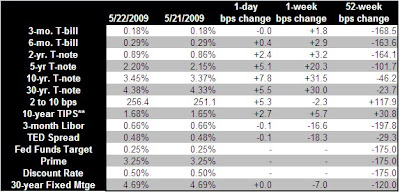

The two-year finished down 3/64, and the ten-year was lower by 45/64. The benchmark curve steepened by 6 basis points, and currently sits at +256 bps. A basis point represents .01%.

The two-year finished down 3/64, and the ten-year was lower by 45/64. The benchmark curve steepened by 6 basis points, and currently sits at +256 bps. A basis point represents .01%.With no economic data and a shortened trading session in bond land, the market turned its focus to next week’s supply. The Treasury will issue $100 billion in 2’s, 5’s and 7’s next week, and if the market told us anything the past two days, demand for government paper is not nearly what it was a few months ago.

The media has really beaten the “US Treasury to lose its AAA credit rating” story to death. Standard and Poor’s got the ball rolling yesterday when they put the UK’s AAA credit rating on negative watch. Meaning they are still AAA but the credit agency is just revisiting the analysis.

There’s no doubt that this administration is spending borrowed funds at a frightening pace, and unless the Fed ups its participation through additional quantitative easing we will definitely see higher rates on Treasury borrowing for the rest of the year. But to say that investors should begin to worry about the credit of the US Treasury is a little much.

A lot of global money flooded into Treasuries during the collapse of the credit markets driving yields to record lows and the dollar to multi-year highs. That trend is reversing now more because of an increase in inflation expectations than a broad based currency meltdown, sorry CNBC. When economic activity picks up, inflation will begin to show itself, but even higher than average inflation from these price levels is far from destabilizing. The exposure this is getting in the media is just way too much.

Have a great evening.

Cliff J. Reynolds Jr., Junior Analyst

No comments:

Post a Comment