U.S. stocks ran hard again as investor demand kept the good times rolling and the S&P 500 has now covered 400 points from its lowly level of 666 hit on March 9. Yesterday’s industrial production (IP) reading provided the impetus to push stocks higher for the eighth day in nine. That IP reading came in better than expected and marked the second straight gain after 17 of the last 18 arduous months saw the measure contract at the deepest rate since WWII.

Investors now believe the global economy has returned to growth. Yours truly thinks otherwise, as most everyone knows by now. There is no doubt we’ll see GDP print its first positive reading in a year, as we’ve been explaining for more than two months now, but the sustainability of this recovery is very much in question – those who believe this will exhibit a normal business cycle expansion should be very careful. It is important to understand that a number of areas are being propped up right now, massive government spending will crowd out private sector activity (the degree of this crowding cannot be known) and history shows that the vast majority of government “fixes” (and they’ll be “fixing” a lot) brings with it unintended consequences that work against progress.

Of course, the further Congress and the White House go with this agenda to have government play a much larger role the more backlash that will eventually result and via the electoral process some of the most worrisome programs will be blocked. But this takes time to occur, a lot can happen until this shift takes place.

The dollar got hammered again yesterday, which drove commodity prices higher and fueled basic material and energy stocks. Financial, energy, consumer discretionary and industrial shares were best performers. All but one of the 10 major industry groups closed higher on the session, telecoms being the odd man out.

Market Activity for September 16, 2009 Mortgage Applications

Mortgage ApplicationsThe Mortgage Bankers Association reported that their mortgage apps index declined 8.6% in the week ended September 11 following a 17% surge in the week prior. Purchased fell 10.3% for the week, while refinancing activity declined 7.4% -- refis accounted for 61% of the index last week. The 30-year fixed mortgage rate pretty much held steady, ending last week at 5.07% vs. 5.03% in the prior week.

In other housing news, it appears that an extension of the $8,000 refundable tax credit for first-time homebuyers is gaining momentum – most people know what will happen to home sales when it does expire. Congress is currently working on extending it for a year, which would probably pass easily. (For those who may not know, a tax credit means that you receive a dollar-for-dollar credit based on the year’s income tax liability. A refundable tax credit means that you do not have to have an actual tax liability of the credit’s size to receive the entire credit – ie. If the tax credit is $8,000, but you only owe $4,000 in federal income taxes, you get a check for the difference).

Consumer Price IndexThe Labor Department reported that the consumer price index (CPI) rose 0.4% in August – as tick higher than the 0.3% expected – pretty much completely driven by the transportation component (of which energy is a part of). As a result, the core rate (excludes the energy component, along with food) remains tame, up 0.1% for the month and 1.4% from the year-ago period. Headline CPI, all items, is down 1.5% an a year-over-year basis, but as we explain in each of these inflation releases, that will change come November when the comparison are no longer against the commodity price spike of summer 2008 and are matched against mild figures.

Retail gasoline rose 9.1%, as measured by this data, and the total transportation component was up 2.3% for the month. The transportation component makes up 15.3% of CPI, so the 2.3% move accounted for 88% of the CPI’s increase in August.

We received the producer price index reading for August yesterday, which showed a large 1.7% increase, or four times the rate of CPI. One wonders if the difference in the rate of increase will begin to raise concerns about profit margins, there are a lot of people – and justifiable so – thinking margins are going to improve markedly due to the rapid pace of firings and other cost-cutting measures within the business community. However, with PPI (business input costs) rising well more than CPI (what they get paid) some may begin to question the rosy margin expansion expectations.

I think the degree to which large-scale firings have boosted productivity will enable firms to absorb these rising costs. However, this may only result in larger profits for a couple of quarters, I don’t think final demand will be enough to keep things going in a prolonged manner due to what the consumer has to work through and a higher level of caution among the business community that will keep business spending at bay. Further, productivity enhancements via layoffs rather than through capital equipment expansion (which is the most powerful driver to a more productive workforce) is a short term situation. But we shall see if people begin to get a bit nervous about profit margins due to the divergence between PPI and CPI.

Net Foreign U.S. Security PurchasesInternational demand for long-term U.S. financial assets weakened in July as investors purchased just a third of the Treasury securities they purchased in June – although June was a record for Treasury purchases from foreigners.

Net buying of all longer-term U.S. securities (stocks and both government and corporate bonds) totaled $15.3 billion in July compared to a jump of $90.7 billion in June – the figures was expected to increase by $60 billion.

