Well, we didn’t quite lose it all, but markets traded lower yesterday to the tune of 224.64 points on the Dow Jones Industrial Average, to close 1.90 percent lower at 11,431.43. A much worse than forecast loss at American International Group (ticker symbol: AIG) was to blame as insurer announced that it lost $5.36 billion on mortgage-related write-downs; shares lost 18 percent of their value.

Oil took an opposite turn, gaining $1.44 per barrel to close up 1.20 percent and close at $120.02 per barrel in New York. It’s too bad, too, since I just filled my tank up today and was thinking how nice it was to be below $60 for a fill-up.

Recently, I read an economist’s take one why we pay such close attention to gas prices: we stand there with nothing to do and stare at the price. Yogurt prices have risen by the same percentage as gasoline prices over the past 18 months, but there isn’t a whole lot of uproar about it (then again, America isn’t addicted to yogurt in quite the same way).

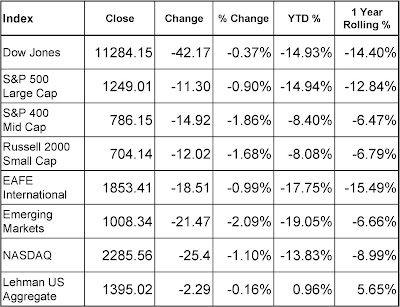

Market Activity for August 7, 2008

This morning futures are basically flat as results from Fannie Mae (ticker symbol: FNM) are reviewed and traders consider oil futures, which are lower again this morning. Right now, oil futures are lower by $2 per barrel suggesting a barrel will trade for under $118 per barrel this morning.

This morning futures are basically flat as results from Fannie Mae (ticker symbol: FNM) are reviewed and traders consider oil futures, which are lower again this morning. Right now, oil futures are lower by $2 per barrel suggesting a barrel will trade for under $118 per barrel this morning.This is no doubt partly a response to the sharply higher dollar, which has moved because China said that it would tighten their currency controls further (is that possible?) and it appears that the European Central Bank will not raise interest rates further. The ECB’s most recent action was to do nothing since it appears that all of Europe is on the verge of a recession/slowdown as well.

As Brent has said many times, at the point when the U.S. dollar stabilizes and begins to recover, the commodity bubble will shrink rapidly (something we have seen in July and August).

With respect to the FNM news, losses were expected and Freddie Mac had already laid the groundwork for some bad results when they posted earnings earlier this week. Therefore, it isn’t likely to have such a negative effect on trading today despite the weak results.

FNM posted a $2.3 billion loss compared to a $1.95 billion positive net income a year ago this quarter. FNM also booked $5.35 billion in credit costs by increasing loss provisions and charge-offs. They also cut their dividend by 86 percent to five cents per share that will save the company $1.9 billion through the end of 2009.

In my personal view, they should have scrapped the dividend on the common stock altogether. I don’t think it makes a whole lot of sense to continue to pay the common shareholder while the government is now officially standing by to rescue the company if they can’t raise enough money to continue independently. Certainly the stocks are so far off (another 11 percent this morning for FNM in pre-market trading) that cutting the dividend to zero wouldn’t likely kill the company. I don’t think anyone still holding the stock is in it for the dividend.

In economic news, U.S. productivity (defined as output per unit of labor) remained strong in the second quarter despite the slowing economy. Non-farm business productivity rose at an annual rate of 2.2 percent in the second quarter. Additionally, labor costs gained only 1.3 percent, below expectations.

This is an important piece of data because labor costs are the largest input in the creation of goods and services. The smaller than expected labor costs suggest that we are not in a 1970’s rerun where higher energy prices spiral into higher labor costs which spiral truly out of control.

Have a great weekend!

Dave Ott, General Partner