A strong earnings report from Hewlett-Packard also helped to boost the market. The largest personal computer maker beat profit and sales estimates during the fourth quarter – although operating earnings (which removes one-time items that either boost or depress profits) did miss estimates by 4.4%; this is the number we watch. Total sales rose 8% thanks to a 41% jump in sales to the BRICs (Brazil, Russia, India and China) – undoubtedly fueled by China and their massive stimulus program.

Hewlett enjoyed increased market share, holiday spending and business outlays as firms had unspent equipment budgets at the end of 2009. This is something we talked about last week, I think it was; firms were unwilling to spend during most of 2009 and as November and December arrived they uses those funds to replace aging equipment. We’ll need to see a comparable follow through in the first quarter to confirm that something exciting is occurring on the business spending front.

Earnings results from Wal-Mart that missed its projection partially offset the good report from Hewlett. Wal-Mart reported that sales for stores open at least a year fell 1.6% in the three months ended January 31. CEO Mike Duke warned that sales will be “more challenging” in the current quarter and. Some people saw the WMT news as a sign consumers are trading up to a higher price point. I’m not sure about that one with 9.8% unemployment and 17% under-employment, but we’ll see.

Basic material shares led the broad market higher, followed by industrials. Nine of the 10 major industry groups closed higher, telecoms being the only loser.

Market Activity for February 18, 2010

Greenback

GreenbackThe U.S. dollar rallied on concerns out of the EU (those sovereign debt issues) and the continued flee from the euro. The situation remains such that the dollar only catches a bid on bad news and investors are certainly fleeing the EU currency, which has gotten smacked by 10% since December. But later in the session the greenback gave up those gains as the euro caught a bit of a bid – speculation that the Swiss engaged in some currency intervention, selling their franc to halt its gains and this meant buying some euros.

While the dollar erased early-session gains it remained above the 80 handle on the Dollar Index (DXY). If it holds here it will help to contain the inflation readings over the subsequent months, particularly with regard to import price inflation that has become a bit frothy of late. After the bell the dollar rallied hard on news the Fed raised the discounts rate, more on this below.

This dollar boost also has ramifications for multi-nationals. Global growth is still not strong enough to boost multi-national company sales without help from a lower currency value – a lower dollar value makes our goods cheaper to overseas buyers. (I am in no way advocating that policy makers move to put pressure on the dollar, they’ve done enough harm to the greenback with an insane level of government spending and the Fed’s ZIRP. You can’t create a prosperous environment by kicking your currency into the dirt, even if it does help in the short term.)

If the U.S. dollar continues to rally on euro woes, and the current belief that Fed tightening is on the way, then this is going to do some damage to profit expectations a couple of quarters out.

Jobless Claims

Well, so much for that decline in claims last week. The Labor Department reported that initial jobless claims rose 31,000 to 473,000 in the week ended February 13 after falling 41,000 to 442,000 in the previous week. Economists had expected claims to fall to 438K.

So you look at the past two weeks and initial claims are down 10,000 but the level remains well above 450K. The previous week’s decline brought excitement that initial claims would crash below the 400K level but that seems a bit premature now. (The 400K level is important because it always signals at least mild monthly job growth.)

The four-week average on initial claims fell 1,500 to 467,500.

Overall continuing claims resumed their move higher too. Standard claims, those that last the traditional 26 weeks, came in unchanged from the week prior.

Overall continuing claims resumed their move higher too. Standard claims, those that last the traditional 26 weeks, came in unchanged from the week prior.

However, Emergency Unemployment Compensation (EUC) rose 274,000. Over the past six weeks EUC claims have jumped 707,000.

However, Emergency Unemployment Compensation (EUC) rose 274,000. Over the past six weeks EUC claims have jumped 707,000.

Well, so much for that decline in claims last week. The Labor Department reported that initial jobless claims rose 31,000 to 473,000 in the week ended February 13 after falling 41,000 to 442,000 in the previous week. Economists had expected claims to fall to 438K.

So you look at the past two weeks and initial claims are down 10,000 but the level remains well above 450K. The previous week’s decline brought excitement that initial claims would crash below the 400K level but that seems a bit premature now. (The 400K level is important because it always signals at least mild monthly job growth.)

The four-week average on initial claims fell 1,500 to 467,500.

Overall continuing claims resumed their move higher too. Standard claims, those that last the traditional 26 weeks, came in unchanged from the week prior.

Overall continuing claims resumed their move higher too. Standard claims, those that last the traditional 26 weeks, came in unchanged from the week prior. However, Emergency Unemployment Compensation (EUC) rose 274,000. Over the past six weeks EUC claims have jumped 707,000.

However, Emergency Unemployment Compensation (EUC) rose 274,000. Over the past six weeks EUC claims have jumped 707,000.  Neither the initial nor the continuing claims data suggest the labor market in improving to a point in which we’ll see job growth, much less statistically significant job growth. I’ve been expecting to see mild job growth beginning in February or March (meaning monthly growth of at least 50K). These numbers aren’t offering much confidence in this call.