Net buying of U.S. Treasury notes and bonds totaled $31 billion after $100 billion in June. Foreigners bought $28.6 billion of U.S. equities in July after an increase of $19.1 billion in June, and sold $11.1 billion in corporate debt after selling $1 billion in June.

One month doesn’t make a trend, but one wonders how long countries like China will continue to purchases particularly Treasury securities, as least relative to the pace they have over the past few years. They pretty much have no choice, they have to keep buying dollar-denominated assets and this means they’ll continue to buy Treasury bills, note and bonds. The question is to what degree those purchases will slow. Many government and foreign investors are questioning U.S. policy (both fiscal and monetary) and worry that the buying power of the dollar will erode over the next couple of years.

We have seen gold, oil and other commodity prices continue to run and this is probably due in some part to foreign governments easing their purchases of U.S. debt and accelerating their purchase of commodities in order to protect against a falling dollar. It will be very interesting to watch how these capital inflow numbers come in over the next few months (again, specifically with regard to Treasury security buying). For now, the Fed is there to keep rates low, but their purchase program is scheduled to end in December and at that point, outside of some exogenous event, what will stop interest rates from rising from these very low levels?

Will the Fed believe it then must extend its purchase program and move further down the road of quantitative easing (QE)? They have made no overture thus far that this is their plan, but if they do I would expect commodity prices to continue their rally as fears of dollar weakness accelerate.

Industrial Production (IP)Industrial production rose for a second-straight month, leaving behind the post WWII record decline of the previous 18 months. IP rose 0.8% in August, following a 1.0% increase for July – the August reading outpaced the expectation, which was for a 0.6% rise.

This latest increase in IP was driven again by auto production, but not nearly as much as the previous month in which nearly the entire gain in IP was due to vehicle assemblies. For August, auto and parts production accounted for 33% of the increase. A nice move in machinery production, up 0.8%, also helped to fuel the total manufacturing component of the data.

Utility output, which makes up 10.6% of IP, was also helpful as it rose 1.9% -- a big reversal as it has been down for many months. Mining activity, which also makes up about 11% of total IP, was up 0.5% for the month. This segment too has recorded two months of gains after looking pretty ugly over the past year.

It’s nice to see these improvement, but just to get back to the peak in IP (hit in January 2008) by the end of 2011, production would have to increase at a 5.15% annual rate – the 40-year average is 2.30% per year, so it is unlikely we’ll get back to the early 2008 levels even two years from now.

Capacity utilization rose last month as well, but remains very depressed at 69.6% -- it rose from 69.0% in July. This is just barely off of the all-time low of 68.3% hit in June (this data goes back to 1967). For perspective, the 40-year average is 81.1%.

As we discussed last month, these extreme low utilization rates cause monetary policy makers to have very little concern about future inflation – textbook education teaches that inflation cannot occur with utilization rates at these levels. That’s all nice in a pedagogic setting, but the textbooks don’t include massive Fed liquidity injections and $1.5 trillion in bond purchases by the central bank – the old QE.

My concern, even though I’m not especially upbeat on the likelihood that normal increases in final demand will flow due to consumer issues, is if we get a mild boost in demand the capacity and labor resources currently employed will not be adequate to absorb all of the money floating within the system. That folks is when higher levels of inflation arises.

This is pretty much unchartered territory we’re in, predicting these things is even more difficult than normal. This is why, frankly, I’m sympathetic to the idea of taking these equity market gains of the past seven months and walking away for a while; we shall see how it turns out.

Have a great day!

Brent Vondera, Senior Analyst

Jobless Claims

Jobless Claims Continuing claims jumped 129,000 to bring the figure back above the 6.2 million level; this erases what many saw as repair over the past month. It’s likely the decline of the previous couple of weeks was more a function of benefits expiring than some sort of job creation taking place. As we’ve touched on for a few weeks now, the duration of unemployment and the exhaustion rate of benefits – the former just barely off of the record high and the latter still making new highs – is the common sense reason for the dip in claims we had seen of late.

Continuing claims jumped 129,000 to bring the figure back above the 6.2 million level; this erases what many saw as repair over the past month. It’s likely the decline of the previous couple of weeks was more a function of benefits expiring than some sort of job creation taking place. As we’ve touched on for a few weeks now, the duration of unemployment and the exhaustion rate of benefits – the former just barely off of the record high and the latter still making new highs – is the common sense reason for the dip in claims we had seen of late.

