Activity was in super-sloth mode as less than 650 million shares traded on the NYSE Composite – about one-third less than what’s become normal on the last session of the year.

And speaking of the year that was quite a turnaround from the March lows. The broad market began the year lower by 25% just 46 sessions into 2009, but staged a dramatic comeback, jumping 67.4% from that point to recoup nearly 50% of the losses from the October 9, 2007 peak.

For the decade, the S&P 500 declined 24.10% in simple-price terms (down 2.71% annualized) and lower by 9.10% when including reinvested dividends (down 0.94% annually). On an inflation-adjusted basis, the decade in stockland was worse with the annual decline at roughly 3.5%, but this is just in terms of price and does not include the contribution from dividends. And worse still for the international investor as the dollar got clocked by 22.25%. (When the foreign investor converts back to his/her home currency, they received less of that currency.)

For the decade, the S&P 500 declined 24.10% in simple-price terms (down 2.71% annualized) and lower by 9.10% when including reinvested dividends (down 0.94% annually). On an inflation-adjusted basis, the decade in stockland was worse with the annual decline at roughly 3.5%, but this is just in terms of price and does not include the contribution from dividends. And worse still for the international investor as the dollar got clocked by 22.25%. (When the foreign investor converts back to his/her home currency, they received less of that currency.) But what’s done is done, let’s look to the future. The multiple compression (decline in the market P/E) that’s occurred over the past several years makes the chances of strong returns for the new decade all the more likely. Of course, this is not axiomatic. For strong returns to materialize we must have sound monetary policy and a tax policy that incentives entrepreneurial endeavors, the investment that those upstarts need, and work over leisure. (We must also get much more serious about security.) The wrong policies will lead to another rough 10-year stretch, just ask the Japanese.

But what’s done is done, let’s look to the future. The multiple compression (decline in the market P/E) that’s occurred over the past several years makes the chances of strong returns for the new decade all the more likely. Of course, this is not axiomatic. For strong returns to materialize we must have sound monetary policy and a tax policy that incentives entrepreneurial endeavors, the investment that those upstarts need, and work over leisure. (We must also get much more serious about security.) The wrong policies will lead to another rough 10-year stretch, just ask the Japanese.All was not totally lost over the past 10 years, a well-balanced portfolio that encompasses an array of asset classes helped. For instance, mid cap stocks rose 63.42% during the decade (up 5.03% annualized); small cap stocks added 23.90% (up 2.16% annualized). Reinvesting dividends into these indexes produced a 6.35% annual return for the mids and 3.55% per year for smalls. The main emerging market index was up 7.29% annually and bonds were obviously positive.

The CRB, which tracks a basket of commodity prices, rose 38.14% for the decade – most of the return was made by 2004. It’s been an especially wild ride for commodity prices since 2004 as the index was up as much as 130% since 1999 at one point during the summer of 2008 and flat for the decade as of February 2009. The CRB index was driven by copper (up 290%), gold (up 278%), and oil (up 210%).

Home prices, as measured by the median price for an existing home, rose 24% for the decade (up 2.25% annually).

Market Activity for December 31, 2009

Jobless Claims

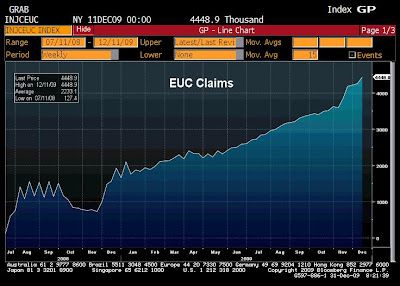

The Labor Department reported that initial jobless claims continued to fall to that very important 400K level – a level that always signals at least some monthly payroll growth. Initial claims fell 22,000 in the week ended December 26 to 432,000. The four-week average declined 5,500 to 460,250.

While the initial claims data show the pace of firings has eased greatly, the continuing claims data unfortunately show hiring has yet to take hold. Standard continuing claims (the traditional 26 weeks of benefits) fell 57,000; however, claims for Emergency Unemployment Compensation (EUC) more than offset this as they jumped 191,000. Until EUC halts its trend to new highs, there is no clue that meaningful monthly job growth has begun.

While the initial claims data show the pace of firings has eased greatly, the continuing claims data unfortunately show hiring has yet to take hold. Standard continuing claims (the traditional 26 weeks of benefits) fell 57,000; however, claims for Emergency Unemployment Compensation (EUC) more than offset this as they jumped 191,000. Until EUC halts its trend to new highs, there is no clue that meaningful monthly job growth has begun.

