talk of such an event will certainly bring back the vaunted run for safety back to the Treasury market. The 10-year finished 3.37% -- here we go again?

All 10 major sectors declined on the session, led by a 5.26% slide in financial shares. Utility shares were the best performing group on a relative basis, down just 0.72%.

All 10 major sectors declined on the session, led by a 5.26% slide in financial shares. Utility shares were the best performing group on a relative basis, down just 0.72%.Volume blew by the three-month average. Roughly 1.6 billion shares traded on the NYSE Composite, 33% more than the average for this summer. Sixteen stocks fell for every one that rose on the Big Board.

Market Activity for September 1, 2009

ISM Manufacturing (August)

ISM Manufacturing (August)The Institute for Supply Management’s manufacturing gauge for August jumped to 52.9 (a reading above 50 marks expansion) from 48.9 in July. This marks the first time the nationwide factory index has moved to expansion in 19 months (January 2008). (Yesterday, in getting everyone ready for this reading, I stated the last time it hit expansion territory was September 2008, sorry about that error I was thinking about the Chicago manufacturing reading).

Eleven of the 18 manufacturing industries reported growth last month, that’s up from seven in July.

New orders jumped 9.6 points to 64.9 – a reading that is well-above the 30-year average of 53.8. This sub index was the main driver for the overall ISM number.

New orders jumped 9.6 points to 64.9 – a reading that is well-above the 30-year average of 53.8. This sub index was the main driver for the overall ISM number. The employment index ticked up slightly but remains in contractions mode. I noticed a comment from PIMCO’s Tony Crescenzi yesterday, in which he pointed to the jump in supplier deliveries (another sub-index of ISM) to 57.1 from 52.0 in July – this component of ISM works in the opposite direction, a reading above 50 means slower delivery times.

The employment index ticked up slightly but remains in contractions mode. I noticed a comment from PIMCO’s Tony Crescenzi yesterday, in which he pointed to the jump in supplier deliveries (another sub-index of ISM) to 57.1 from 52.0 in July – this component of ISM works in the opposite direction, a reading above 50 means slower delivery times.Crescenzi states that this may mean manufacturing job growth is on the horizon. That would be nice. No doubt the jump in orders has caused some potential bottleneck issues. One can see this in the new order less inventories figure, which jumped to the highest reading since June 1975. But manufacturers understand that the jump in orders is largely driven by the auto sector, and to a lesser extent apparel as the fall line ups roll out. Neither of these factors spells sustained orders growth though, and thus factories are more likely to boost hours worked for current workers than to add to payrolls at this time.

The prices paid index surged. Early inflation signal? We shall see.

Some of this rebound in ISM manufacturing is due to the inventory dynamic. As we’ve talked about for a few months now, the very low state of inventories will encourage firms to boost production in order to rebuild those stockpiles.

Some of this rebound in ISM manufacturing is due to the inventory dynamic. As we’ve talked about for a few months now, the very low state of inventories will encourage firms to boost production in order to rebuild those stockpiles.But the surge in the new orders index does not jibe with aggregate demand, which has yet to rebound. What is occurring is more than just the inventory dynamic, a function of all business cycle upswings. The boost in vehicle orders is the primary contributor. One can see this by way of the “what respondents are saying” section of the ISM report. The transportation and fabricated metals sectors were clearly the most upbeat, other industries stating activity is on the rise struck a rather cautious tone. Comments from the fabricated metals industry even explicitly stated that manufacturing has increased “thanks to cash for clunkers.”

I noticed an often-quoted economist state, “that the pieces are falling in place for a recovery to take hold.” I wouldn’t get too carried away here. This move in ISM is very welcome, but clunker-cash is over. I wonder if car dealers appreciate people calling this clunker-cash. Since most are still waiting for their government payments, maybe we should call it clunker IOUs.

Prior to this government subsidization, car sales had been in the tank for nine-straight months. This was due to the reverse wealth effect, very weak job market and tighter credit conditions. What occurs once the auto makers have replenished stockpiles? One would think dealer inventories will swell again. Does anyone really believe that car sales will follow a path that is unlike what had occurred before cash for cars?

Unfortunately, instead of a prolonged expansion in factory orders that generally lasts several years in the typical economic recovery, my view is that this one will last only a few months.

In the short-term though, GDP for the current quarter will mark the end of the four-quarter contraction. The latest two readings on ISM average 50.9. I’m guessing economists are upping their third-quarter GDP estimates as we speak.

Construction Spending (July)

Construction spending fell 0.2% in July, following a 0.1% increase for June. The index is down 10.5% year-over-year.

The residential side of things was robust in July as private-sector home construction jumped 2.3% and public-sector outlays for housing rocketed up 3.6% -- that is a huge one month move. (This is a great start to the quarter and suggests housing will lift Q3 GDP, marking the first positive impact from this component in 13 quarters. Again, those GDP estimates are on the rise)

The increase on the residential side, however, was not enough to offset the private sector weakness in commercial construction spending, which was down 1.2% -- down 8.3% y-o-y and lower by 15.8% past three months on an annualized basis.

Looking out over the next several months, private sector commercial construction will remain in the tank, I’m not sure what will happen on the residential side, but it would be a surprise to see a complete recovery in this segment as the inventory/sales ratio for new homes, while much lower, remains elevated. The public sector will take over though and boost this overall reading as the bulk of the government’s stimulus spending has yet to roll out.

Pending Home Sales (July)

Pending home sales continue to roll, up 3.2% for July – the sixth month of increase. Contract signings were fueled by a 12.1% jump in the West (where California’s state tax credit on new home purchases combines with the federal government credit and foreclosure-related price declines) and a 3.1% increase in the South. Pending home sales fell 3.0% in the Northeast and 2.0% in the Midwest.

This data suggests we’ll see another nice month for existing and new home sales when the July data is released. We’re heading for that tax credit expiration, have to close by November 1; we’ll see what happens to sales after that – unless it is extended, which some have speculated.

Another Big Find

BP has reported a giant discovery at the Tiber Prospect in the Gulf of Mexico that may hold more than 3 billion barrels of oil. The well is located about 250 miles southeast of Houston. Between this and the huge find off of the coast of Brazil not that long ago, the “peak oil” crowd is really taking some blows.

More of this to come, technological improvements will lead to additional finds. Despite what many would like everyone to believe, we are not even close to running out of oil; we should be more focused our own preservation.

Have a great day!

Brent Vondera, Senior Analyst

No comments:

Post a Comment