Neither the initial nor the continuing claims data suggest the labor market in improving to a point in which we’ll see job growth, much less statistically significant job growth. I’ve been expecting to see mild job growth beginning in February or March (meaning monthly growth of at least 50K). These numbers aren’t offering much confidence in this call.We need job growth to keep things going, to get final consumer demand trending higher. Without it, the inventory-led GDP boost we’ve seen is going to fizzle out in short order.

Producer Price Index (PPI)

Producer prices rose 1.4% in January according to the Labor Department, which outpaced the 1.0% rise that was expected. The increase was mostly due to the fuel components as the ex-energy reading rose just 0.3%. But energy sort of matters as it makes up between 8-12% of disposable income for most households. It’s ridiculous for the Fed to use an inflation gauge that excludes food and energy as their desired tool for tracking price activity.

The overall energy component rose 5.1% for the month, boosted by an 11.5% jump in gasoline. Overall consumer goods rose 1.8% in January and are up 18.4% at an annual rate over the past three months. Gasoline and residential electricity are two components within the consumer goods segment.

Over the past 12 months the PPI is up 4.6%, quite a turnaround just three months removed from an 11-month streak of PPI decline.

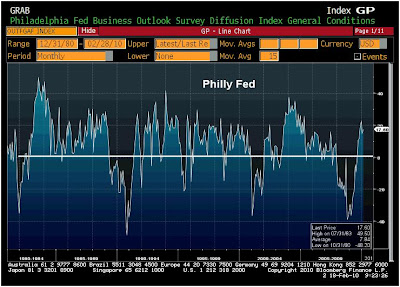

Philly Fed

Philly Fed

The Philadelphia Federal Reserve Bank’s gauge of factory activity within their district rose to 17.6 in February (in line with expectations) from January’s 15.2. This follows a good headline figure from the Empire index (New York-area manufacturing) so the month is off to a good start. Like Empire though, some of the sub-indices suggest factories aren’t going to be quick to hire workers.

Producer prices rose 1.4% in January according to the Labor Department, which outpaced the 1.0% rise that was expected. The increase was mostly due to the fuel components as the ex-energy reading rose just 0.3%. But energy sort of matters as it makes up between 8-12% of disposable income for most households. It’s ridiculous for the Fed to use an inflation gauge that excludes food and energy as their desired tool for tracking price activity.

The overall energy component rose 5.1% for the month, boosted by an 11.5% jump in gasoline. Overall consumer goods rose 1.8% in January and are up 18.4% at an annual rate over the past three months. Gasoline and residential electricity are two components within the consumer goods segment.

Over the past 12 months the PPI is up 4.6%, quite a turnaround just three months removed from an 11-month streak of PPI decline.

Philly Fed

Philly FedThe Philadelphia Federal Reserve Bank’s gauge of factory activity within their district rose to 17.6 in February (in line with expectations) from January’s 15.2. This follows a good headline figure from the Empire index (New York-area manufacturing) so the month is off to a good start. Like Empire though, some of the sub-indices suggest factories aren’t going to be quick to hire workers.

The new orders index jumped to 22.7 from 3.2 in January – this is the highest reading since April 2006. Inventories rose to 3.2 from -1.6 -- a similar level of improvement showed up in Empire. The employment data was mixed as the number of employees gauge rose to 7.4 from 6.1, yet the average workweek index fell to 1.6 from 4.2 – that divergence doesn’t make sense and one questions which reading is providing the right picture.

Among the components we’re watching most closely for clues of future hiring, the readings weren’t quite as good. The unfilled orders index fell big time, dropping to -7.5 from 3.6; the delivery times index declined to -2.1 from 6.6. We need these reading to trend in positive territory for several months as it would show that factories are having difficulty keeping up with orders. So long as they are not, which is what negative readings suggest, manufacturing employment is unlikely to move higher.

Maybe the big new orders reading will provide the work needed to stretch current workers and send the unfilled orders and delivery times gauges higher over the next couple of months. Households are saddled with high debt levels and those liabilities have to be paid down to some extent before this economy can return to normal – to state the obvious, that takes employment growth.

For now manufacturing activity is looking good, a rebound that began 5-6 months back, as inventories had been slashed at record levels and firms are rebuilding those stockpiles a bit.

Fed Timing Surprises the Market

The Fed chose to raise the discount rate by 25 basis points to 0.75% last night after the market closed. (This is the rate banks are charged to borrow directly from the Fed.) They also returned the term of these loans to overnight from 28 days. This move gets the discount rate closer to its normal 100 basis point spread over fed funds

This move by Bernanke is not a surprise as there has been talk of such action for a couple of months and they laid this out in their minute release on Wednesday. The timing is a bit interesting though. This change is intended to encourage financial institutions to rely more on money markets rather than the central bank for short-term liquidity needs.

It will be interesting to watch how the market perceives this move, possibly expecting the total exit strategy to occur sooner than formerly expected. This is a test by the Fed, testing to see how the market reacts; I still think they’ll be slow to move with regard to actual tightening – raising the fed funds rate. Former Fed Governor Laurence Meyer is predicting fed funds won’t rise for the first time until mid-2011.

For past issues of Daily Insights and other daily publications please visit: www.acrinv.com/blog

Have a great weekend!

Brent Vondera, Senior Analyst

No comments:

Post a Comment