U.S. stocks gained ground as the S&P 500 moved to a new 13-month high. The broad market pared early-session gains on a quiet Veterans Day of trading (the bond market was closed, they’ve get more days off than a government job) but held to enough of that rally to now have completely erases the late-October pullback.

Financial led the way yet again, but basic material stocks weren’t far behind as the Bank of England signaled they will keep rates at emergency levels and left the door open to more government bond purchases. As this follows the Fed’s pledge to keep standing on the accelerator, the trade into commodity-related material stocks rolls on. Energy shares weren’t able to participate in the rally, ending the session essentially flat as the latest data out of Mastercard showed gasoline demand fell 2.3% in the latest week and is up just 2% from the very weak levels of a year ago.

Advancers beat decliners by a two-to-one margin on the NYSE Composite. Volume was weak as barely one million shares traded on the exchange, although I was expecting even less considering the holiday.

Futures are pointing lower this morning even with the news that Hewlett-Packard will purchase networking gear maker 3Com. Such deals usually get investor optimism going, maybe the market sees it as a bad deal. HP clearly wants to take on Cisco, they may be stretching themselves on this one.

Also, Wal-Mart just released quite good quarterly results, maybe too good as it shows discounters will reign supreme this holiday season, reminding this fairly euphoric market that the consumer is in rough shape – as if anyone needs reminding.

Market Activity for November 11, 2009 Holiday Sales, and More Importantly Spending Trends Beyond

Holiday Sales, and More Importantly Spending Trends BeyondAnd speaking of holiday shopping, we received some welcome news out of FedEx yesterday as the second-largest U.S. package-delivery company projects handling about 8% more shipments on their busiest day of the Christmas season. The company expects to handle 13 million packages on December 14, up from 12 million on December 15, 2008. The forecast is based on “positive signs” via the latest GDP and industrial production reports. For sure, what were likely good spending numbers during October probably also stoked their forecast. We’ll get the October spending numbers on November 25.

This is all fine and dandy, certainly expectations we would celebrate under

normal circumstance, but the reality remains that households are dealing with a nasty combination – the highest level of joblessness in 26 years (and rising) and very high levels of indebtedness. We can get excited about higher holiday sales (and let’s hope this is true considering the year-ago period occurred smack-dab in the middle of credit-market chaos and a relative shutdown in spending), but basing expectations on the latest economic numbers that have been boosted by short-term stimulus programs may not prove to be the wisest thing to do. This is a theme we’ve talked about for some time now as the indicators that economists/analysts/businesses have historically looked to for evidence of what will occur in the near future may not work well this go around.

The stimulus is temporary, this form of stimulus must be as the levels of government spending, aggressive monetary accommodation and incentives to keep consumer debt levels high cannot last. Therefore, we’ll see more choppy activity instead of the typical development of things flowing and trending higher during the normal expansion. Indeed, consumers will have to work down debt levels and this will adversely affect spending, a situation that will prove more difficult and elongated if the jobless rate remains elevated for an extended period. This must occur in order to get back to normal and it’s why I remain quite skeptical about growth prospects – a skepticism that long time readers understand has not been my nature.

So let’s hope the holiday shopping season is stronger than that of the year-ago period. But don’t hope for too much because fundamentals do not support such behavior.

The China TripPresident Obama and his Treasury Secretary Tim Geithner are making a trip to Asia, actually Geithner has been there for a couple of days explaining to Japanese and Singaporean officials about how the administration will deal with massive budget deficits in the intermediate term – you know how to read these statements: higher across the board tax rates.

I believe President Obama arrives in Asia today and the main focus of the trip is to talk to Chinese President Hu Jintao about the “need” to strengthen the yuan (Chinese currency). I’m sure that’s going to go over really well as our own currency is devalued on weekly basis.

It was just Monday night in which the Chinese got in front of this trip by making the explicit statement that they’ll keep the yuan pegged to the U.S. dollar – meaning they are not going to allow it to rise. Then, suddenly, by Tuesday night they revised their statements to say they may gradually re-peg the yuan to a higher level against a basket of currencies. (This has its own implications. When the yuan is pegged to the U.S.dollar it means the Chinese must buy dollars to keep the pegged rate intact, which means they must buy Treasury securities. If they go to a basket that means their need to buy our government debt is reduced.) This revision to the statement comes after intense pressure from other countries in the region. The dollar has gained some support over the past two days as governments in Thailand, South Korea and Russia buy dollars (devaluing their own currencies) because the yuan is sliding in value against those currencies due to its peg to the dollar – as the dollar slides so does the yuan. It appears there is a race to the bottom as a destructive zero interest-rate policy by the Fed affects behavior across the globe. Widespread devaluation of currencies is not a good sign for future global growth.

