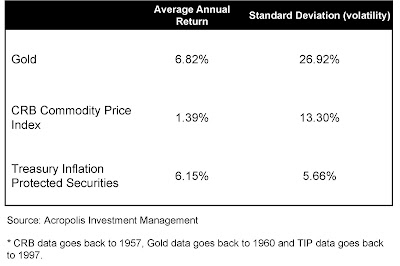

Acropolis, however, does not invest directly in commodities because they do not offer the optimal risk/return relationship when compared to other inflation hedges like Treasury Inflation Protected Securities (TIPS). The table below compares the average annual return and the standard deviation (also referred to as variance or volatility) of gold, the CRB Commodity Price Index, and TIPS.

As you can see, gold has the highest average annual return but is by far the most volatile, with returns varying by 26.92%. Meanwhile, TIPS have a slightly lower average annual return but are much less volatile, with returns varying only 5.66%. The CRB Commodity Price Index, a widely used aggregate of all commodities, has the lowest return but is still more than two times as volatile as TIPS. As a result, we view TIPS as a superior inflation hedge to commodities.

As you can see, gold has the highest average annual return but is by far the most volatile, with returns varying by 26.92%. Meanwhile, TIPS have a slightly lower average annual return but are much less volatile, with returns varying only 5.66%. The CRB Commodity Price Index, a widely used aggregate of all commodities, has the lowest return but is still more than two times as volatile as TIPS. As a result, we view TIPS as a superior inflation hedge to commodities.

Unlike other Treasury securities, TIPS’ coupon payments and underlying principal are automatically increased to compensate for inflation as measured by the consumer price index (CPI).

TIPS have a smaller track record – TIPS data only goes back to 1997 while commodities data stretches back to 1957 – so the comparison above is a bit unfair. Still, you would be hard pressed to find an investment with a guarantee by the U.S. government on the growth of your purchasing power.

In addition to TIPS, Acropolis believes owning commodity-related stocks that provide earnings and dividend streams is a more reasonable inflation hedge than owning hard assets like gold, especially with our long-term mindset.

Companies such as Chevron (Chevron), Transocean (RIG), or Arch Coal (ACI) are obviously commodity-related stocks, but you shouldn’t forget those who benefit through increased demand for mining commodities such as equipment makers Caterpillar (CAT) and Harsco (HSC) as well as industrial container manufacturers like Greif (GEF). Of course there are also transportation companies like Norfolk Southern (NSC) and Expeditors International of Washington (EXPD) that would see increased revenues in light of higher commodity prices. The list could go on and on.

Acropolis also gets commodity exposure through investments in the Asia-Pacific and Australian regions, where commodities are a key driver of economies. Even more, the commodity exposure of Emerging Markets is more than double that of the S&P 500.

--

Peter J. Lazaroff, Investment Analyst

No comments:

Post a Comment