Outlook

Stocks

For 2009, the stock-market trade, at least post-February, was all about easy money and rock-bottom interest rates encouraging a move into risky assets as the hunt for return was on. The 2010 market should depend on profit growth (and it better be accompanied by some top-line improvement or the strong profit growth that will come in 1H 2010, enabled by massive cost-cutting, will peter out); it will take aggressive earnings improvements for stocks to withstand even marginally higher interest rates, if they are to materialize.

The Economy

U.S. corporations are the bright spot for this economy as they have locked in leverage at very low rates and sit on mounds of cash. (The same cannot be said, sorry to say, for households; and the government debt situation is a mess.) However, firms will remain chary with this cash as final demand will struggle to pick up – a function of high unemployment and exacerbated by the $500 billion, at the low-end of the estimate, in additional credit-card lines that will be erased in 2010.

One of the places business caution will continue to show up is in hiring. Yes, we’ll see monthly job growth begin within the next two months (something we first mentioned following the October jobs report), after shedding more than seven million jobs over the previous two years – 4 million gone in a six-month stretch, November 2008-April 2009. But the business side of the economy, and I’m talking in large part, is the only saver right now. Government is going hog wild on deficit spending and households are backing off from their hog-wild escapade of the previous several years. Businesses will also have to manage around what they estimate Washington has in store for them via higher tax rates and regulations.

Remember this: By the spring, hiring for the 2010 census will peak as 800,000 workers are needed for this endeavor, according to the government. This will boost the monthly job gains for a couple of months (showing up via a spike in government jobs) and lead to some euphoria, but shortly thereafter these people will be looking for work again – the census work is a six-week gig.

On banking, the 2010 economy will have to face a gathering pressure from the credit markets as banks will be forced to add to provisions due to still increasing delinquencies. This is simply a reality of the credit bubble that still must be dealt with, affecting the economy for a while still. And more to come as 25% of all mortgages are underwater and 5.3 million borrowers are 20% or more underwater – 2.2 million properties are worth less than half of the mortgage balance, according to First American CoreLogic – that’s really hard to believe but even if they are off by a long shot, you’re talking a real problem. (We must engage in the RTC-style program that TARP was originally sold to do – or let the market take care of it, but there is zero political will for this. The bad assets that still sit on bank balance sheets must be removed; the government can sit on these assets for several years if that is what it takes and sell them off when the time is appropriate. This should have been the main federal government response to this entire situation, that and slashing tax rates. Alas, we dropped that ball. The Bush Administration fumbled it big time and the Obama Administration ran with the darned thing, in the wrong direction.)

Another serious issue is the one that arrives when government intrudes on the private sector to the degree it is at the present. It sets up serious barriers to entry for upstart businesses. Who’s going to create the 100,000 jobs per month that it takes to just keep the unemployment rate from rising – the 300,000 per month it takes to move the jobless rate lower in a reasonable amount of time? (Maybe those numbers need to be even greater as a higher number of workers in their early 60s come to the cruel reality that they cannot retire yet due to the $10 trillion reduction in household net worth that’s occurred from the peak, making it more difficult for newer entrants into the job market.)

Why do you think that many of the CEOs of the largest U.S. corporations haven’t a problem with this government largess? They don’t because they have the resources to buy themselves handouts and government contracts, making it easier to manage around increased regulations and taxation – the government is picking winners and losers and some of the largest corporations are buying themselves into the winner’s circle. The smalls don’t have a chance in this environment and the big guys know it; they know it shuts out current and future competition. This is a problem that must be reversed. Small business currently accounts for 65% of job growth, get in the way of this engine and you get more crazy policies out of Washington as politicians scurry for anything that they believe will get them re-elected as the unemployment rate remains high. When Washington is this involved do not underestimate their ability to screw things up, royally.

The U.S. economy will emerge from this situation, but I fear the timeline has been delayed due to the government’s response. That response may very well have eased the degree of downward economic pressure, but always elongates the cycle to a full-fledged recovery. Sure, GDP will record 3-4 quarters of growth, with a couple of these being above-average results as the inventory dynamic adds 1.5 -2.0 percentage points to growth and government infrastructure spending peaks in 1H2010, which may add another percentage point. There may even be a 6% GDP quarter in the cards, possibly in Q2, as those refundable tax credits for first-time homebuyers are collected and propel consumer spending. Enjoy it while it lasts as 2H2010 may very well show the rebound to be especially transitory. Expect something in the manner of 3.0%-3.5% GDP for all of 2010, almost all based on stimulus and a transitory inventory rebuild.