But the administration goes to China with the overall belief that large amounts of Chinese exports funnel into the U.S. (well, at least before consumer activity took a turn for the worse), thus allowing higher levels of prosperity in China, only because their currency is fixed at what the administration judges as a low currency value. This is a flawed premise. The Chinese were not “dumping” goods into the U.S., as if to take advantage of the American consumer. The administration seems to be ignoring a vital piece of this puzzle – monetary policy.

Look, I’m not trying to play the Chinese apologist here, I frankly despise communist regime, and while they appear to have shifted to a softer communism that government can hardly be trusted. But darn, one cannot look at this as if we were preyed upon. Let’s concentrate on getting our own policies right and the rest will fall into place.

But the flood of imports from China in the previous few years was not nearly so much the result of the Chinese holding the yuan from rising as it was a function of our Federal Reserve’s stance back in 2002-2005, a topic we’ve spent much time on over the past several years. Chinese goods don’t arrive on our shores unless there is demand to support those shipments. (Besides, we should remember that the Chinese yuan has been pegged to the U.S. dollar since the mid-1990s – with the exception of an adjustment a couple of years back; this peg helped them escape the direct effects of the Asian Contagion in 1997-1998. I don’t remember anyone expressing a problem with this pegged rate until the Fed’s actions began to create market distortions. The people who should be, and probably are, complaining are the Europeans as the yuan has declined in value along with the U.S. dollar against the euro.) The goods really began to flood in when the Fed kept rates too low for too long earlier in the decade. This monetary policy fueled a consumer credit expansion that drove demand for these imports. So long as the Fed doesn’t royally screw up, the degree of trade deficit with China would not be nearly as wide. For that matter, the housing bubble would have never occurred. While literally everyone takes the blame for this mess, it’s starkly ironic to see the Fed largely escapes criticism.

When our government officials fail to understand, or simply ignore, the preponderant reason driving the topic with which their argument is based, it sort of makes their goal tough to achieve. We’ll find out who holds the whip hand during this visit to China. I don’t like the probable intermediate term answer to this question, based on the obscene level of deficit spending we’re engaged in.

Going OffEmerson Electric’s CEO David Farr didn’t hold back in expressing his opinion of U.S. policy yesterday at an industrial conference in Chicago, saying: “Washington is doing everything in their manpower, capability, to destroy U.S. manufacturing – cap and trade, medical reform, labor rules.” He stated tax rates and regulations are pushing his company to create jobs in emerging market regions, “places where people want the products and where the governments welcome you to actually do something.” He didn’t stop there, going on to project his own question and answer: “What do you think I am going to do? I’m not going to hire anybody in the United States. I’m moving. They are doing everything possible to destroy jobs.” Wow!

This guy is going to take a lot of heat for these statements. I can see the coming accusations of anti-patriotism. But his attitude just shows he cares and wants to wake people up. He could be like the vast majority of multi-national corporate CEOs, who say nothing for fear of a backlash, but go ahead and move jobs overseas anyway due to higher domestic costs – and we should not only concentrate on the labor cost differential (which is simply the difference between rich and relatively poor societies), if we were to slash the corporate tax rate and implement a regime of streamlined and common sense regulations instead of insane mandates that do nothing but drive costs higher and destroy jobs we wouldn’t see so much outsourcing occur. (For the record, not all outsourcing is bad, some result in increased profitability and thus more higher-paying jobs here at home, but certainly more of it than would otherwise be beneficial occurs due to policy that drives capital away.)

So, Mr. Farr will certainly be labeled as anti-patriotic, but it is the business leaders that remain quiet, for fear of a backlash, who assist in damaging American exceptionalism.

Economic DataWe get back to economic data releases after essentially nothing over the past three days. This morning we await the weekly jobless claims data.

Have a great day!

Brent Vondera, Senior Analyst

Crude Oil

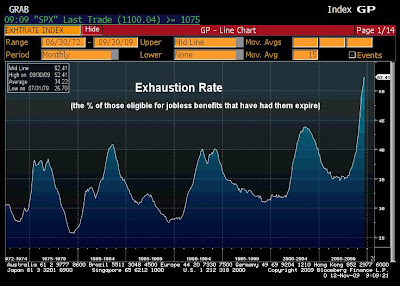

Crude Oil Continuing claims fell for an eighth-straight week, down 139,000 to 5.631 million, although more because of traditional benefits running out than job creation, as the exhaustion rate chart illustrates below.