The headline number made the report appear a bit better than was actually the case; starts were driven by multi-family housing starts, which jumped 25.3% in August. This is a very volatile component of the overall figure and thus it makes it difficult to have conviction starts will continue to rise and continue to benefit GDP. (The rise we’ve seen in housing starts, even though they are off of all-time record lows, will add to Q3 GDP after subtracting from the figure for 12 straight quarters.)

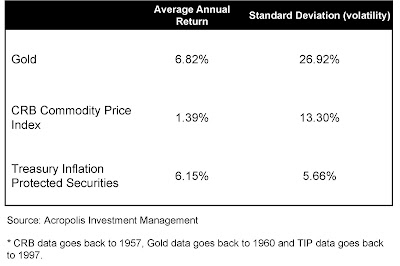

The headline number made the report appear a bit better than was actually the case; starts were driven by multi-family housing starts, which jumped 25.3% in August. This is a very volatile component of the overall figure and thus it makes it difficult to have conviction starts will continue to rise and continue to benefit GDP. (The rise we’ve seen in housing starts, even though they are off of all-time record lows, will add to Q3 GDP after subtracting from the figure for 12 straight quarters.) As you can see, gold has the highest average annual return but is by far the most volatile, with returns varying by 26.92%. Meanwhile, TIPS have a slightly lower average annual return but are much less volatile, with returns varying only 5.66%. The CRB Commodity Price Index, a widely used aggregate of all commodities, has the lowest return but is still more than two times as volatile as TIPS. As a result, we view TIPS as a superior inflation hedge to commodities.

As you can see, gold has the highest average annual return but is by far the most volatile, with returns varying by 26.92%. Meanwhile, TIPS have a slightly lower average annual return but are much less volatile, with returns varying only 5.66%. The CRB Commodity Price Index, a widely used aggregate of all commodities, has the lowest return but is still more than two times as volatile as TIPS. As a result, we view TIPS as a superior inflation hedge to commodities.

Mortgage Applications

Mortgage Applications As we discussed last month, these extreme low utilization rates cause monetary policy makers to have very little concern about future inflation – textbook education teaches that inflation cannot occur with utilization rates at these levels. That’s all nice in a pedagogic setting, but the textbooks don’t include massive Fed liquidity injections and $1.5 trillion in bond purchases by the central bank – the old QE.

As we discussed last month, these extreme low utilization rates cause monetary policy makers to have very little concern about future inflation – textbook education teaches that inflation cannot occur with utilization rates at these levels. That’s all nice in a pedagogic setting, but the textbooks don’t include massive Fed liquidity injections and $1.5 trillion in bond purchases by the central bank – the old QE.

Retail Sales

Retail Sales Year-over-year core PPI is up 2.3%, which is down from 2.6% last month.

Year-over-year core PPI is up 2.3%, which is down from 2.6% last month. This will change over the next couple of months as the data will show inventories rising as result of the clunker-driven auto sales as vehicle assemblies have picked up. This component will drive the overall reading and the good back-to-school clothing and electronics sales, as witnessed via the August retail figures discussed above, should induce general merchandisers to boost stockpiles at the margin.

This will change over the next couple of months as the data will show inventories rising as result of the clunker-driven auto sales as vehicle assemblies have picked up. This component will drive the overall reading and the good back-to-school clothing and electronics sales, as witnessed via the August retail figures discussed above, should induce general merchandisers to boost stockpiles at the margin.

Again, we were without an economic release yesterday, but this gives us a chance to touch on a couple of topics – the first has been something I’ve wanted to mention for about a week now but haven’t had the space.

Again, we were without an economic release yesterday, but this gives us a chance to touch on a couple of topics – the first has been something I’ve wanted to mention for about a week now but haven’t had the space. In addition, a falling dollar, and especially the perception that it will fall further (driven by the massive fiscal deficits we have now begun to run and very easy Fed policy that keeps interest rates ultra-low), is not conducive to the capital inflows that our economy needs. Further, there’s concern the adverse effect higher tax rates (lowering after-tax return expectations) will have on foreign investments to the U.S. These inflows are necessary to fund capital formation – a pretty important factor with regard to technological innovation (it’s the seed money for that innovation) and the future direction of productivity.

In addition, a falling dollar, and especially the perception that it will fall further (driven by the massive fiscal deficits we have now begun to run and very easy Fed policy that keeps interest rates ultra-low), is not conducive to the capital inflows that our economy needs. Further, there’s concern the adverse effect higher tax rates (lowering after-tax return expectations) will have on foreign investments to the U.S. These inflows are necessary to fund capital formation – a pretty important factor with regard to technological innovation (it’s the seed money for that innovation) and the future direction of productivity.