I hear economists talking about how strong 2010 is going to be. You’ve heard it plenty of times now: “The deeper the contraction, the stronger the upswing.” For this to result, we’ll have to see 7.75% GDP growth for the entire year in order to compare with past rebounds from the worst recessions of the postwar era – doubt that’s in the cards. One reason for the doubt is that I’m mindful past postwar-era recessions were simply driven by the inventory cycle. That is, as manufacturing stockpiles became bloated the economy had to wait for the next production surge as those inventories needed to be sold off first. But those past recoveries had the luxury of relying on an expansion of credit to offset the organic weakness. Not this time; no such luxury – households don’t have the capacity with the household debt/disposable income ratio at 123%. Notice in the chart below that with each recovery during the past 30 years the household debt/income ratio kept rising, spiking to the insane level of 130% as the Fed induced such behavior with its very low interest-rate environment 2002-2005.

Stocks

For 2009, the stock-market trade, at least post-February, was all about easy money and rock-bottom interest rates encouraging a move into risky assets as the hunt for return was on. The 2010 market should depend on profit growth (and it better be accompanied by some top-line improvement or the strong profit growth that will come in 1H 2010, enabled by massive cost-cutting, will peter out); it will take aggressive earnings improvements for stocks to withstand even marginally higher interest rates, if they are to materialize.

The Economy

U.S. corporations are the bright spot for this economy as they have locked in leverage at very low rates and sit on mounds of cash. (The same cannot be said, sorry to say, for households; and the government debt situation is a mess.) However, firms will remain chary with this cash as final demand will struggle to pick up – a function of high unemployment and exacerbated by the $500 billion, at the low-end of the estimate, in additional credit-card lines that will be erased in 2010.

One of the places business caution will continue to show up is in hiring. Yes, we’ll see monthly job growth begin within the next two months (something we first mentioned following the October jobs report), after shedding more than seven million jobs over the previous two years – 4 million gone in a six-month stretch, November 2008-April 2009. But the business side of the economy, and I’m talking in large part, is the only saver right now. Government is going hog wild on deficit spending and households are backing off from their hog-wild escapade of the previous several years. Businesses will also have to manage around what they estimate Washington has in store for them via higher tax rates and regulations.

Remember this: By the spring, hiring for the 2010 census will peak as 800,000 workers are needed for this endeavor, according to the government. This will boost the monthly job gains for a couple of months (showing up via a spike in government jobs) and lead to some euphoria, but shortly thereafter these people will be looking for work again – the census work is a six-week gig.

On banking, the 2010 economy will have to face a gathering pressure from the credit markets as banks will be forced to add to provisions due to still increasing delinquencies. This is simply a reality of the credit bubble that still must be dealt with, affecting the economy for a while still. And more to come as 25% of all mortgages are underwater and 5.3 million borrowers are 20% or more underwater – 2.2 million properties are worth less than half of the mortgage balance, according to First American CoreLogic – that’s really hard to believe but even if they are off by a long shot, you’re talking a real problem. (We must engage in the RTC-style program that TARP was originally sold to do – or let the market take care of it, but there is zero political will for this. The bad assets that still sit on bank balance sheets must be removed; the government can sit on these assets for several years if that is what it takes and sell them off when the time is appropriate. This should have been the main federal government response to this entire situation, that and slashing tax rates. Alas, we dropped that ball. The Bush Administration fumbled it big time and the Obama Administration ran with the darned thing, in the wrong direction.)

Another serious issue is the one that arrives when government intrudes on the private sector to the degree it is at the present. It sets up serious barriers to entry for upstart businesses. Who’s going to create the 100,000 jobs per month that it takes to just keep the unemployment rate from rising – the 300,000 per month it takes to move the jobless rate lower in a reasonable amount of time? (Maybe those numbers need to be even greater as a higher number of workers in their early 60s come to the cruel reality that they cannot retire yet due to the $10 trillion reduction in household net worth that’s occurred from the peak, making it more difficult for newer entrants into the job market.)