Continuing claims fell for an eighth-straight week, down 139,000 to 5.631 million, although more because of traditional benefits running out than job creation, as the exhaustion rate chart illustrates below.  Extended benefits also show there is some expiry going on as the EUC (Emergency Unemployment Compensation) program showed claims rise (more recent laid off workers moving from traditional to EUC), while extended benefits fell (the longer-term unemployed exhausting the extensions).

Extended benefits also show there is some expiry going on as the EUC (Emergency Unemployment Compensation) program showed claims rise (more recent laid off workers moving from traditional to EUC), while extended benefits fell (the longer-term unemployed exhausting the extensions). All in all, the claims data suggest that the pace of firings continues to decline, yet a pick up in hiring has yet to become evident.

All in all, the claims data suggest that the pace of firings continues to decline, yet a pick up in hiring has yet to become evident.

Holiday Sales, and More Importantly Spending Trends Beyond

Holiday Sales, and More Importantly Spending Trends Beyond The Dollar

The Dollar There doesn’t seem to be any policymakers (at least domestically) who currently see a falling dollar value as a problem. For sure, the conventional wisdom views this as a good thing in that it will boost U.S. export activity. If the dollar continues to decline, we’ll see yet again how flawed conventional wisdom can be.

There doesn’t seem to be any policymakers (at least domestically) who currently see a falling dollar value as a problem. For sure, the conventional wisdom views this as a good thing in that it will boost U.S. export activity. If the dollar continues to decline, we’ll see yet again how flawed conventional wisdom can be. Clearly, economically-sensitive stocks have been outperforming strongly, something that one expects in bull, not bear, markets. “Cyclical” sectors outperformed in the eight months since the S&P 500’s bottom, with the financials sector jumping 140.6%, the consumer discretionary sector adding 81.5%, the materials sector growing 78.6% and the information technology sector gaining 77.7%. In contrast, “defensive” sectors like healthcare, utilities, and telecom underperformed.

Clearly, economically-sensitive stocks have been outperforming strongly, something that one expects in bull, not bear, markets. “Cyclical” sectors outperformed in the eight months since the S&P 500’s bottom, with the financials sector jumping 140.6%, the consumer discretionary sector adding 81.5%, the materials sector growing 78.6% and the information technology sector gaining 77.7%. In contrast, “defensive” sectors like healthcare, utilities, and telecom underperformed.

October Jobs Report

October Jobs Report Over the past six months jobs losses have averaged 272,000 per month, this is a huge improvement from the previous six months in which losses averaged a super-high 645K per month. The current level of job losses has finally moved to a range that is no longer at the deep levels of the prior three recessions and that is an important development – for the short term, and I’ll explain what I mean by this below.

Over the past six months jobs losses have averaged 272,000 per month, this is a huge improvement from the previous six months in which losses averaged a super-high 645K per month. The current level of job losses has finally moved to a range that is no longer at the deep levels of the prior three recessions and that is an important development – for the short term, and I’ll explain what I mean by this below. The U6 jobless rate – this figures includes the official jobless rate, plus those marginally detached (those too discouraged to look for work during this survey period), and those working part time because they can’t find full-time work, which probably reflects labor-market torpor more than anything else -- jumped to 17.5% in October from 17.0% the previous month. This measure was re-calculated in 1994, so we can only view it to that point.

The U6 jobless rate – this figures includes the official jobless rate, plus those marginally detached (those too discouraged to look for work during this survey period), and those working part time because they can’t find full-time work, which probably reflects labor-market torpor more than anything else -- jumped to 17.5% in October from 17.0% the previous month. This measure was re-calculated in 1994, so we can only view it to that point. In terms of its previous methodology the U6 jobless rate hit 14.0%, which is still below the postwar record of 14.3% hit in 1982.

In terms of its previous methodology the U6 jobless rate hit 14.0%, which is still below the postwar record of 14.3% hit in 1982. The duration of long-term unemployment (the percentage of the unemployed that have been out of work for over 27 weeks) held at the record high of 35.6%.

The duration of long-term unemployment (the percentage of the unemployed that have been out of work for over 27 weeks) held at the record high of 35.6%. The average weekly hours worked data fell back to the record low (data goes back to 1964) of 33.0 from 33.1 in September – it’s dropped back to this record low three times now. Unfortunately, we’ll need to see this figure head to 34.0 before employers even think about adding jobs. The average over the past decade is 33.8 hours per week.

The average weekly hours worked data fell back to the record low (data goes back to 1964) of 33.0 from 33.1 in September – it’s dropped back to this record low three times now. Unfortunately, we’ll need to see this figure head to 34.0 before employers even think about adding jobs. The average over the past decade is 33.8 hours per week.