Why do you think that many of the CEOs of the largest U.S. corporations haven’t a problem with this government largess? They don’t because they have the resources to buy themselves handouts and government contracts, making it easier to manage around increased regulations and taxation – the government is picking winners and losers and some of the largest corporations are buying themselves into the winner’s circle. The smalls don’t have a chance in this environment and the big guys know it; they know it shuts out current and future competition. This is a problem that must be reversed. Small business currently accounts for 65% of job growth, get in the way of this engine and you get more crazy policies out of Washington as politicians scurry for anything that they believe will get them re-elected as the unemployment rate remains high. When Washington is this involved do not underestimate their ability to screw things up, royally.

The U.S. economy will emerge from this situation, but I fear the timeline has been delayed due to the government’s response. That response may very well have eased the degree of downward economic pressure, but always elongates the cycle to a full-fledged recovery. Sure, GDP will record 3-4 quarters of growth, with a couple of these being above-average results as the inventory dynamic adds 1.5 -2.0 percentage points to growth and government infrastructure spending peaks in 1H2010, which may add another percentage point. There may even be a 6% GDP quarter in the cards, possibly in Q2, as those refundable tax credits for first-time homebuyers are collected and propel consumer spending. Enjoy it while it lasts as 2H2010 may very well show the rebound to be especially transitory. Expect something in the manner of 3.0%-3.5% GDP for all of 2010, almost all based on stimulus and a transitory inventory rebuild.

I hear economists talking about how strong 2010 is going to be. You’ve heard it plenty of times now: “The deeper the contraction, the stronger the upswing.” For this to result, we’ll have to see 7.75% GDP growth for the entire year in order to compare with past rebounds from the worst recessions of the postwar era – doubt that’s in the cards. One reason for the doubt is that I’m mindful past postwar-era recessions were simply driven by the inventory cycle. That is, as manufacturing stockpiles became bloated the economy had to wait for the next production surge as those inventories needed to be sold off first. But those past recoveries had the luxury of relying on an expansion of credit to offset the organic weakness. Not this time; no such luxury – households don’t have the capacity with the household debt/disposable income ratio at 123%. Notice in the chart below that with each recovery during the past 30 years the household debt/income ratio kept rising, spiking to the insane level of 130% as the Fed induced such behavior with its very low interest-rate environment 2002-2005.

Besides, let’s be serious about how we define a strong expansion, we’re talking about business cycles here. You’ll hear most of the optimists effuse positively about 2010, but express concern over 2011. The average business-cycle expansion over the past quarter century has lasted roughly eight years on average. One year of growth is not an expansion; more frequent downturns is not a positive development. It will take a significantly higher than average growth rate for a prolonged period to bring back the jobs that have been extinguished over the previous two years. Without a durable recovery, the household-debt pay down process will take longer to play out.

Besides, let’s be serious about how we define a strong expansion, we’re talking about business cycles here. You’ll hear most of the optimists effuse positively about 2010, but express concern over 2011. The average business-cycle expansion over the past quarter century has lasted roughly eight years on average. One year of growth is not an expansion; more frequent downturns is not a positive development. It will take a significantly higher than average growth rate for a prolonged period to bring back the jobs that have been extinguished over the previous two years. Without a durable recovery, the household-debt pay down process will take longer to play out.I guess an outlook would be remiss to not even mention geopolitical concerns. I’ve spent so much time on this subject over the past few years, I’ll keep this topic short. At some time, and the clock is ticking, someone will have to deal with Iran’s hell-bent desire to weaponize nukes. If the Revolutionary Guard doesn’t put down their guns and stop shooting student protesters (which there is a chance of this happening, just remote), or the U.S. doesn’t take out/seriously delay the regime’s nuclear capability, then Israel will do it. Beyond thinking about its survival, Israel also must worry about capital flows to the country. If investors believe that Iran is two years from a bomb, they won’t wait to pull capital from Israel until that date arrives, they’ll do it much sooner. Israel will be forced to act for a number of reasons.

So there are a lot of headwinds out there, but assuming a geopolitical event or large-scale domestic terrorist attack does not occur, we should get a short-lived bounce in economic growth. While things may very well take longer to return to normal, we will get past this trouble. When the Fed normalizes interest rates (either voluntarily or by force via the bond market) this will drive the final leg of the de-leveraging process. That is when a durable economic expansion will emerge from the next downturn – the kind of expansion that we’ve become accustomed to; the kind of expansion that this great country is capable of producing. A durable economic expansion will emerge in time, but it is likely to take an extended period.

One year closer to normalcy, as Truman would have put it.

Have a great day!

Brent Vondera, Senior Analyst

No comments:

Post a Comment